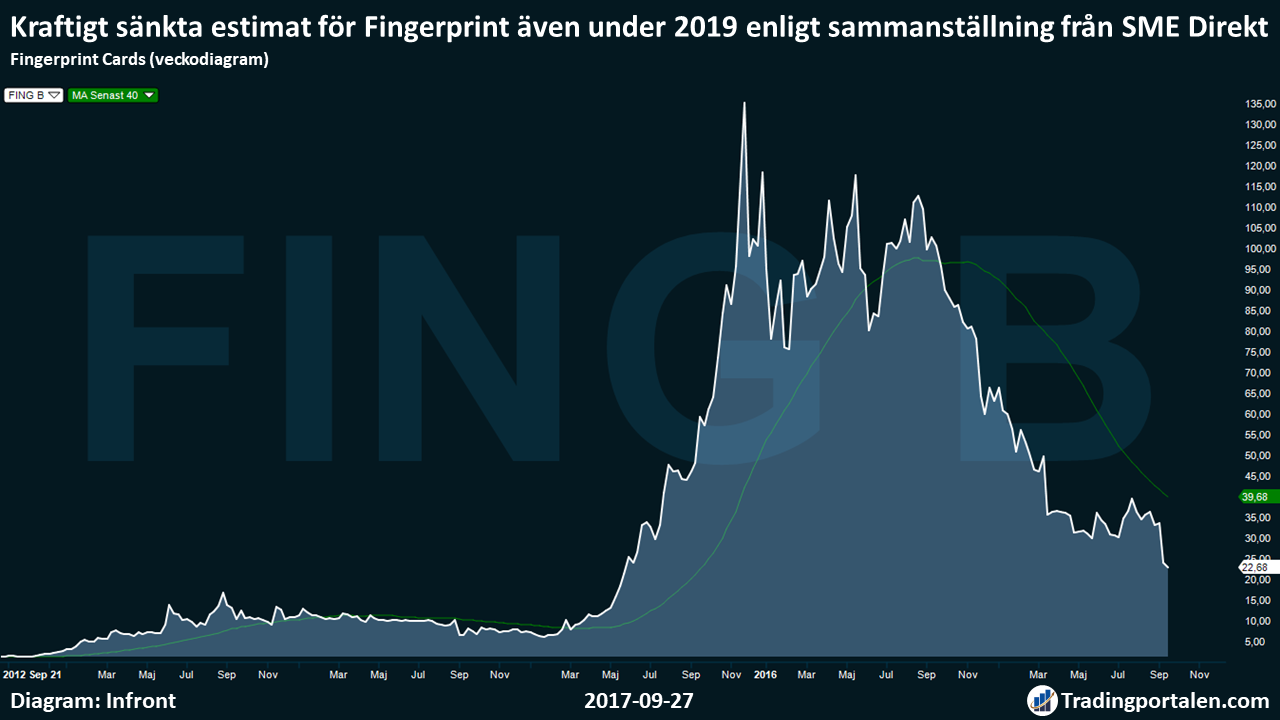

Fingerprint Cards profit warning for the third quarter of the set not only track of the forecasts for the current year but also in the long run. Snittprognosen for revenue in 2019 has been adjusted downwards by almost 2 billion and the consensus for operating profit in the same year has more than halved.

It shows the SME Direkt fresh compilation of seven analysts expectations.

”A lower market share than in the earlier estimates and a much lower asp (average price per sensor, ed) hit very hard in the expectations. At the same time, dare not think on a high level of growth in the IoT and smart cards in the coming years,” concludes one analyst, who wishes to remain anonymous, the News agency Directly.

In its profit warning on 18 september flagged Fingerprint Cards for far less revenue than what the market had anticipated for the third quarter. The reasons – a cautious market, greater pricing pressure, changed product mix and a weaker dollar – gnawed, however, in the expectations for the coming years.

The SME consensus for Fingerprints revenues during the helåren 2018 and 2019 has been reduced by 32 per cent and 35 per cent. In the latter case is the level now of just over 4 billion. The outcome in 2016 at 6.6 billion.

Noteworthy is that the analytikerkollektivet now believe a slowing growth rate in 2019, when the increase in net sales is expected to be at 7.8 per cent. It is closer to a halving of the expected growth rate for 2018, according to SME direkt.

The lowest intäktsestimatet for 2019 now stands at 3.2 billion, just below this year’s expected level.

Looking at the individual analyses, Handelsbanken has, for example, lowered intäktsestimaten with 28 per cent in 2019, more than the reduction for 2018, and the bank expects, therefore, that the company’s revenue in 2019 will be lower than in 2018.

For the third quarter individually, analysts have adjusted down their sales estimates by nearly 50 percent and now estimates that the Fingerprints revenues amount to eur 822 million.

The consensus of the ports, thus just over the midpoint in the intäktsintervall at 800-840 million as the Fingerprint itself stated in its assessment for the third quarter in the profit warning on 18 september.

A slight recovery is expected for the fourth quarter, when analysts on average assume revenues of 980 million. For the fourth quarter intäktsförväntningar, however, has been reduced nearly 40 percent since the consensus from in August.

On lönsamhetsfronten see the adjustments even worse. Here, analysts have drawn down their expectations for the Fingerprint Cards operating with 64 per cent for the full year 2017 and with over 50 per cent for 2018 as well as 2019.

The operating margin for the third quarter expected to be 13.9 per cent, clearly lower than the outcome of 41.1 per cent from the same quarter last year but slightly higher than first-and second-quarter outcomes on the 10 and 9 percent, and for the full year 2017 is expected to an operating margin of 13.1%.

The margin is expected to then recover to 17.3% in the year 2018 and to 17.8% in the year 2019.

It is also noteworthy that no major expectations is that the Fingerprint Cards to distribute any dividends for 2017. Here is the consensus now of 0:03 per share for 2017, with a medianestimat in the compilation, enter zero, a cut from the utdelningsförväntningar at 0:48 crowns per share in the SME Direkt compilation in August.

Tradingportalen/Agency Directly.

Questions and comments always welcome in the newsroom[at]tradingportalen.com