Värdeinvestering

- Part 1: Introduction

- Part 2: Moats

- Part 3: Special events

- Part 4: Quality

If there is a ”Warren Buffett-school within värdeinvesteringen there is a Peter Lynch-school. Where Buffett preaches vallgravens value (see Part 2 in the series) that gives some companies an incredible long-term advantages against the competitors, preached Peter Lynch instead, the value of the excellent growth prospects.

Peter Lynch is the most successful fund managers. During the period (1977-90) in which he led the Magellanfonden of Fidelity in increasing fund value by over 29 % per year. When his own initiative, he retired as the 46 year old was fund the world’s largest at the time unimaginable 19 billion dollars in assets (up from 18 million at the start). His explanation to early retirement belongs to the classics in investerarkretsar: I realized that no one ever on his deathbed, has regretted that he has not spent more time at the office.

Peter Lynch’s greatest contribution to the värdeinvestering is, without doubt, his main rule: Invest in what you know! With this, he meant that we all are experts on one or a few areas, and this we shall exploit by holding ourselves to these areas and beat other investors who do not have as good track. If we have not mastered a certain area, so we will learn as much as possible about it before we invest. Himself, he had the great benefit of the to ask his three daughters and his wife what young people respectively. women of the moment thought about for the products and then go on to investigate the companies and learn the industry. Another known method was to simply spend hours in shopping malls and see what stores there were a lot of people and in which there was more or less empty.

It turned out that some of the stores with a lot of people was yet a small number who had only managed to establish itself in a small part of the country. Lynch then met the senior management, usually overjoyed that someone showed them interest, and got to learn more about the products and what plans they had for expansion. In this way he found the early t.ex. Taco Bell and Walmart. Another trick was to ask each PRESIDENT he met, which was their worst competitor and why. Often it ended with that he bought the shares to the fund in the competitor.

Lynch turned completely against market timing and stop loss which he considered as excellent ways to lose money. Instead preached the Lynch that we should buy good tillväxtcase and ignore if they already have had time to rise a lot, it is a good case so they will continue to rise for a very long time. Buy and keep with other words.

Peter Lynch’s principles are described in the classics ”One up on Wall Street” and ”Beating the Street” which I really recommend for those who have not read them. His thinking has had a huge influence on me as an investor and contributed to that I found many promising businesses, and dared to buy even though they usually already have doubled a few times before I got up the eyes for them.

What are we then to look for in growth stocks? Here are some very typical traits and examples of these from the past few decades:

The company is an early adopter of a new technology (t).ex. The Tesla).

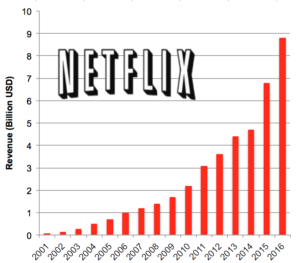

The company is on the way to acquire a monopoly/oligopoly (like Microsoft and Amazon and Netflix that I own).

The company are linked together with a certain lifestyle, image , and/or noble goal (t).ex. Starbucks and Apple which I also own).

There are of course many other categories, but these are, as I see it is very usual for the companies which multiplied in the recent time. Note that it is not necessarily the companies like Microsoft and Apple managed to turn its popularity to the tremendous profit growth. Tesla and Amazon are no companies that reward their loyal shareholders with steady earnings growth and dividends. Still, the shares have risen at least as much as Microsoft and Apple did when their profits exploded.

That share rises in this way, when only increases in income depends, of course, that companies are valued on their future earnings, not what you earned in the past. In the same way that H&M have fallen by a third in the last two years, so have t.ex. Amazon rushed despite the fact that H&M is a much more profitable company than Amazon. While the market obviously does not believe in any bright future for H&M so attracted by the potential of Amazon. This company has, as is known, succeeded marvellously with its expansion over the first the united states and then in several other countries. Would in the future become the dominant global retailer within many industries, you get, of course, a huge moat against competitors on the web and in physical stores. Those who stood at the side in anticipation of the company ”profit” has missed the entire recovery.

It is very common to fundamentalanalytiker and värdeinvesterare scoff at these aktieresor. There are lots of articles on the net from skilled investors that make a mockery of the upturn in the Amazon. Not to mention everything that has been written in recent months in line with Tesla gone if the major car manufacturers in the market capitalization despite the fact that you are losing money and only sold 77 000 cars in the last year. This excessive fondness for profitable growth make, unfortunately, as I said, you miss the stars of tomorrow. As most people know so trying to the majority of the younger tillväxtföretagen not to make a profit, but more to keep their losses at a reasonable level during the growth phase. For some companies with huge ambitions, like Amazon, this does not apply during the year but for decades.

To which I said not to worry that you do not come in near the beginning. It took ten years to find to companies such as Microsoft, H&M and Netflix after their success started was, nevertheless, very handsomely rewarded. They, however, waited until ”everyone” owns one share and the next big shift in consumer behavior or technology has managed to learn, however, not make any good deal.

Thus, there are huge profits to be download for the that in all cases reasonably early to find good growth stocks. The growth has a very high value, in the same way as moats, attractive brands, and other things today or in the long term helps the business to make money.