After a shorter summer break is råvarubrevet back in the usual way. The summer has definitely been nice on the commodities market, not least among the precious metals, but also base metals which, nevertheless, had the opportunity to experience big moves. The oil that was up and turned at 53 dollars at the beginning of August, has, unfortunately, fallen to just over 50 dollars on unrest around OPEC and its agreement about the produktionsfrysning. A shaky OPEC has, however, been in the dark, on the uncertainty surrounding north Korea and the united states, which put great impression on the market last week.

As you probably already noticed, we have with great joy launched a weekly valutabrev now in August.

Demand has been strong, which we think is very, very fun. This means that from today on so it becomes less of a focus on the global foreign exchange market in Råvarubrevet. A more comprehensive and in-depth analysis, you will find instead in the valutabrevet, which also contains most of the technical analysis.

In recent times, considerable focus has landed on the united states and north Korea, which is clearly marked börshumöret. It continued ordkriget between the president of the united states, Donald Trump, and north Korea’s Kim Jong Un is undeniably something that affected the market negatively.

Even if north Korea countered with the threat of a missile attacks on the island of Guam in the Pacific, where the united states has several bases, this has now been toned. However, said north Korea’s president that it can change ”if the yankees insist on their extremely dangerous and reckless actions”, which means that the game is considered to be far from done.

”It will be difficult for the markets to fully regain his balance, until we have come out of this mellanmånadsfönstret without any provocation”, commented Deutsche Bank’s strategists, according to an analysis by Marketwatch.

As a result of utspelen, the u.s. dollar has fallen sharply, and the precious metals as both gold and silver has got to shine with his ”safe haven”. We also note that the dollarindexet has gone from 97 to just over 93 dollars since the beginning of the summer, a fall of almost -4 per cent.

Overall, the commodities market have otherwise been really nice during the summer. Oil has been refreshed, and was up and turned so high as at 53 to the dollar as recently as August, a steady rise from 44:50 dollars at the end of June.

Most of the base metals note, nevertheless, is really nice gains during the summer. Copper rose over +8%, and was up and turned at the highest price level since 2014, Zinc is slightly better with over +9%. Zinc is also and stomps around the high levels, and can be on the road to note a new 10 year high. Iron ore stand out a little extra with a rise of more than +36% since the beginning of June.

Risk appetite has also increased the current week for base metals, when tensions between the united states and the Dprk slowed slightly. However, we believe the risk to be high for at least a minor rebound and profit taking after this summer’s development.

When it comes to the oil market compliance around the produktionsfrysning as OPEC reached agreement with its member states re-scored to be in focus. A meeting was held recently in Abu Dhabi to discuss why countries like the Uae and Kazakhstan have not reduced production as much as promised.

Ecuador was the first member state left to the agreement, Iraq latched on shortly thereafter, but is said to regret the decision after in connection with the meeting in Abu Dhabi.

After the meeting in Abu Dhabi, revealed in a press release that ”all countries have expressed their full support,” wrote Bloomberg News.

OPEC raised recently its forecast for growth in global oil demand, while the forecast for the range written down in the year.

OPEC raises while efterfrågeprognos between by 2017-2018, 96.49 million barrels per day on average in 2017, 97.77 million barrels per day in 2018.

Among the food stands of wheat out a little extra with a clear decline, similarly, we think that orange juice now beginning to see short-term interest, after the great fall, which we were lucky enough to have matched very well in conjunction with the peak levels in november 2016. Is the bottom reached already now, or can we expect a continued decline?

Get Råvarubrevet to your e-mail every Tuesday!

