Imminent concerns continues to reflect the commodities market since the previous week. North korea and the united states continues to be the focus, at the same time, Trump also will send more troops to Afghanistan to prevent the terrorists have a safe haven. All of this has continued to squeeze the u.s. dollar, given the continued strength to both base and precious metals. Among the food is the worse development, with heavy declines since the summer.

The past week has clearly been marked on the unrest between the united states and north Korea.

It is now a military training between the united states and south Korea, which is an ”aggressive war scenario” in order to allow preventive attacks against north Korea. It even included a secret plan to overthrow the country’s leadership in the exercise it said.

This improves, of course, hardly the tensions between the united states and north Korea, which threatens US with ”merciless retaliation” over the exercises on Tuesday.

The u.s. dollar is greatly affected around the concern, and data from the CFTC has shown that the expectations of a weaker dollar, is now on the fyraårshögsta.

In addition to the hostilities between the united states and north Korea, we have also obtained a weaker development as a result of falling confidence in the Trump administration’s ability to implement growth-promoting policies.

Even Trumps the message to send more troops to Afghanistan has been allowed to stand in the focus. It will apparently be up to 4,000 more troops and american troops, which shall remain for a period of time enough to prevent that the terrorists have a safe haven, and to get to a political agreement with the taliban.

This week’s spotlight lands on Jackson Hole at the end of the week, then the makers of both u.s. central bank governor Janet Yellen and european central bank governor Mario Draghi may be to provide new guidance.

Expectations are at an advertisement of initial slimming of the balance sheet at the FOMC meeting in mid-september, and the question is also about financial stability that is expected to be in focus, whether Yellen will affect the balance sheet in more detail.

Brent oil continues to be balanced within the 50-53 dollars, and will have difficulties to outbreaks under the current OPEC-touch.

We have been continuously questioning about the current produktionsfrysning, and whether this settlement will get a proper compliance.

A shaky OPEC is thus a contributing factor to why we don’t at the moment get an outbreak. Compliance has also been reported falling from 98 to 94 per cent between June and July, which will further fuel the pessimism.

American oljelagerdata is expected later on Wednesday, with the API’s unofficial statistics on Tuesday, which is expected to provide a guide to whether or not we are heading towards a further challenging of the 50 dollars or not.

This is enough, of course, not in the long term, an analyst at Fat Prophets in Sydney highlighted clearly in a comment to Bloomberg News.

”Oil will continue to be under pressure while we see that oil production in the U.S. continues to increase, there is the swing factor. WTI price will probably stay between 45 to 50 dollars per barrel. To break out of that range, it requires either larger produktionssänkningar from Opec, or that the demand is more sustainable after the seasonally strong period”.

Among the several base metals, we continue to experience a positive development with notes on the high for the year. Copper, which fully exploded during the summer, is now testing a 3 year high. Nickel looks to have space to challenge the 12 000.

Precious metals have been good with the fuel, as investors fled to gold, but also silver and other correlated securities. Gold was just a few days ago up-and-tested 1 300 dollars, but has lost 15 points since then. However, it looks like that the current political turmoil, may come to give the fuel enough to cause an outbreak over 1 300 dollars, now listed three of the major peaks in the year.

Among foods, it is slightly worse development experienced. After a clear decline is challenging the tea, a heavy, technical support level, with support from both the technical indicators pointing to the decline as well as particular cautious sentiment from investors. Sugar and soybeans have also suffered a large decline during the summer, and wheat tokdog with a decline of over 20 percent in the summer.

Get Råvarubrevet to your e-mail every Tuesday!

