I been on earlier, there are different ways to invest in utdelningsbolag where one is more geared towards dividend growth, and more often have a lower yield than the investments we will look at in this post. We shall now look at some investments that have the really fat dividend in the here and now. Here are the possible dividend growth, no focus, but it is a high dividend now with or without growth potential. Important to keep in mind is that if you do not expect any growth, so will the dividend likely to be the only return you get at the location. Purely theoretically, is the course still and the dividend represents the total return. Are you aware of it, you can also take investment decisions with it in mind. There are many investors who can benefit from a reliable return for example, if 6.5% per year. It is up to each one and its strategy to make these choices. For some, it is right to focus on other things while some of the various reasons value a high dividend/dividend yield. Below are a bunch of different investment alternatives on the theme of high dividend.

BlackRock Health Sciences Trust. This is an ETF or rather the CEF, which is roughly the same thing with the difference that it is closed in the sense that they do not give out new shares on a continuous basis as regular ETFS do. This fund owns about 100 companies in the hälsovårdsektorn and set running out of options against their holdings to generate additional returns. It gives a higher risk, and with it a greater potential. Historically, this fund performed really well, since the start of 2005 is the annual average total return of just over 13 per cent. In one year the total return is 14 percent and in the past five years, they have performed throughout the 17,31% per year on average. Fondavgiften is 1% and the dividend yield is about 6.6 percent. The dividend will be paid on a monthly basis. Ticker: BME

Global X PFFD is a new ETF with a focus on u.s. preferred shares. So far, they have made a dividend, and it looks like that the yield lands around the 5.5 per cent annual rate. The dividend will be paid on a monthly basis and anything that makes this fund a little bit special is the relatively low fee of 0.23%. Normally for this type of fund is a charge of around 0.5 per cent, which means that there will be ”more” over to the investors. Investing in shares via an ETF provides a very broad spread of risk as it contains around 250 different preffar. It is not so exposed to events in the single preffar. Yet, I own not this myself but it is pretty high up on my wishful/watch list. Ticker: PFFD

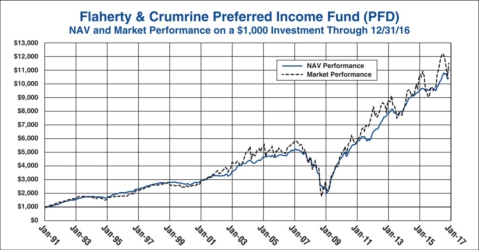

Flaherty & Crumrine Preferred Income Fund. Even those who are versed in ETFS can pull on the eye brow over the name of this. For most completely unknown, but this fund is one of those with the longest history and the history then! Flaherty & Crumrine PFD has been around since 1991 and they have performed very well since then. This is also a closed fund, a so-called CEF which allows them to work with the use of leverage to increase the return. Something I tend to look extra closely on the Cef is the amount of money that they originally started with and what it is now, and then I look at the NAV (Net Asset Value). This fund started with a $15 NAV in 1991 and now is a NAV of $14,46 which is very well approved! Many similar funds have over the years, norpat on their NAV in order to maintain a high dividend, and thus they have a HUB a good bit under what they started with but not this fund. Pension fund contribution of eur 1.3 per cent, one might think is high but you get to see what it is and evaluate it accordingly. The yield is about 6.5% and it is likely that they will continue to perform well as they have done historically and then you have to evaluate it based on the 6.5 per cent return after fees. Thus, if the return is 6.5%, it is not essential if the fee is 1 or 1.3 per cent. They have proven that they can deliver returns and it is the return they shall assess rather than to conclude that the fee is expensive or not. Historical return is no guarantee, but a good indication and in this case with history, since 1991, a very good indication in my opinion. The dividend will be paid on a monthly basis and the focus is, as the name of the fund suggests: the preference shares. Ticker: PFD