Will there be a transplant of electronic implants to the bank advisors of tomorrow, in the manner of “The man who was worth three billions”, to make the banks “increased by” more efficient ? The Boston Consulting Group, will naturally not also far when he calls on banks to ‘ accelerate their transformation to bionic. “Behind this expression a little barbarian, the cabinet of council in strategy american speaks, in reality, a subtle balance to find between digital technologies (artificial intelligence, robotics, machine learning or machine learning) and human interactions in order to reinvent the distribution model for the retail bank. A concept that he invented two years ago.

“The banks […] should become bionic, by combining the capabilities of digital, quick and convenient, with human interaction, thoughtful and caring “, argues BCG in its latest annual study on the retail bank.

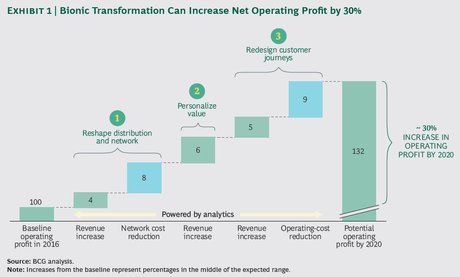

The consulting firm being offered to stakeholders in the sector, an increase of 30% of their operating profit by 2020 if they accelerate their efforts in this direction, focusing on three points : the reorganization of the branch network, the customization of the value proposition and the redesign of the customer paths.

[Reorganization of the branch network, value proposition of custom and redesign of the course clients should allow retail banks to reduce their costs and increase their income. Credits : OCG]

Customer experience “hybrid” and really “multi-channel”

At a time when a u.s. bank is testing agencies 100% automatic with no employees, and where the agencies are closing their funds with the clerk for the benefit of spaces self-service automated the largest, the “processing ” bionic” already seems to be well underway, or even the technology to take over the employee of bank. The consulting firm points out that customers want choice in how they enter into a relationship with their bank and claim the most often is ” banking experience hybrid, where the digital tools are associated with the council people at the important moment.”

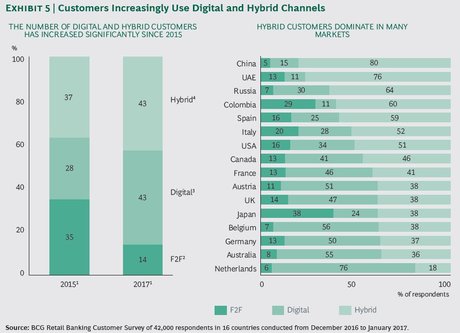

Thus, in France, 46% prefer the all-digital, 41% in using a relationship as a “hybrid” (online and travel agency), and 13% do swear by the face-to-face. There is that in the netherlands, the european country less focused on the cash, that the respondents greatly prefer the all-digital (at 76%).

[The proportion of customers preferring the all-digital, or a relationship hybrid was markedly increased in two years, according to a survey conducted in December 2010 and January 2017 with 42,000 people in 16 countries. Credits BCG]

The BCG estimates that the retail banks are still long delays in processing, features in-line and off-line discordant and offers that are too generic in the face of the diversity of client profiles. “Now the customer has the same requirement level, online, or in an agency, while banks continue to deal with often the two channels separately.

“Instead of a model agency uniform, the banks need to create multiple formats, integrated experience in a multichannel harmonious “, argues the firm.

The reorganization of the branch network, which represents in average 30% of the operational costs of a retail bank, is “one of the most important challenges” of the “processing ” bionics” : the reduction of the number of agencies cannot be the only answer, because these are the meetings face-to-face that still generate a majority of the business (in average in the world, 98% of real estate loans and 74% of new accounts require a form of human interaction), and away compared to digital. Finding the right balance of formats agencies in terms of the customer (for example, agencies self-service with advisors remotely by video conferencing, such as at Bank of America), banks will be able to both reduce their costs and improve the customer satisfaction according to the OCG, which encourages them to use data and analytics to optimize their coverage of the territory.

The netherlands-based ING, which is seen as the “Spotify of the bank, has engaged in a radical rethinking, and costly in terms of jobs, its network, in order to better meet the requirements of the clients.

Human intelligence and the power of data

The other component of transformation is intended to ” combine the expertise of the human intelligence with the power of the data “, in particular to better understand the expectations of the consumer. The BCG suggests adapting the pricing based on the customers ‘ preferences and customizing services in order to make prices more transparent and fair, based on the value of the service, while the “packages”, packages, multi-service banks are often “complex” (with more than 50 features) and poorly adapted.

For this, we must equip employees with the right tools and fully review the course customers, by focusing on a few that really count.

“The reality is that banks have made progress to a significant deployment of interfaces, elegant, apps, web and mobile sites are easy to use, but much less in terms of integration with the rest of the bank “, says the BCG.

In other words, in the nice digital front, but beneath the surface of the pipe to the old, who don’t communicate well with each other the next crucial back-office. The firm notes that there is no correlation between the number of online interactions and operational efficiency : to be clear, the banks with the most fingerprints are not the most effective.

One of the powerful tools of this transformation, particularly in improving the processing times of the operations, is the artificial intelligence. The program Watson from IBM has been adopted by several large retail banks, particularly in France, the Crédit Mutuel and at Orange Bank, but also in the Royal Bank of Scotland, Citigroup, USAA or ING. At Crédit Mutuel, where the Watson technology is deployed with 20,000 employees in 5.000 funds and agencies, we insist on the fact that the technology is “at the service of the human” :

“Analysis of e-mail helps these employees to process more than 350,000

emails from clients are received each day. The solution allows Crédit Mutuel to identify the most frequent requests, determine their level of urgency and help its customer service representatives to be treated more quickly, or to delegate the associated tasks, and thus speed up and improve the responses provided to customers “, details the mutual bank.

Thanks to the semantic analysis, Watson would save time for advisors, who can focus on tasks less daunting, more value-added. Of virtual assistants based on the same technology also allows advisors to quickly inform the clients on highly specific issues, such as insurance for car or home, and the full range of savings products. The famous “adviser increased” amount.

IA : advisors “increased” or decreased ?

However, these developments raised concerns in the employees and unions that the prospect of becoming “bionic” is not necessarily to dream and who see rather the risk be reduced (in numbers) rather than increased. It is known that part of the personal, focusing on the administrative tasks and paperwork, still abundant, are threatened. In early January, the national union of banks, SNB/CFE-CGC (which became the first organization in the area in front of the CFDT, except among the members of the company) had sounded the alarm:

“Today, the employees in the agency are generalists : they know how to talk about 80 to 110 products. Tomorrow, we will no longer need them, since its tasks will be taken by software, robots, artificial intelligence, ” said its president, Régis Dos Santos.

The French banking Association (AFB) has decided to take the topic to arm the body and has appointed an accounting firm to conduct a comprehensive study on the impact of artificial intelligence on the business of the bank. The union FO Banks is very alert and wants to start thinking about “solutions in terms of maintenance, staffing, jobs, positions and also formations, or any other axis of the bridge between the professions” :

“The banking sector and financial companies, has been able to manage and dampen the rise of the computer over the past 30 years, the transition to the year 2000, the arrival of the euro, the generalization of the automata in terms of banking transactions (cash or cheque), the bank is remote and the Internet… then for FO Banks and Financial Companies it should be the same for the AI “, argues the organisation, in a press release.