Political unrest has put a clear imprint since the previous råvarubrev. The dismissal of FBI director at the same time as Trump accused of having leaked secret information to Russia has continued to be a wet blanket on the market. This has created a clear concern about Trumps future tax credits, and infrastructure investments in the united states. This week’s big focus in the commodities market is Thursday’s Opec meeting in Vienna. The consensus is that there will be an extended produktionsfrysning with 9 months, which caused the oil to rush greatly.

Since the last week has been a wet blanket has been above market. The dismissal of FBI director James Comey came in the wake of Trump tried to get Comey to discontinue an investigation if the Russian contacts. At the same time has Trump been accused of having leaked secret information to Russia, which meant a clear concern among market participants.

Investors question the potential future tax credits, but also the infrastructure investments previously announced, during the election campaign.

Sharp concern in Brazil after the political crisis of mutskandal, have passed relatively unnoticed. Leading börsterminer fell 10 percent on the Ibovespa index, while the futures for currency real was stopped after a decline of over 6% during Thursday.

The country’s president, Michel Temer denies consent to the bribe, while more and more brazilian politicians called on the Temer to resign. Brazil’s former president Dilma Rousseff, after a corruption scandal.

”That Temer loose is probably an understatement…”, wrote Johan Javeus, chief strategist at SEB, in a marknadsbrev.

Skräckindexet VIX rushed briefly during the previous week to over 16, followed by a stabilization and decline to the current listing at 12, which clearly shows a correlation in tune with the increased disorder, volatility, and the ”sell-off” that arose in the wake of the Trump concern.

In a week, we turn our focus to the Opec meeting in Vienna, on Thursday.

The oil has been clear with the fuel to rise, which is now in its third week in the row with the closure on the plus. This has meant that Brent oil gained enough köpstyrka, to start the week with the listing of the 54 dollars, for the first time since a little more than a month back.

Oil-producing countries in the Opec meet on Thursday, to discuss a possible extension to fall a further 9 months. An extension of 9 months would contribute to achieving the producers ‘goals to reduce global oil stocks for the past five years’ average according to Saudi arabia’s energy minister, Khalid Al-Falih, reported Bloomberg News on Sunday.

Iraq is the country that has so far shown the least kindness to a compliance during the current contract reduction in capacity.

“Getting Iraq on board is going to be interesting….I think Iraq in the end will get on board but they might make it difficult along the way,” said an analyst for CNBC’s Squawk Box on Monday.

Some analysts have even raised the issue if it is enough with just an extension, and if not an extended decline in production is required, in order to get the oil to return to its former glory.

Upcoming interest rate announcement in the US on June 14, indicates, according to the calculation of the Fed Funds-the semesters almost 100% probability that there will be a rate hike to 1.00-1.25.

Dollarindexet in line with the increased political unrest, continued to drop clear of the land, and noted right now just under 97 dollars.

Thus, we have clearly deviated from the 100 dollars level, which in the past was an obvious pulling point.

This, in turn, has given fuel to not at least several base metals, but also precious metals.

When it comes to base metals, it is again China which is on the wallpaper. The country has, as we reported last week given new hope to investors after you highlighted that it will increase its infrastruktursatsning.

An interesting observation to this is that the country will build a ”mega city” in the area Xiongan from scratch. In the beginning of april announced the country will build a town 11 kilometers from Beijing, near the port city of Tianjin.

The demand for several base metals like steel and copper is expected to increase in connection with this. The city will initially cover 100 to 200 square kilometers, but in the long term, amount to around 2 000 square kilometers, roughly the size of three New York city! The construction of the city is done, in order to manage the unsustainable situation that prevails in Beijing, överpopulation, traffic, and bad air.

Among precious metals, we see primary support in the rise in gold, which has been ongoing in recent weeks from the weaker dollar. In particular, an outbreak of 1260 dollars be a possible sign of strength for further rise.

Within the food continues the corn to clearly be affected by the weather, with both rain and cold. Expectations according to the weather forecasts is that the further severe weather will hamper planting. Sugar went on the setback of the previous week, when China announced tariffs on imports of the raw material. The decision may clearly influence the top producers like Brazil and Thailand.

Analysis

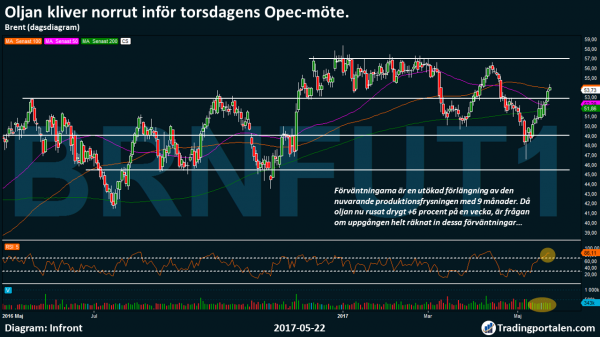

The oil climbs the north face of Thursday’s Opec meeting.

