Helomvänding in oil has taken us sharply to the south since the previous week, and once again, it is Opec in focus. Among base metals, China is once again the backbone, whereupon this time the country’s investors are asking themselves clearly positive to include steel and is located on the purchase page. Eurogruppsmötet in Hamburg has also been in focus, but this week’s speech by Yellen and Brainards can bring increased volatility in the statement. Precious metals continues to experience a wet blanket over them, including the silver who went on a hefty decline in connection with the strong american market data.

Råvarubrevet now take a summer break, and is back again on Tuesday, August 15.

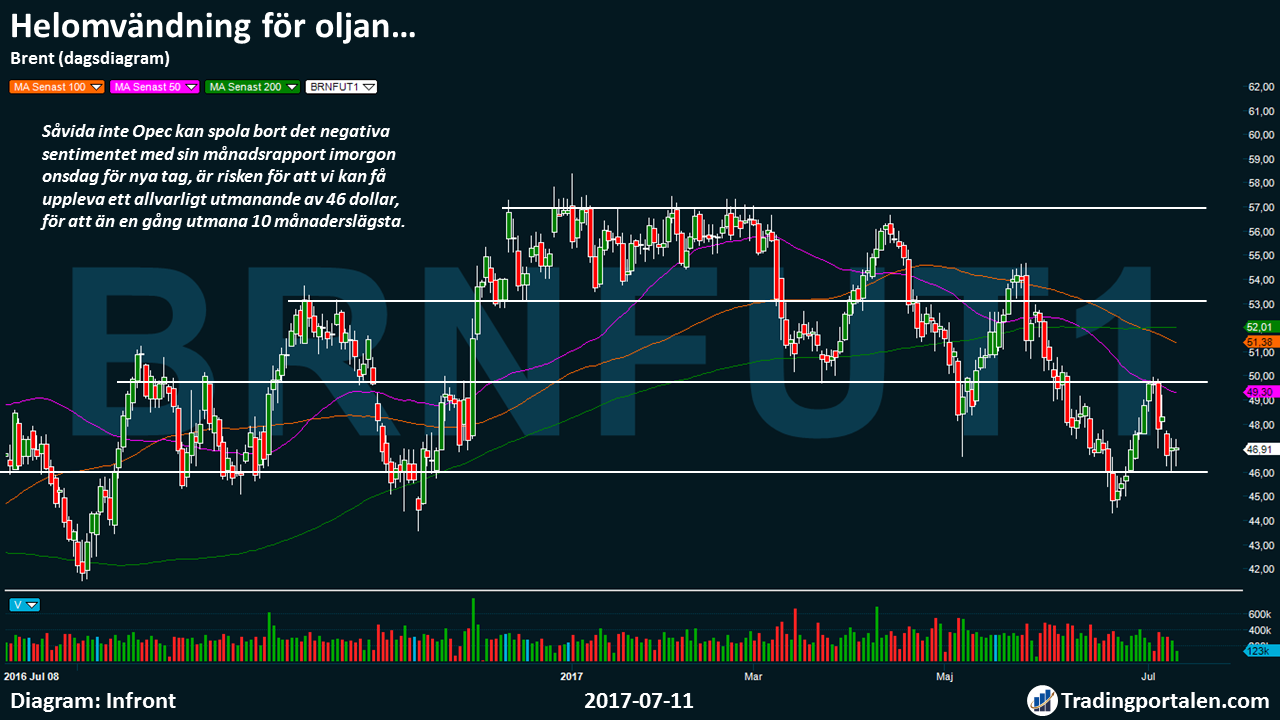

After the new tag as well of $ 50, we got instead a u-turn, which took us down to 46 u.s. dollars on Monday.

Thus, we have now instead taken it all in closer to the step 10 månaderslägsta again, after a decline of -5.70 percent a week ago.

A continued concern about the global supply continues to lie like a wet blanket over the investors ‘ sentiment, and even if we got renewed hope that we would challenge the $ 50 on gravity, and the possible establishment above, continue Opec to fuss.

Libya and Nigeria production has continued to increase, and now it is said that the two countries have been invited to a meeting on 24 July to discuss a stabilization of the countries ‘ oil production.

In addition to this, saudi Arabia has been on the wallpaper of the week, which is now said to produce above the production cap. According to sources, the Goldman, the country has pumped 10.07 million barrels per day in June, and thus contributes to further selling pressure on the oil market.

Tomorrow Wednesday ahead opec’s monthly report, and it will be interesting to see if the forecast will be adjusted slightly, when it comes to supply and demand.

