Forgotten, the uncertainties of Brexit and the geopolitical tensions that threaten world trade : the british bank HSBC, is in full form and wants everyone to know that to its shareholders, with a third share buyback program in a year, an amount that could reach $ 2 billion. Two years after the announcement of a plan to save drastic, including a reduction of 10% of the workforce in two years, the first european bank in terms of assets can boast of having improved its profitability. HSBC has exceeded expectations in the first half, with profit before tax of $ 10.2 billion, up 5%, on revenues of 26.2 billion, a decline of 11% due to currency effects and perimeter.

“We have made an excellent start to the year 2017, reflecting the changes put in place since our investors’ day in 2015 and the strengthening of our competitiveness, ” noted the ceo, Stuart Gulliver.

The DG, who has postponed his retirement, potentially until December 2018, prepares his exit on a good balance sheet.

The “Pivot to Asia”

Stuart Gulliver thanked 233,000 employees of the “considerable efforts” made. Two years ago, they were 266.000. In the meantime, the british bank has sold its activities in Brazil and Turkey, which has decreased from around 25,000 the number of employees in the group, and has also removed 466 posts in France, where she provides however to bring about 1,000 jobs in the context of the Brexit.

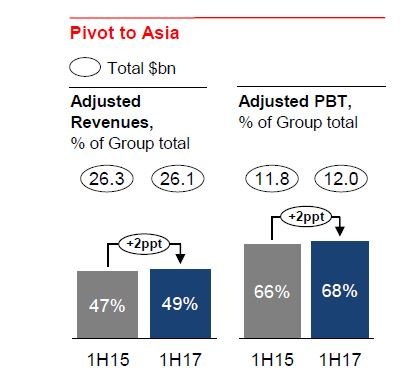

The bank has reduced its costs but also gained market share and increased its revenues by repositioning it on promising markets, in particular Asia, its historical stronghold. This “pivot to Asia” was one of the key thrusts of the plan of 2015 : HSBC now generates 49% of its activity and 68% of its profits before taxes in Asia. Its asset management business and insurance is growing fast. The Hongkong and Shanghai Banking Corporation born in 1865, and will continue the shift of its centre of gravity, by taking advantage of the opening of financial markets chinese : she just has to get the green light to launch as a joint venture, Qianhai Securities, the leading brokerage in mainland China held by an international bank. HSBC is already the first foreign bank on the market of ” panda bonds “, the bonds in renminbi made by issuers non-chinese.

Champion value creation

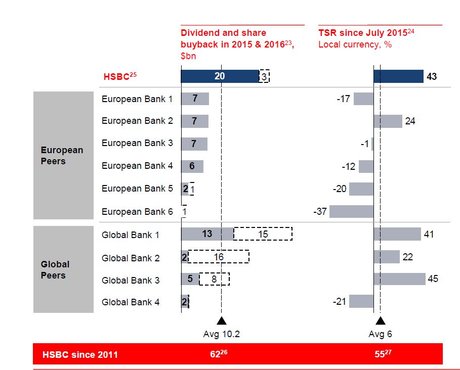

The symbol of good health, recovered from the bank, it is his generosity with shareholders. Stuart Gulliver has set before you :

“Over the last twelve months, we have paid more dividends than any other bank, european or american, and returned $ 3.5 billion to shareholders in the form of stock buybacks. “

All in all, from August 2016, HSBC will have $ 5.5 billion of share repurchases. Year in 2015 and 2016, the bank has paid 20 billion in dividends. Which puts it at the head of the european banks, and from very far away.

[Comparison of the remuneration of shareholders dividends and repurchases of securities, of the major european banks and global rate of total shareholder return (TSR), which includes the evolution of the Stock price and the dividend paid in the local currency from June 2015. Credits : HSBC]

The british bank made the race with the large american : JP Morgan has announced, at the end of June, a mega-stock buyback program to $ 19.4 billion during the coming twelve months. Citigroup has provided a plan of 15.6 billion of redemptions of securities and Bank of America for $ 12 billion. These plans shall be used to reduce the dilutive effect of equity compensation plans or stock dividends.

The news is well received on the London stock Exchange, where the title HSBC earns close to 2%.