During the week that have passed, the eye is returned to the Dprk, at the same time as the focus of the week lands on the us interest rate announcement. The oil has reclaimed its land and has made great strides to the north, after the sign of strength from the OPEC members with the potential extension of the current produktionsfrysning. Gold has lost ground in line with the concerns surrounding north Korea has slowed down, and finds himself in something of a waiting mode ahead of Wednesday’s interest rate announcement from the Fed. Base metals have also lost clearly with mark during the week, with consistently wide declines as a result of weak macro data from China.

After the previous unrest around the storm Irma, who came to Florida, the focus has returned to north Korea, and this week’s macro data.

Despite the fact that north Korea carried out a further missiltest on 3 september, the market has largely shaken off the out the unrest. As late as on Tuesday warned us president, Donald Trump, north korea’s ”Rocket Man” to the case of the disputes leading to krik, the united states does not ”have no other choice than to total of the first north Korea”.

The united nations has carried out sanctions against north Korea as late as 11 september, the current exports of oil to north Korea, and the import of textiles.

Recurring political concern around the world is seen, however, increasingly do less to the brief imprint on the market, and the uncertainty surrounding north Korea is no exception right now. Should the unrest escalate, well then we are in a completely different situation.

Brent crude has been properly köpstyrka on a visit, by the oil stepped above the previous resistance at 53 dollars, to be now trading around 55.34 dollars. This was after a brief visit of the threshold and the technical resistance level of 56 dollars a week.

Discussions within OPEC for an extension of the produktionsfrysning is one of the reasons köpstyrkan, over the increasingly weak u.s. dollar. WTI has also finally managed to get over 50 dollars, after that the previously demonstrated reluctance to get a breakthrough of this heavy sentimental heltalsnivå.

Any accounts can now be suspended for the second half of 2018, according to the OPEC members, and possibly the year. The current agreement extends to march 2018, and the oil cartel already meet on Friday to discuss the current situation.

As we touched upon already in the previous week so raised the Opec its forecast for growth in global oil demand this year and next year, while the forecast for supply was slightly reduced in 2018.

On Tuesday night, will the weekly statistics of the american oil (API) at 22:30, yet on Wednesday, the weekly statistics of u.s. oil inventories (DOE) at 16:30.

Among the base metals has been largely profit-taking that had characterized the week. Copper, Nickel and Aluminum have lost -3.00, -5.50, respectively, -1.40% a week ago.

According to Bloomberg News has a Chilean kopparmyndighet signalled more increases in their kopparprisprognoser. Copper has, as a result of this started the week with a rise of more than +1.00 per cent.

As to the concerns surrounding north Korea has slowed down, we have been a small recovery in the us dollar. This has led to that investors have shown less köpstyrka to gold, which is now trading around 1310 dollars. Then, a week back has gold lost more than -1.30%.

Gold has, however, had a really nice trip since the summer, and the step that most 135 dollars when the high for the year at 1350 dollars noted earlier in August.

We are also right now in a standby mode, when the u.s. central bank leaves interest rate announcement, tomorrow, Wednesday at 20:00. For the moment, there is nothing to suggest that the Fed raise its key interest rate, which means that the focus instead will land on the flagging before the coming increases, and any statements.

According to the Fed Funds Rate is now expected a rate hike at a later FOMC on 13 december. The probability is, however, not entirely convincing. 51.6 per cent point to an increase to 1.25 – 1.50 per cent, while 47.3 per cent points on maintaining the benchmark interest rate in the 1.00 – 1.25%.

Orange juice has continued to maintain the land around 1.50 dollars after a previous outbreak associated with the storm Irma drew in Florida, and may continue to be traded within a smaller consolidation before a clearer guidance is given.

This week we are highlighting cocoa in the new. We asked ourselves, positive already for a couple of weeks ago, and in an increasingly narrow consolidation indicates the mobilization before the outbreak. During the several trading days, we have now challenged the long-term partner in the form of the 200 day moving average, and the underlying köpstyrka suggest that we may get an outbreak further north.

Get Råvarubrevet to your e-mail every Tuesday!