On Tuesday evening at 18:30 will the attention be directed toward the Fed governor Lael Brainards speech ”normalising central banks ‘ balance sheets”, ahead of Wednesday’s semi-annual statement of monetary policy before the house of representatives, Yellen. Here, it is not entirely impossible that the volatility increases at the statements.

We often talk about what the market expects when it comes to future increases in interest rates, including Fed Funds Rate. Right now praise the market in two increments of 10 points for depositräntan in the next year, which can be compared with no increase in assessment in the middle of June.

Eurogruppsmötet in Hamburg has also been in focus during the weekend, whereupon Malcolm Turnbull has lobbied to exclude Australia from any tax when it comes to the u.s. import duties on steel and aluminum.

Part of the Donald Trump campaign during the u.s. presidential election contained such an agenda. But the question really is how realistic this is, then Trump recurring receive setbacks in their implementation.

The european stålorganisationen (Eurofer) recently raised its forecast for 2017, and expects an increased demand on the +1.9%, compared with +1.3 per cent earlier.

Stålorganisationen thinks that a taxation of imported steel would be devastating for global capital inflows.

China lifts at the same time, base metals in general, and the support programmes is expected to continue, and when it comes to steel, the chinese investors have gone in heavy on the futures market and believe in a continued strong bull market.

Among precious metals, gold continued to maintain the land just above 1 200 dollars, however, went silver on a proper decline last Friday, when the US delivered strong employment figures, and fell over -7% intraday. After stabilization, we note now a drop of -3.25% since the previous week.

The number of employed persons outside agriculture in the USA increased by 222.000 persons in June, which was significantly above the analysts expectation of 178.000 according to the Bloomberg News survey.

This means that investor sentiment has strengthened, which also means that the precious metals are expected to maintain a wet blanket over it until further notice.

This has resulted in a slight strengthening in the u.s. dollar, and has strengthened more against several currency pairs, including the british pound gathered since the end of april.

Among foods, we will highlight this week until the wheat stepped up to challenge heavy resistance level. This rise has been steady since the summer of 2016, and the question is whether it ahead on the rise, or correction, when utbudsnivåerna is up over 2 percent this year, compared with what the market expects…

Get Råvarubrevet to your e-mail every Tuesday!

Analysis

U-turn for the oil…

The previous week, arose positive attitude in connection with that 50 dollars was about to be challenged seriously. Continued concern around stock levels have, however, continued to put pressure on oil prices.

In addition to this, Libya and Nigeria landed at the wallpaper, which we have so often reported as a risk factor, in order to keep down their levels of production.

Opec has invited the two countries to a meeting on July 24, to discuss the stabilization. The question is whether this is sufficient, and the question is whether Wednesday’s monthly report can help with positive fuel.

Technically, oil has backed down -5.70% in a week, down -17.60% since the end of the year and noted in writing during the 47 dollars. This means that we have a u-turn and now challenges the technical support level 46 dollars on new.

Unless Opec can wash away the negative sentiment with its monthly report tomorrow Wednesday for the new tag, is the risk that we might experience a serious challenging of 46 dollars, in order to once again challenge 10 low of the month.

China paints a continued positive journey for steel.