Analysis

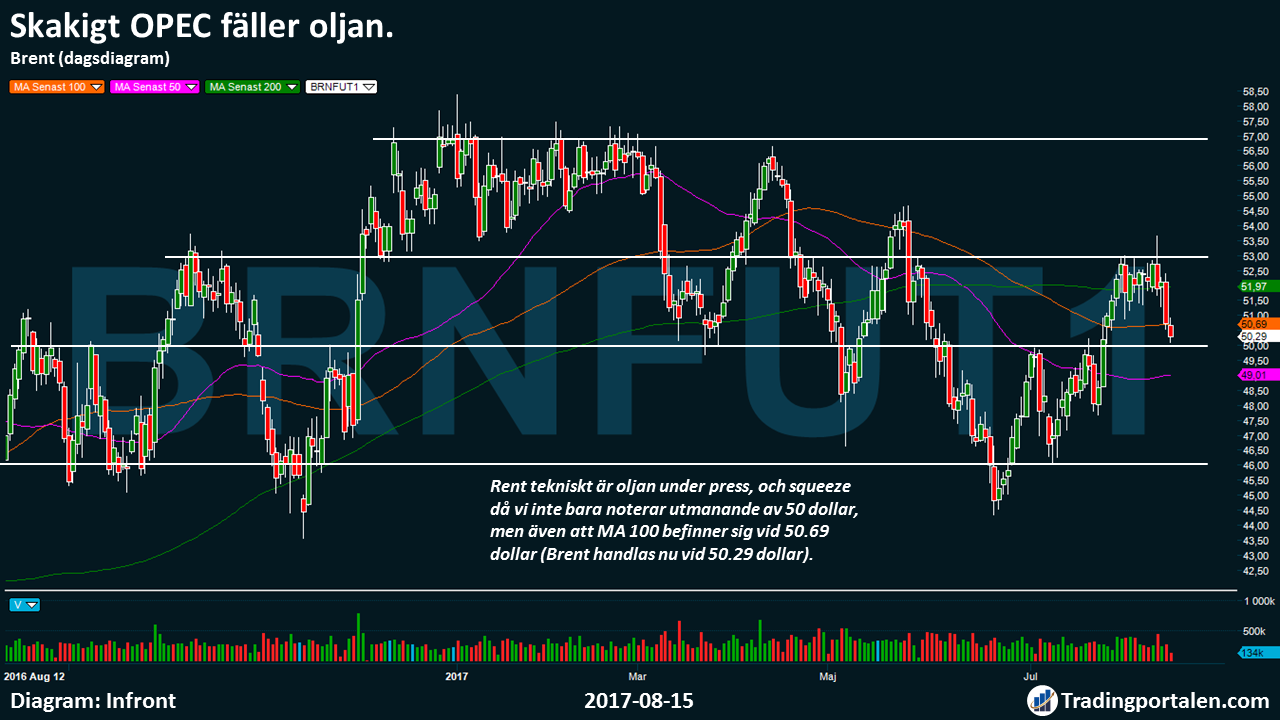

Shaky OPEC shed the oil.

After the meeting in Abu Dhabi has the oil in connection with the us dollar lost ground, continuing to the south. Thus, the rise to 53 dollars has been blurred, now after we stepped back down to 50 dollars.

Even if OPEC pronounce itself officially to all countries stand behind the produktionsfrysningen, you can ask the question, then why some member states can not comply with the agreement. To Ecuador and Iraq have also taken a step to the side, improves not the image that OPEC is trying to paint up.

Tonight roll it in after the u.s. exchanges closed, the weekly statistics regarding oil storage (API), similarly, shedding it tomorrow Wednesday in oljelagerstatistik from the DOE.

Technically, the oil is under pressure, and squeeze when we not only note the challenging of the 50 dollars, but also that the MA 100 is at 50.69 dollars (Brent is now trading at 50.29 dollars).

The sales force has, however, slowed down, but we are us, therefore more passive of the week then Tuesday’s and Wednesday’s statistics can degrade, or alternatively, improve mood.