Analysis

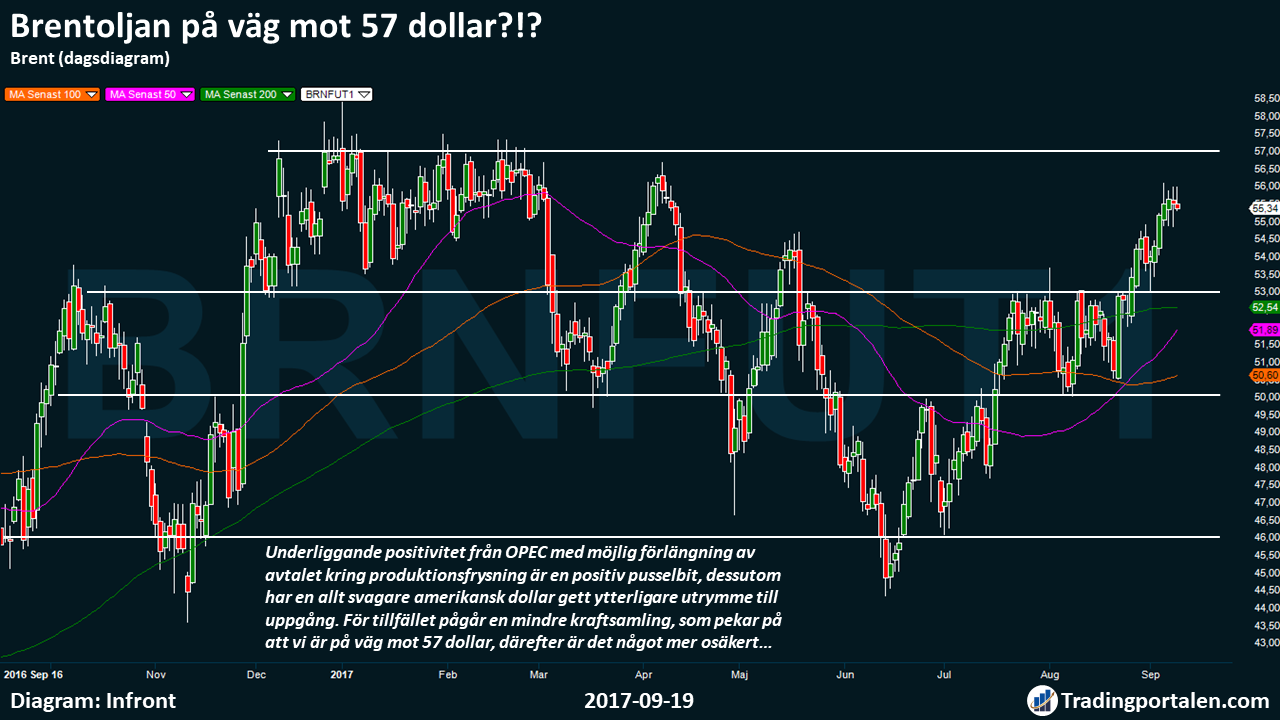

Brent crude on the way to 57 dollars?!?

The previous eruption from the handelsintervallet 50-53 dollars that went on for a few weeks is intact. Oil is traded in addition as high as more than 55 dollars, which means that we stepped over 53-55 dollars which we thought to remain within the, in addition, have the oil for several occasions now challenged 56 dollars.

The underlying positivity of the OPEC, with a possible extension of the agreement on produktionsfrysning is a positive piece of the puzzle, in addition, has an increasingly weaker us dollar has given further space to rise.

At the moment there are a smaller concentration, which suggests that we are on the way to 57 dollars, then it is something more uncertain, even if we can possibly get up to the 60 dollars a year, if köpstyrkan persists.

Thus have 53 dollars not been challenged, but if weakness occurs, we expect at least a minor support from buyers is already at 54.50 dollars, which was something hard to beat after the previous eruption over 53 dollars.