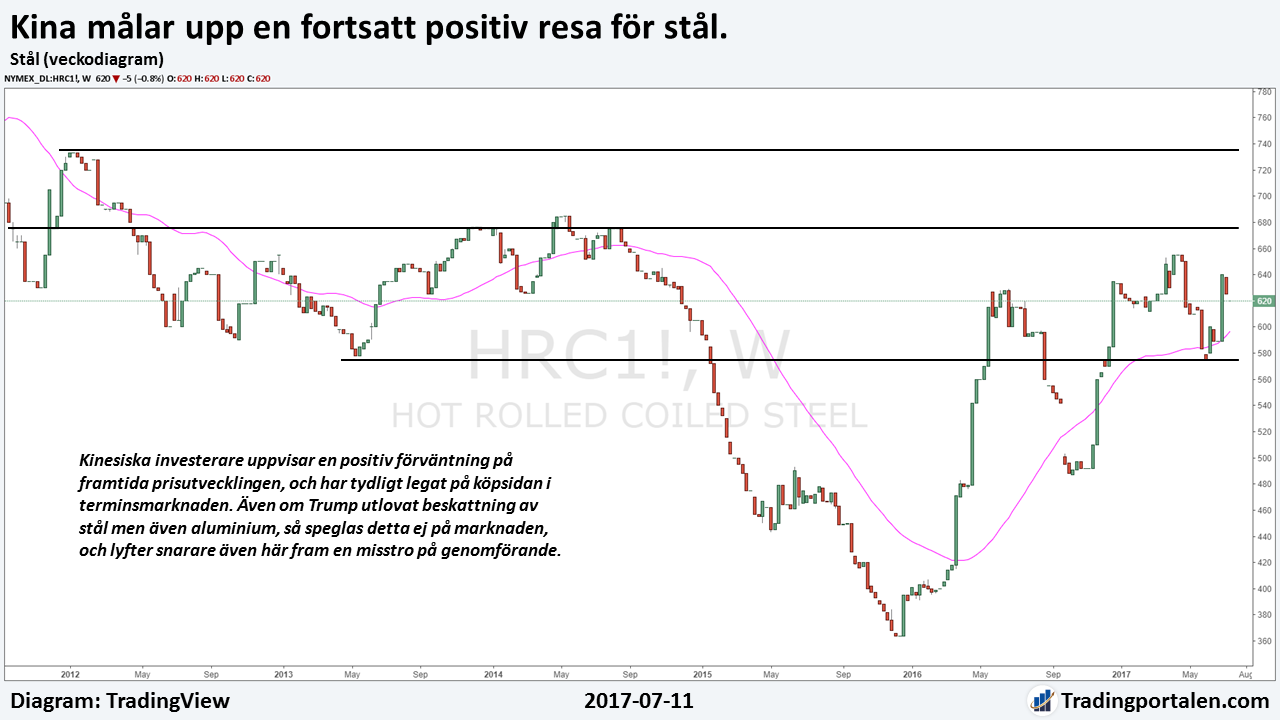

In addition to a correction during the summer of 2016, we note a sharp rise since the end of 2015.

In addition, we received a establishment of technical nyckelnivån at 570, we have experienced difficulties stepping up to challenge the 680 level.

Chinese investors exhibit a positive expectation on future price developments, and has clearly been on what they can purchase in the futures market. Even if Trump promised taxation of the steel but also aluminium, as is reflected this is not on the market, and takes the rather, until a disbelief in the implementation.

Technically has steel found land over the 40-week moving average, and köpstyrka stepped at the same time, check where the intensity at 570 challenged.

This means that as long as nothing unexpectedly negative arise, that we assess the likelihood that high for a new high for the year shortly, but also a challenging of the 680 in the future.

Strong u.s. data put pressure on silver.

Already on Friday when u.s. data surprised the market went silver on a sharp decline. Intraday fell semester of -7%, but since then we’ve gained a certain degree of stabilisation.

However, the traded silver is still based on the sole technical support level at 15.50 dollars, and continues to be clearly pressed.

Right now we find no sign of renewed strength, and believes rather that there is a high probability that we can get a renewed decline below the support level.

Maybe it is time to turn the attention to the 15 dollars now…?

Mobilization continues for the pound.

Despite a slightly stronger us dollar, so goes the british pound to show a focus since we had an establishment of 1.26 at the end of april.

Recurring occasions, we have challenged 1.31, but not managed to find momentum enough for the establishment of emptiness.

Underlying support level at 1.26 gave a nice rebound, and we now have two larger challenging of the technical resistance level at 1.31.

We now look to find the support of the MA 50, can come to mean that we are short-term receive a renewal of the challenging north.

However, it is expected the u.s. dollar to continue to maintain its position, and thus retains a cautious sentiment then the risk is high that the dollar can continue to fall in the long term.

Has wheat reached a turning point?!?

Since over a year back, we noted a steady rise for wheat, which meant that we stepped over several technical key levels.

This year’s rise means that we are now challenged 4.40 dollars, and the heavy technical key level.

This fulcrum has been hard to beat since a time back, and given that expectations are at an oversupply on the market of wheat, rather, is the probability that we have now reached a turning point.

Wheat has clearly established itself over the 40-week moving average since the beginning of the year, which certainly bodes well for the future development.

However, unless nothing unexpected happens on the väderfronten, which may affect the utbudsprognoser, we believe that in the short term a decline to 3.80 is within easy reach.

Click on the link for more information about ”Focus, strategy and ansvarsbeskrivning”

Upcoming course

“Learn to support Yourself on Your Trading – a complete three-day course!” – see the next course!

More about Ingredients:

- Oljebjörnen

- Kakaokaos and chockladchock

- Unsustainable cheap cup of coffee, thank you

- Cotton is cheap

- Glencore exemplifies råvarusektorns crushing spiral downwards

- The gold glitters are not

- Fish for return of salmon

- Dawn for Solar energy

- Sweeten your portfolio

- Bitcoin – digital gold, fixed köpvärt

- Tighten the woods!