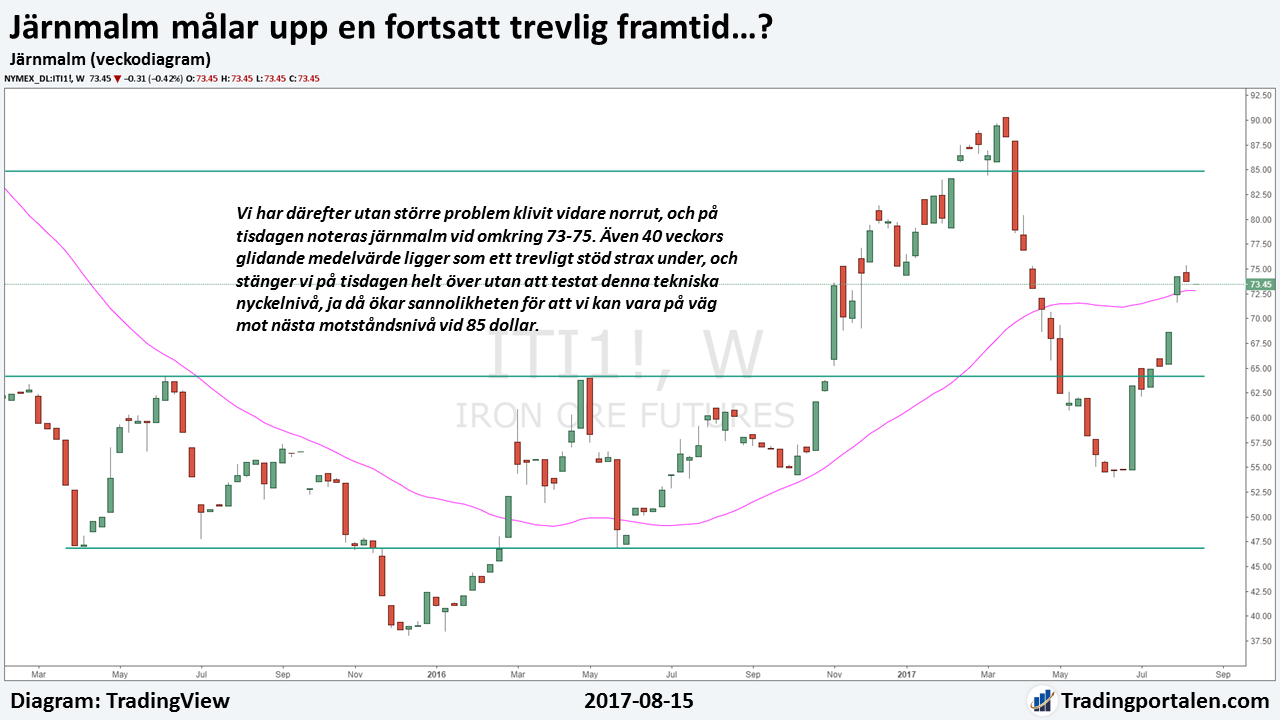

Iron ore paints a nice future…?

Despite the fact that iron ore has risen by more than +36% in the summer, it looks actually pretty nice out.

From there we left a note about the 55, we have got a rise not only beat out the competition at 64, whose price level acted, not unsurprisingly, as a fulcrum.

We have then, without major problems stepped further to the north, and on Tuesday noted iron ore at around 73-75. Even the 40-week moving average is like a nice support just below, and we will close on Tuesday completely over without being tested, this technical key level, then increases the likelihood that we may be on the way towards the next resistance level at 85 dollars.

Would weakness, however, is presented, so increasing the risk instead of that we can get a less recoil, a rebound that may well take us so low for a challenging of 64 dollars.

Is gold on the way towards the challenging of 1300 dollars?

After a really strong rise during the summer, managed to the gold, step up to 1290 dollars, an increase from 1210 dollars since the beginning of July.

During the year we have had three clear peaks, the first time in april, the second time in June, and the last time in August.

Gold also got a boost as investors fled to safety on the uncertainty surrounding north Korea and the united states. Relief has, however, emerged in the market, and the trip looked to be heading towards a new high for the year took hux flux end of the year.

Underlying momentum may still be continued to be positive. The uncertainty surrounding north Korea and the united states is not fully played out, as so we don’t really know how it will be with interest rate hikes even though some believe in a rate hike this year.

If we were to get an outbreak out 1300 dollars, we turn our eyes to 1310, followed by 1320 and 1340. Our medeltalstrio are also a good distance from an element of risk that can paint a negative picture, but if so, that would prove to be the case, it is primarily a return visit around 1210-1220 which can be current.

Orange juice in the short term interesting.

After a clear decline in two phases since its peak in november 2016, the orange juice started to slow down.

Just before the summer we started to see signs that we can possibly be on your way to soon be a turning point. Then we have a clear consolidation, and since the middle of July we begin to receive signals on the clear underlying positive momentum.

Orange juice has lost over 30 percent just since the end of the year, and even if there is a technical aspect of it all, and why we believed in a turning point back in november, so show the statistics that americans consume less juice, mainly frozen fruit juice have become most affected between 2012 and 2016.

This has also resulted in that trade have become increasingly thinner, then 2016.

Technically, we think, nevertheless, that the basis of a short-term perspective it can start to get interesting. We have the underlying guide in the back, and is believed to be on the path to a challenging of 144. Whether we may get a rise to the next major resistance level just above 160, however, is more doubtful, possibly we can get a challenging of the 150 shortly.

Orange juice is, however, that many foods any more difficult to trade. Not least, it is more expensive to get access to good market data, but even then, this segment of the ”softs” as it so nicely is called depends on how the weather develops.

Click on the link for more information about ”Focus, strategy and ansvarsbeskrivning”

Upcoming course

“Learn to support Yourself on Your Trading – a complete three-day course!” – see the next course!

More about Ingredients:

- Oljebjörnen

- Kakaokaos and chockladchock

- Unsustainable cheap cup of coffee, thank you

- Cotton is cheap

- Glencore exemplifies råvarusektorns crushing spiral downwards

- The gold glitters are not

- Fish for return of salmon

- Dawn for Solar energy

- Sweeten your portfolio

- Bitcoin – digital gold, fixed köpvärt

- Tighten the woods!