Analysis

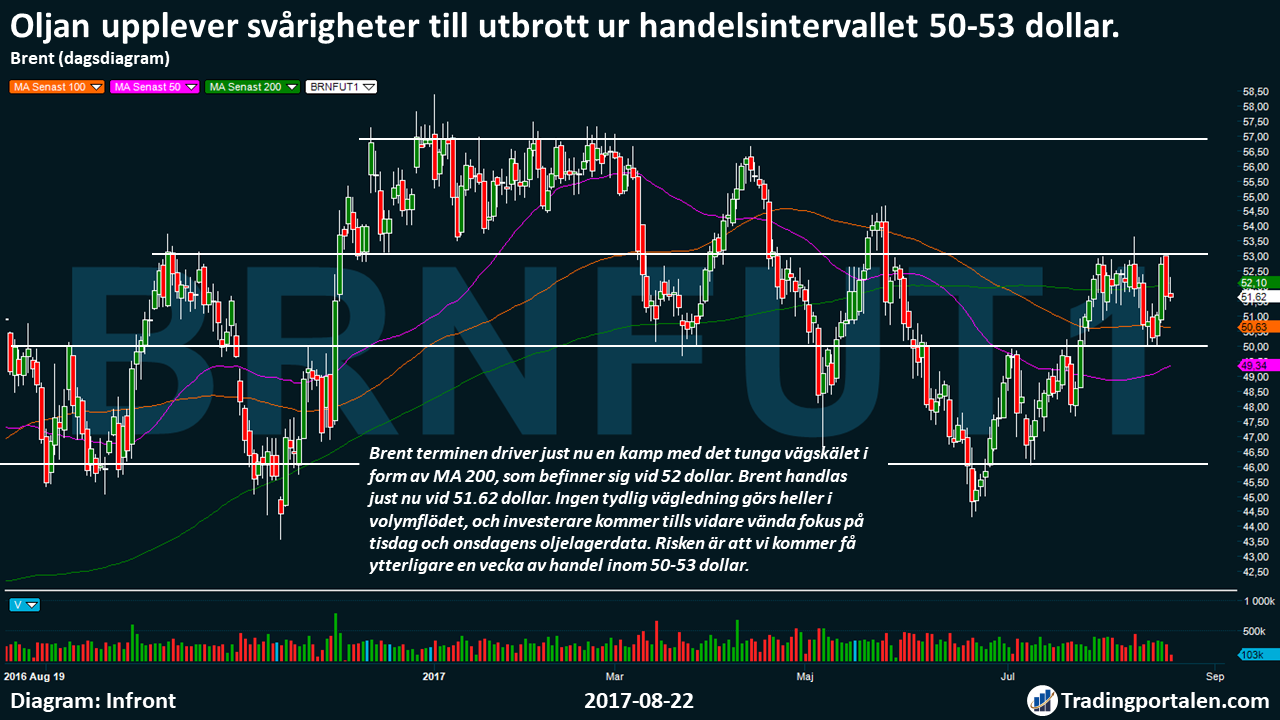

The oil experiencing difficulties for the outbreak from the handelsintervallet 50-53 dollars.

Oil continues to maintain the land, within its clear handelsintervall about 50-53 bucks.

Significant with the volume starts to be built up within this interval, especially at $ 50 but also 53 dollars.

Investors are beginning to obviously cast doubt on the OPEC, and its current produktionsfrysning, because compliance is deteriorated. Anyway maintain the oil land over 50 dollars since the end of July.

Brent semester runs right now a fight with the heavy fork in the road in the form of MA 200, which is at 52 dollars. Brent is trading right now at 51.62 dollars.

No clear guidance is made either in the volume flow rate, and investors will turn focus on the Tuesday and the Wednesday oljelagerdata. The risk is that we will get another week of trading within the 50-53 dollars.

Underlying support is waiting at 50, then, in particular at 46 dollars. Nevertheless, the found technical resistance at 53 and mainly 57 dollars.

