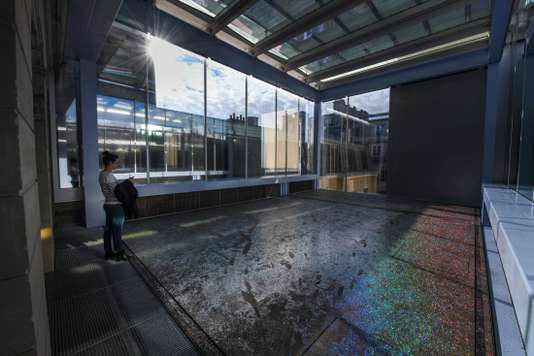

“There was a before and after the law Aillagon [2003]. Without this act of corporate patronage, Lafayette expectations would not have been possible, ” said Guillaume Houzé, president of the fondation d’entreprise Galeries Lafayette. After five years of gestation, this new place reserved for contemporary art, beautifully drawn by the Dutch Rem Koolhaas, opened to the public, Saturday, march 10, in the heart of the Marais, in Paris. With a peculiarity : the important place made for the artists, so that they realize in-situ works designed to be exposed.

The outbreak of corporate foundations dedicated to contemporary art in France – Cartier, the pioneer, Ricard, Yves Rocher and soon Emerige and Carmignac… – is closely correlated to the law on sponsorship, which has enabled it to multiply by two the amount of défiscalisations for businesses. The Admical, an association that develops the sponsorship, remember that the tax reduction is 60 % of the amount of donations of corporate sponsors in the limit of 0.5% of their turnover excluding taxes. The organization of exhibitions, acquisitions of works of art and the construction of the building of a business foundation may, under certain conditions, benefit from tax credits.

For Galeries Lafayette, two separate structures have been put in place : the company foundation Lafayette expectations, which will have a five-year budget of functioning of 21 million euros, of which 60 % will be tax exempt, and the endowment fund Family Mill, which houses a collection of 300 works of art and will make available to the foundation.

“All the causes of general interest ”

“If I had made it a law reserved for the cultural patronage, writes Jean-Jacques Aillagon, a former culture minister Jacques Chirac and cultural advisor to François Pinault, founder of Kering, this would never have happened. The act…