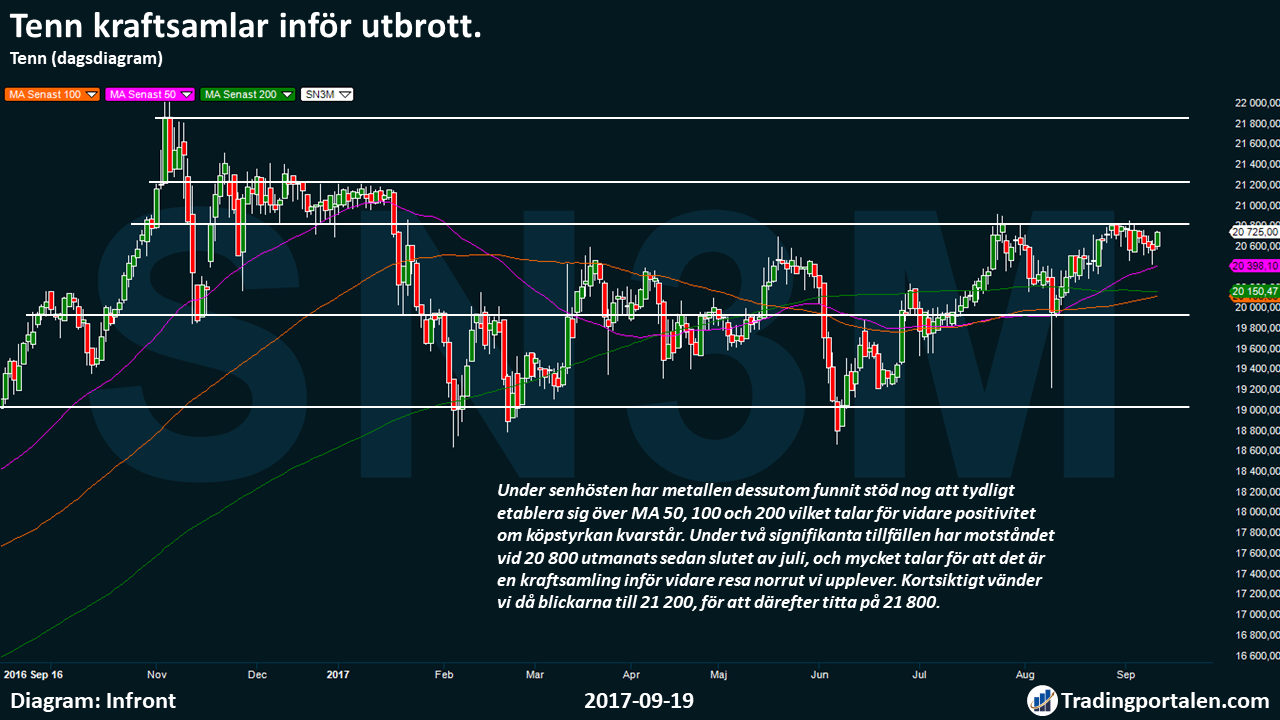

Tin concentrates before the outbreak.

Unlike several other metals, so tin etched itself all the more to the north to now challenge the technical resistance level at 20 to 800 dollars.

During the late autumn has the metal also found support enough to clearly establish itself above the MA 50, 100 and 200, which suggests further positivity on the köpstyrkan persists.

During the two significant occasions, the resistance at 20 800 been challenged since the end of July, and there is much to suggest that there is a mustering of strength for further travel to the north we are experiencing. In the short term, we turn its eyes to the 21 200, then look at the 21 800.

Even if the underlying support is awaiting at the sentimental heltalsnivån at 20 000, the probability is much lower that we get to experience such a challenging, especially when we got a candlestick ”hammer” in the previous week, which gave a sharp rebound on Monday.

