Recent moves in the oil ahead of next week’s Opec meeting has been put in focus since the previous week. This time it is Russia and saudi Arabia who wanted to show a strength, by presenting a common position, to an extended produktionsfrysning after the summer, with 9 months. Above all, we have this week noted more clearly the movements in, inter alia, base metals and precious metals, following the unrest from american sources. In the usual order is, once again, Donald Trump, who created the turmoil, this time the dismissal of FBI director, but also public concern over the potentially leaked confidential information to the Russian representatives on a visit to the White House.

The aftermath of the French presidential elections has been relatively quiet in the market since the previous week.

Riskaptiteten continues to be high, which is also confirmed from the VIX which continues to be noted around a historically low level.

This week, the newly elected French president, Emmanuel Macron appointed as prime minister. To great surprise, was elected in a landslide victory over Edouard Philippe, which is probably an attempt to attract voters at the parliamentary elections in June.

As late as today, Tuesday flagged the Swedish Riksbank in order to already in september, changing the inflation measure from CPI to the CPIF.

The reason is that the Riksbank to remove the effect of changes in the instrumental rate from inflationsmåttet, because inflation is rising faster in the upcoming rate increases, versus decreases, which previously pushed the CPI.

Now, it is also less than a month to go until the next interest rate announcement comes from the u.s. central bank, which is currently pointing to over 70 per cent probability that the interest rate is maintained at 1.00-1.25, on 14 June, according to the Fed Funds Rate.

The oil has managed to regain ground last week, and it was on Monday briefly over 52 dollars.

Russia and saudi Arabia have been in the spotlight, whose acting has given fuel to further strength. The two countries ‘ energy ministers said at a joint press conference in Beijing that it is necessary to extend the agreement, which expires in the summer, with a further nine months in order to achieve the goal to reduce the global inventory to femårssnitt.

The big question is whether it is enough to extend the agreement. Several analysts have highlighted the additional fall in production in addition to an enhanced agreement.

For a little more than a week, on 25 may next week in Vienna, it is time for the next Opec meeting. We await with great focus on how the result is, for the moment, it is a positive signal that exists for an extended produktionsfrysning with a further nine months. At the same time, Nigeria and Libya to stand in the focus, which can be set to the situation which we previously touched with increased production.

The international energy agency (IEA) lowered this week its forecast, with growth in the global demand of oil.

The IEA adjusted up utbudsprognosen something, while at the same time pointed out the previously agreed produktionsminskningarna within Opec is expected to continue to be around 96 per cent compliance.

Base metals have since the previous week, gained strength from China, which has given new hope to investors who had renewed positive sentiment over the chinese economy.

The country highlighted that it will increase its infrastruktursatsning, as previously announced.

Copper was one of the base metals which had a clear impact, with renewed köpstyrka, which resulted in a clear rise since the previous week.

The us president, Donald Trump continues to end up in the new thunderbolt, which has meant that since the previous week has a negative sentiment occurred, which caused the dollar to, inter alia, to lose against the Swedish krona.

Trumponomics starting to get an ever-more questioning, and a large dose of mistrust. Previously announced infrastruktursatsning, which was part of the valpropagandan has continued to be in focus.

In addition to this general concern about the possible leaked classified information to the Russian representatives on a visit to the White House made headlines, in addition to the major focus which landed on the dismissal of FBI director James Comey.

”The issue of Comey will probably linger, and the recent revelations about Russia, if it grows into a bigger problem, will increase the concern for the US administration and the definitely be a dollarsäljande factor. The market can now come to gradually reduce their long dollarpositioner” said Jun Kato of Shinkin Asset Management, to Bloomberg News.

This has also meant that the precious metals experienced the renewal of the fuel. Both gold and silver have risen, particularly in the silver on the cutting edge with a sharp rise since the previous week.

When it comes to food, we will highlight this week until the cotton completely rushed. The underlying factor is said to be strong, the figures for american exports. Analysts are of the opinion that the united states exported a large part cotton, which means that the market can get the experience of a possible deficit until the next harvest later in the year.

Analysis

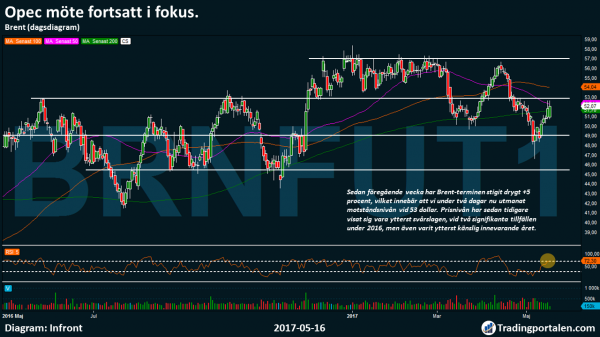

The Opec meeting continued to be in focus.

