Köpstyrka looked up on Tuesday in connection with storbolagsindexet OMXS30 searched to the north. The OMXS30 rose +1.28% to 1543.76, while turnover on the stockholm stock exchange rose and amounted to 15.4 billion. Köpstyrkan also continued in the united states, which closed clear plus in the evening, also during the night’s trading in Asia. Weak positivity is felt early this morning, and we expect a careful introduction of just over Tuesday’s closing.

Get morgonrapporten to your e-mail daily before the stock market opens!

Today’s analysis

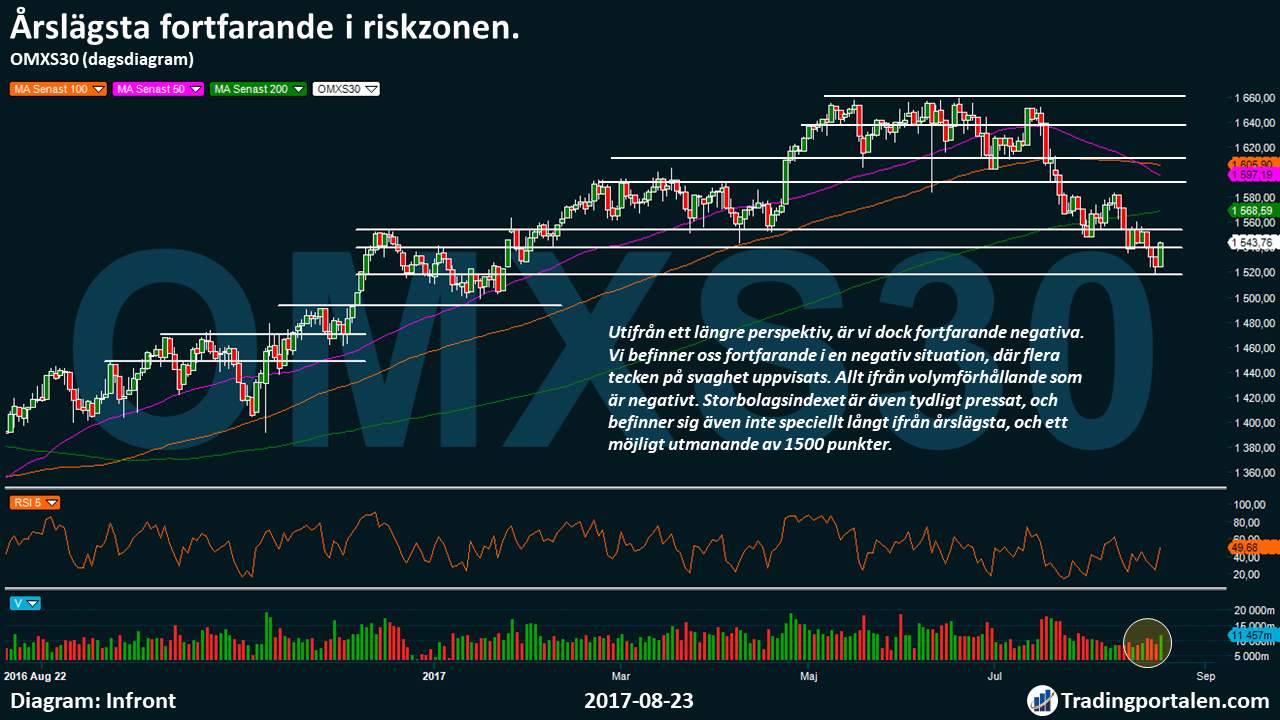

Storbolagsindexet OMXS30 managed to get further north on Tuesday, through the rise of +1.28% to 1543.76.

This increase was in trade when the turnover step, and köpstyrkan was higher than what the sales force has been over the last 15 trading days.

This sends a weak underlying positivity, as we closed over technical resistance level at 1540 points.

However, it is a short-term positivet, and as we had highlighted earlier, are seeking we significantly köpstyrka. This means that we want to see a more marked köpstyrka than that now experienced, to get a more clear picture and confirmation.

Leading futures point early this morning that we get a positive introduction, when the stockholm stock exchange opens on more than a couple of hours.

Us senior semester, the S&P 500 is, however, slightly less, after the night’s trading in Asia. This can possibly get to dampen sentiment, and potentially lead us to challenge the 1540 points initially on Wednesday, who are now acting as a technical support level.

That we can possibly get a continuation of the journey to the north, may possibly be that we see an underlying movement and kraftsamlingsfas in the workshop. It was also this sector which led Tuesday’s rebound.

