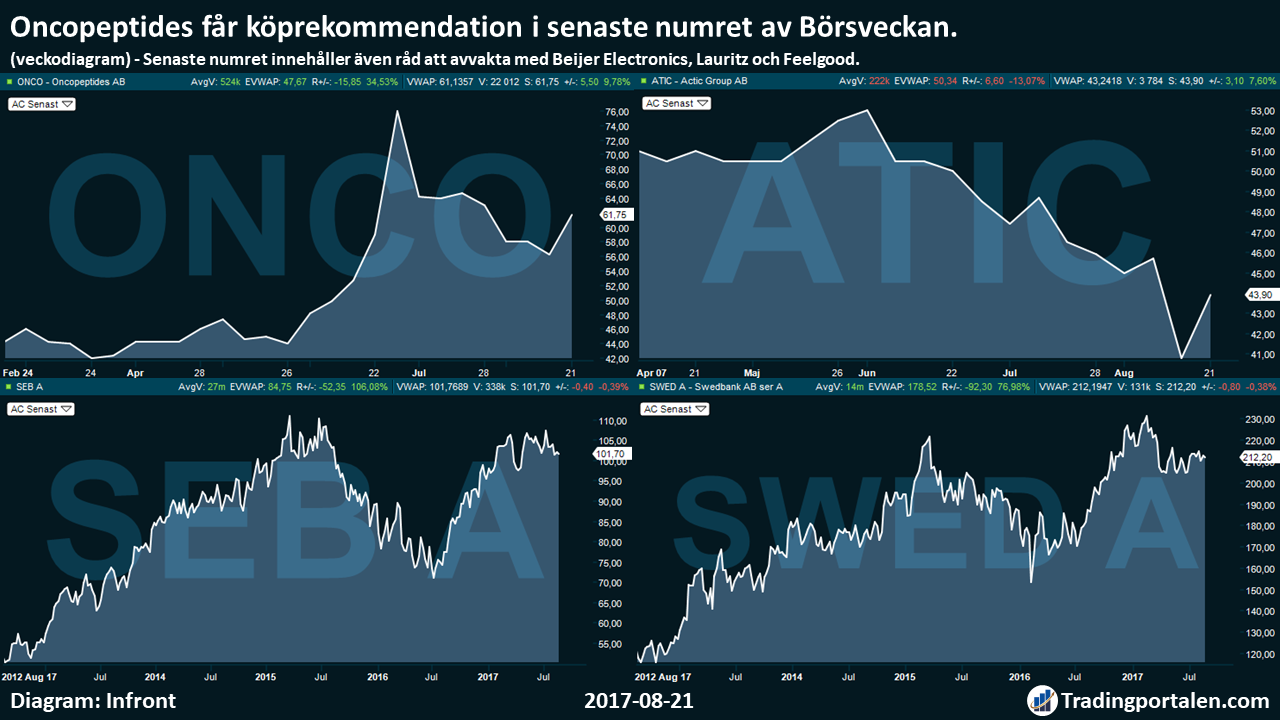

Oncopeptides is Börsveckans new buy recommendation. The magazine has also been reinforced in its positive opinion of the Actic and Transtema and the like SEB and Swedbank.

It is clear from the latest issue, which also contains advice to wait with Beijer Electronics, Lauritz and Feelgood.

The weak performance of the company Oncopeptides in the last time ”gives a good köpläge”, especially for those who do not shun risk. Including the potential for growth of the company, which is active in blood cancer, is the valuation low, according to Börsveckan.

”Furthermore, Oncopeptides have good odds to get good agreement given the interesting profile of their drug candidate”, called it in the analysis.

There are, according to Börsveckan ”chance for revenge” for the gym chain Actic, which has fallen since its listing in the spring and backed off a lot after the report a couple of weeks ago. The newspaper forecasts give a p/e ratio of just 12 and it makes köprådet persists.

Börsveckans positive image of the First North-listed fibernätsolaget Transtema has been strengthened since the interim report. Köprådet stands firm and riktkursen is located at 72 sek.

Börsveckan believe in a ”good development” for the teknikbolaget and sourdough Beijer Electronics earnings trend in the coming years. But the newspaper want proof that the good trend is stable, and decides to wait with the share for so long.

Företagshälsovårdsbolaget Feelgood have not felt so good the last few years. It looks to Börsveckan ”okay” out before 2018, but the overall situation is not enough for a buying advice. Börsveckan says wait.

A change of ceo and the program is a step in the right drawing for the auction house Lauritz, which has not made investors happy since its introduction. It is doubtful if the measures are enough. Börsveckan think not, and put the wait.

The magazine has also looked closely at the banking sector and come to the conclusion that SEB is clearly buyable. There is an additional favorite.

”Swedbank has good profitability, rock-solid balance sheet, a high proportion of revenues from net interest income and, in addition, the second-best yield of the four major banks, which means we also see this share as a year,” writes Börsveckan.

The magazine makes no changes to his portfolio this week.

Tradingportalen/Agency Directly.

Questions and comments always welcome in the newsroom[at]tradingportalen.com