Köpstyrkan have remained since the previous week in the oil. However, we managed to break above the resistance at 53 dollars, and started the week with a listing of over 54 dollars for the first time since april 19, ahead of Thursday’s Opec meeting.

Expectations are an enhanced extension of the current produktionsfrysningen with 9 months. Then the oil now rushed more than +6 per cent in a week, the question is whether the upturn fully factored into these expectations.

Further köpstyrka can come to mean an establishment above the MA 100 at 54 dollars, followed by a test of the previous teeming year high at 57 dollars.

Would, possibly, market participants expect slightly more during the Opec meeting, maybe an extended decline in production than the current production levels, then, increases the risk of a renewed test of support level at 53 dollars, followed by the MA 200 which is currently quoted at just under 52 dollars.

The tin on the way to break the heavy resistance?

Among base metals, we highlight this week until tin as an interesting case. The metal has risen almost 3 percent since a week back, which means that we now challenge a heavy technical resistance level.

Significant volume is noted for several years back at this resistance level which is 20 to 400, which means that we expect that the sales reps can come to show their prowess.

We have, in line with that, we approached this price level experienced a certain slowing köpstyrka, and the question is, are we mobilizing before the outbreak, or if it is time for a turning point and a renewed test of the underlying support around the 20 000?

The short-term tin overbought, which increases the risk of a potential short-term rebound, at the same time as we challenge for the fourth month in a row the 12-month moving average, which is often considered to be a clear indicator of the direction of travel. This in itself is negative, but we await a utkristallisering to see where the current challenging resistance at 20 400 wearing of…

Time for gold to shine on?

Gold has, in line with the political concerns that prevail in the united states received renewed köpstyrka, which means a journey with a rise of over +2.5 per cent in a week.

The upturn has taken us back to the 1 260 dollars, and the heavy resistance level.

The dollar has clearly lost ground, which we touched on earlier in the week råvarubrev, which created further fuel to the rise in gold.

At the same time it is positive attitude that prevails, we note that the short-term, gold is overbought.

However, we see more positive pieces than negative from a technical perspective. Heavy crossroads, as the 12-month moving average continues to be challenged, at the same time, we have now stepped over not only the 200 day moving average, and MA 40 weeks.

The establishment of the 1 260 opens up for the potential rise to 1 295 dollars. At the same time, there is a risk of rebound and the decline followed by återtest of the MA 200 which is currently noted at 1 243, if the Fed against all odds, would present a more aggressive tongång.

On the other hand speaks nothing for this to happen in the current situation, rather on the contrary. With Trump behind the scenes, you know not what is to come, and it comes to in the usual order, to grope gently…

The Swedish krona continues to strengthen against the dollar.

The political turmoil prevailing in the united states, with a focus on possible leaked classified information to the Russian representatives, and the dismissal of FBI director James Comey still holds.

The dollar has had the opportunity to experience a broad weakening, which means that the crown is clearly strengthened. Since the previous week, the dollar has lost -1.54 percent against the Swedish krona.

We lifted the already in the previous week up to the likelihood of an outbreak down below the support level had been increased in line with the above. Very true, this was the case, and the current week has clearly established itself in this level of support 8.75 kronor.

At the same time, we note that the USDSEK stepped during the 12-month moving average, which as previously touched often seen as a guidance in the future. The listing below indicates the possible trade to the south, and vise versa.

Unless we get a recovery and strength in the dollar and the new challenging of 8.75, which is seen as a lower probability right now, it opens it up for potential decline and the challenging of the next technical support level at 8.60 in the future.

Corn joins forces for the rise?

Maize has since the beginning of the second quarter experienced a clear sideways trading.

Buyers and sellers have pushed a fight around 3.70 dollars. Since the previous week, however, has köpstyrka looked back, which resulted to an increase of +2%.

Weather, atc with both the storm, the rain but also the cold continues to pose problems. Purely fundamentally, this opens up for further positive progressions for the price, especially now when köpstyrka emerged during the two days.

We will hold short-term top at the resistance level at 3.80, while the really heavy resistance awaits at 3.99 dollars in the future. At renewed weakness and the outbreak on the downside, awaiting the particularly significant support for 3.46 dollars.

There is hardly any exciting developments we have experienced since the end of the summer of the previous year, but as my dear colleague always say ”never stop monitoring the boring markets”. In the food is corn hardly any exception, and we may very well get volatile movements, once we get clear of outbreaks through the support resistance.

Get Råvarubrevet to your e-mail every Thursday!