During the week, oil (Brent) had underlying fuel from both Russia and saudi Arabia, which favours an expanded produktionsfrysning ahead of next week’s Opec meeting in Vienna on 25 may.

Since the previous week Brent semester has risen more than +5 percent, which means that we for two days now challenged the resistance level at 53 dollars. The price level has previously been shown to be extremely hard to beat, on two significant occasions in 2016, but also been extremely sensitive current year.

An outbreak above resistance level at 53 dollars, increases the probability of a possible visit of the former year high at 57 dollars.

Oil is also traded around the heavy technical branch 200-day moving average, at the same time that we find ourselves in a short term overbought scenario, it means that if an establishment above this resistance level fail, increasing the risk of a return visit by in particular 50 dollars initially.

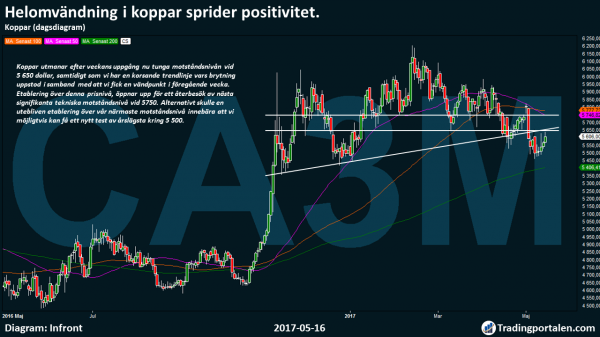

U-turn in the copper spreading positivity.

Since the previous week, copper has at least made a u-turn, which resulted in an increase of more than +2 percent.

After that we had previously experienced pressure on the downside, China has entered the picture and spread positive sentiment, with the statement that the country will increase its infrastruktursatsning, as previously announced.

Copper challenge after this week’s rise now heavy resistance level at 5 650 dollars, at the same time we have a crossing trend line, whose break occurred in conjunction with that, we got a turning point in the previous week.

The establishment of this price level, opening up for a revisit of the next significant technical resistance level at 5750. Alternatively, would a non-establishment of our next resistance level mean that we can possibly get a retest of the year low around 5 500.

Silver rebounds just above the support level.

Then we experienced a weakening of the dollar after the distrust and unrest of Donald Trump, this has been a particular boost for precious metals, including silver.

Unlike gold, which has risen +0.66 per cent since the previous week, silver has rushed more than +3%.

We received a bounce and rebound before we even reached the support level at 16 dollars. Four-day rise means that the silver is now trading just below 17 dollars.

From a purely technical point 100 day moving average to the north, while the MA 200 looks to be able to start turning north.

Above all it is the resistance around 17 dollars which is the focus in the short term, and an establishment of this price level means that the eyes turn toward the 18 dollars.

The dollar is dropping following the unrest.

The dollar has dropped against several of its currency pairs since the previous week, about the general concern over possible leaked classified information to the Russian representatives on a visit to the White House, and previously announced the dismissal of FBI director James Comey.

Against the Swedish krona, the dollar has lost more than -0.8% since the previous week.

This means that we are currently experiencing challenging of a heavy support level at just over 8.75 kronor.

Since the establishment of this price level, we have for 2017, the experienced three in the past challenging, and we now find ourselves at a fourth challenging.

The probability of an outbreak down below the support level at just over 8.75 has increased, in line with the general concern that exists. Initially, this might mean a trip down to 8.60. Would buyers on the other hand stepping back into the picture, opens this up for a renewed challenging of MA 200 again, as just now quoted at 8.88 dollars.

Cotton are taking steps towards technical resistance after the sharp rise.

Since the previous week has cotton fully exploded, which meant an increase of more than +3.80%.

The underlying factor is said to be that the statistics on strong us exports, which may mean a possible deficit until the next harvest later in the year.

The outbreak means that we have clearly stepped over kanaltaket in the rising trendline, as noted in the chart below.

We take a step back, we see that in the inserted the weekly chart indicates that we have an upcoming resistance within the card. At the same time, it means that we noted at highest level since 2014, and the establishment of the resistance level of around 87 dollars, can come to mean that we get a renewed test of the 2014 high for the year.

It would prove to be a false eruption, we see an initially decline to 82 dollars, followed by around 79 dollars, which earlier experienced the clear volume.

Get Råvarubrevet to your e-mail every Thursday!