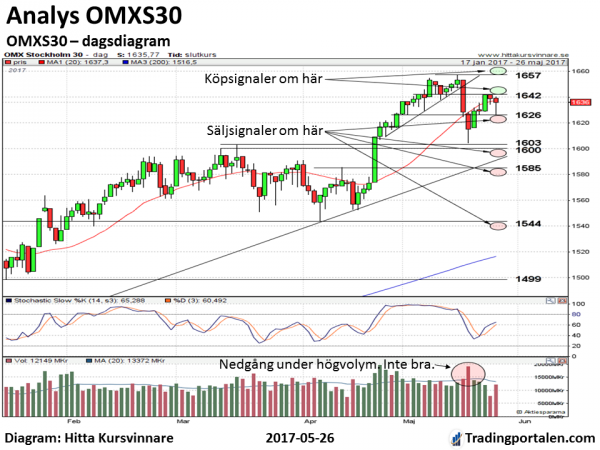

The OMXS30 is in the long term as seen in an upward trend. But in the technical analysis has the risk level increased, then the index in the middle of may happened to downs in a relatively high trading activity. There are strong warning signals that the upward trend may be challenged in the next few months. But so long as keeps the OMXS30 remain close to their year high levels. Sell signals are obtained if the OMXS30 establishes itself in the guides at about 1626 and ca 1600-1604. Buy signals are obtained instead if the index breaks above the resistors at about 1642, and about 1657.

The stockholm stock exchange had the last of the holidays shortened week an irregular development during the relatively low trading activity. Our Swedish storbolagsindex OMXS30 index advanced by a modest 0.4 percent and ended the week at 1635,77. So far this year, the index has in and with the risen 7.9 per cent and 11.2 per cent, including secluded dividends.

On nyhetsfronten the situation was relatively quiet for the OMXS30 companies. Ericsson broke up out of a tradingintervall on speculation that Christer Gardell and his Cevian Capital shall have acquired the company. But even as a smittoeffekt of that, Nokia went up sharply after a patentuppgörelse with Apple.

What may, however, be observant of the here is the position of the US dollar. The us dollar has gone down which is usually a negative factor not only for Ericsson but for börsläget at large. The reason for the dollar’s decline can mostly be explained with the president Trumps increasing political problems. Which makes it harder for him to get through their stimulus program, including tax cuts and infrastructure investments. Those, in turn, is expected to be able to get both growth and inflation.

If not, these policy programs are going through, there is a risk that the dollar continues to go down. And it was not so much better that German chancellor Angela Merkel last week declared that the Euro was too weak.

Get the OMXS30 analysis automatically to your e-mail every week!

A the OMXS30 companies , however, considered that the benefit of dollarnedgång is HM. Also the stock has broke during the week, up from a tradingintervall. Here is also the principal owner Stefan Persson and aktieprofilen Sven-Olof Johansson storköpt shares in the spring.

The long-term trend for the OMXS30 index is still upward. The index is well above its upward 200-day medeltalskurva and shows in the long-term perspective up a clear pattern of rising bottoms and tops.

Even the short trend, which we define, following the slope of the 20-day medeltalskurvan, is upward. However, so are the OMXS30 during the 20-day medeltalskurvan which is a sign of weakness.

But above all, it has in the past so unequivocally positive handelsvolymmönstret been shaken. This by the fall on 18 may, with a trading volumes on the high 24.7 billion. It is a powerful warning signal that the sellers at the stock exchange come to life. It raises the risk that the power of the upward trend is tailing off. The rise from the level at about 1604 has also been under a clearly lower trading activity than during the downturn. Not a good thing.

What is needed in order to break the uncertainty created with these svaghetssignaler is that the market starts to go up, with the same high börsaktivitet as during the downturn. Or in all cases by at least 20 billion per day during the uppgångsdagarna. In addition to the OMXS30 get new strong buy signals through to establish itself above the resistance at about 1657.

OMXS30 also get new buy signals in the short-term resistance at about 1642 broken. In this case, we aim at a test of resistance at about 1657.

Would on the other hand, the OMXS30 to establish itself in the support at about 1626, the obtained short-term sell signals. Then, we aim instead at a test of the support area around ca 1600-1604.

Considerably stronger sell signals would, however, be obtained if the OMXS30 would also break below support at ca 1600-1604. Especially if this would take place in a relatively high trading activity. Intensities are then at about 1585, but the risk is then great that the declines will continue down to the support area at about 1544 or down to the area of the 200-day medeltalskurvan is currently at about 1516.

The Stochastic indicator is in a neutral position, and therefore currently not so much guidance.

Säsongsmönstret indicates, however, that, after a possible peak in the beginning of June, there is a risk of a downturn which usually end up around midsummer. It is, however, only a statistically medelutfall. It need not of course be so right every year. But it can be good to be psychologically prepared for such a development.

Acting mainly with short-term time horizon has during the week been able to take home the profit on the uppgångspositioner around ca 1640-the area that we wrote about in last week’s OMXS30 analysis. Now is the OMXS30 in a tradingintervall with support in about 1626, and resistance at about 1642.

Establishes the OMXS30 over the 1642, you can aim for a rise to, first and foremost, about 1657. Stop loss is suggested if the index goes below 1640-1642.

If the OMXS30 and instead breaks below the support at about 1626 can aim downs to, first and foremost, about 1600-1610. Stop loss example, if the index goes over 1626-1630.

Investing for more long-term strategies, one can conclude that the trends are still pointing upwards but that the level of risk has risen significantly. Are you careful of so it can therefore be reason to gradually sell of the index and shares.

If the OMXS30 would start to take off down under a relatively high trading activity, however, it can be time to a little more determined to sell long-term holdings.

However, should the OMXS30 start to go up in greater trading activity than in the recent decline looks börsläget less risky out again. In particular, if the resistance on the OMXS30 at about 1657 break below a rising trading activity looks good.