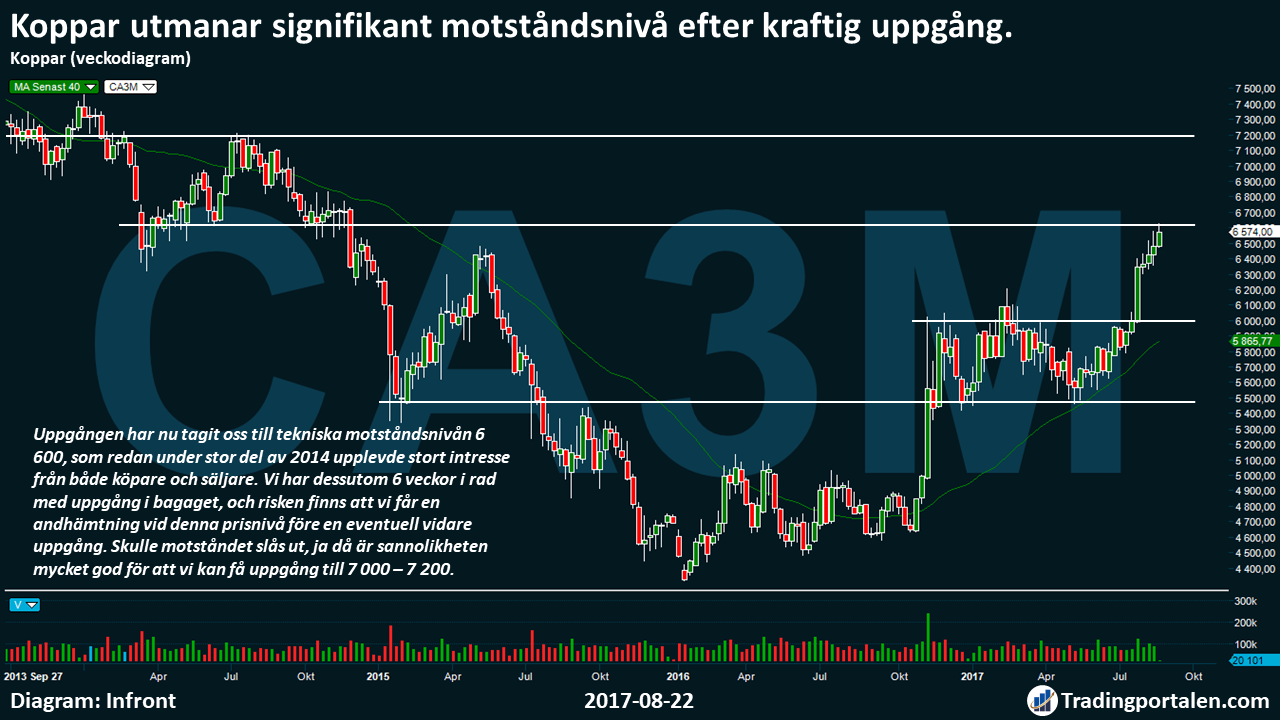

Copper is challenging significant resistance level after the sharp rise.

Copper is the base metal that is not really came to life until the last quarter in 2016, unlike several other base metals.

Since the end of the year, it has been a fairly shaky movement, with the press in the second quarter.

During the summer of this year woke up this base metal in earnest, and completely exploded from his previous handelsintervall in 5 500 – 6 000.

The upswing has now taken us to the technical resistance level 6 600, which is already in the large part of 2014 experienced strong interest from both buyers and sellers.

In addition, we have 6 weeks in a row with the rise in the baggage, and the risk is that we get a break at this level before any further rise. Would the resistor is switched out, then the likelihood is very good that we can get the rise to 7 000 – 7 200.

If the buyers against all odds begin to decline in earnest, and the seller begins to look forward, it is primarily 6 000 we keep our eyes on, before a possible return and trade within the 5 500 – 6 000 on the new one.

Gold challenge 1 of 300 dollars, seriously!

The shiny precious metal gold, has re-emerged in focus, as investors flee to gold for security in the present turmoil being experienced in the market.

It is primarily the uncertainty surrounding the united states and north Korea, which has been put in focus, but also the incidents in Barcelona, Spain has contributed with a worse sentiment on the market. Nevertheless, expected the dollar to fall, according to several analysts, and as we wrote above shows data from the CFTC that the expectations of a weaker dollar, is now on the fyraårshögsta.

This is positive for gold, which becomes interesting for investors outside the united states, then the gold becomes more interesting not only for the ”safe haven”, but also because of the currency effect, which then should result in gold continues further north.

We now have three clear peaks in the gold from a technical perspective, and 1,300 were challenged seriously for the first time since the end of 2016.

Underlying the MA 200 and its direction, are also beginning to point more to the north, which means that we take a positive view to a further rise. We believe that the likelihood then is great for a rise to the initially 1 330 dollars, before the sales force should look forward to provide counter-thrust.

The coffee is clearly pushed at the heavy intensity!

Coffee did a u-turn in August, after that this food looked to be on his way north to challenge the technical resistance level at 1.45 dollars.

Shortly after the turning point, it became almost free-fall to now not only be noted in 1.35, but even challenging the heavy technical support level at 1.26 dollars.

A certain cautious sentiment has been reported in the news. Investors have shown more passivity when it comes to increasing the positions, which could mean that we get a further decline if it continues.

It is, however, a significant key level at 1.26 dollars that we now find ourselves at, and a proper match from the buyers expected.

The heavy fork in the road in the form of MA 200 turned north in the summer, and the question is whether this is sufficient after a longer period of decline, in order to give strength and continuation of the journey to the north.

Coffee is like so many foods clearly väderstyrt, and maybe something one should be clearly aware of, when starting from the positioning from a technical perspective.

Click on the link for more information about ”Focus, strategy and ansvarsbeskrivning”

Upcoming course

“Learn to support Yourself on Your Trading – a complete three-day course!” – see the next course!

More about Ingredients:

- Oljebjörnen

- Kakaokaos and chockladchock

- Unsustainable cheap cup of coffee, thank you

- Cotton is cheap

- Glencore exemplifies råvarusektorns crushing spiral downwards

- The gold glitters are not

- Fish for return of salmon

- Dawn for Solar energy

- Sweeten your portfolio

- Bitcoin – digital gold, fixed köpvärt

- Tighten the woods!