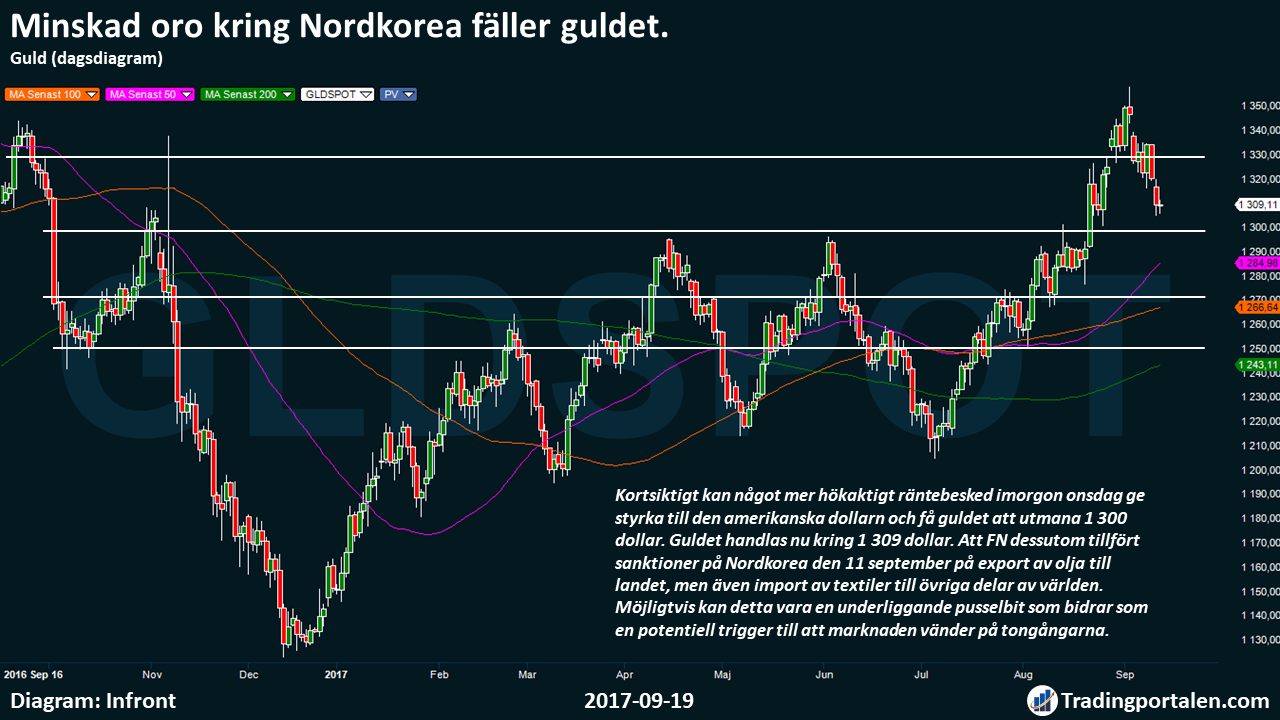

Reduced concerns about north Korea shed the gold.

Continued nedsida has influenced gold’s performance since the previous week, everything in the line that concerns about north Korea subsided.

It feels like there is a lot of talk and little action between north Korea and the united states, although it can change. Trump also felt like a person who very well can take words to action.

The gold is a bit of a waiting mode ahead of Wednesday’s interest rate announcement, at the same time as dollarkorrelationen not been as clear in line with the concerns about north Korea.

In the short term can something more hökaktigt interest rate announcement, tomorrow, Wednesday, give strength to the u.s. dollar and gold challenge 1 of 300 dollars. The gold is now trading around 1 309 dollars.

The united nations also added sanctions on north Korea on 11 september on the export of oil to the country, but also the import of textiles to other parts of the world. This could perhaps be an underlying piece of the puzzle that contributes as a potential trigger for the market turn on the vibes.

This means that the risk is elevated that we will challenge the 1 300 dollars, at the same time as a withdrawal of the concern surrounding north Korea, at the full-scale outbreak between north korea’s ”Rocket Man” and Trump can get the gold to go over 1 $ 350 shortly.

Also cocoa joins forces before the outbreak…

Already for a couple of weeks ago, we highlighted cocoa, and its potential breakout that looks to be at the time.

A narrow handelsintervall has been going on since then, and the underlying köpstyrka within this less consolidation indicates, rather, that the outbreak may be somewhat sharper than we had previously estimated.

We have now for regular occasions challenged the long-term partner in the form of the 200 day moving average. We have in addition, unlike in the past, in the beginning of August, kept the land around this juncture, which suggests that we are mobilizing before the outbreak.

At an establishment above the MA 200, this indicates that we will not only challenge the 2.10 dollars, but also because we can get to challenge the 2.20 dollars within the card.

Then it becomes slightly more uncertain, since we are outside of this range do not hold any significant volume of last year. Thus, we see cocoa as a short-term interesting case, with a low risk of nedsida versus upside potential.

Click on the link for more information about ”Focus, strategy and ansvarsbeskrivning”

Upcoming course

“Learn to support Yourself on Your Trading – a complete three-day course!” – see the next course!

More about Ingredients:

- Oljebjörnen

- Kakaokaos and chockladchock

- Unsustainable cheap cup of coffee, thank you

- Cotton is cheap

- Glencore exemplifies råvarusektorns crushing spiral downwards

- The gold glitters are not

- Fish for return of salmon

- Dawn for Solar energy

- Sweeten your portfolio

- Bitcoin – digital gold, fixed köpvärt

- Tighten the woods!