We often talk about the sektorrotation, and maybe it is time for the workshop to lead, at least a short-term rebound. The workshop had a bitter summer in connection with the rapportsäsongen, and had hardly damaged by a jolt of the north.

This means that both the 1550 and 1560 will be in focus, if the inledningsvisa indicative of the movement continues further north during the day.

On the basis of a longer-term perspective, however, we are still negative. We are still in a negative situation, where several signs of weakness have been presented. Everything from ‘ vapour is negative. Storbolagsindexet is also clearly pressed, and is also not very far from the low for the year, and a possible challenging of 1500 points.

We do not want to see a decline in the 1500, even if the strength is not significant. In contrast, the signal from the market more worrying if this happens in connection with that we experience significant sales force.

For a start, need storbolagsindexet to establish itself in both the 1540 and 1527 points, before such a scenario occurs.

On Wednesday’s agenda are a couple of popular latecomer to submit a report. Elekta and Scandi Standard will already by 07:30. Away in the united states will Hewlett Packard after U.S. exchanges close.

Makroagendan lands focus on the preliminary weighted PMI in August within the EMU, at 10:00. In the afternoon, the preliminary figures of Markit weighted PMI August to be in focus at 15:45.

For today’s trading are awaiting the technical resistance 1550, 1560, 1580 and 1600 points. Technical support levels await at 1540, 1527, 1517, and 1500 points.

What hålltider and the company reports the next weeks you can read here.

Yesterday’s main börshändelser.

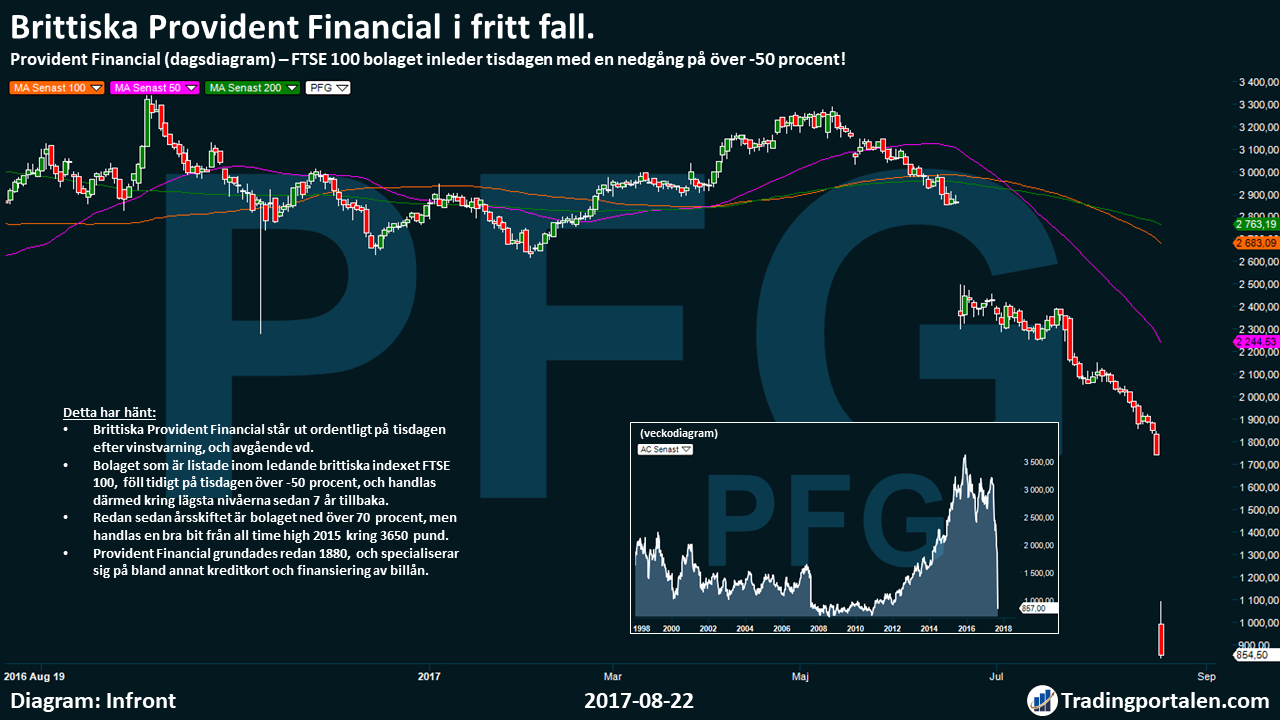

British Provident Financial in free fall.

The FTSE 100 company launched Tuesday with a decline of over -50%!

British Provident Financial is out properly on Tuesday after a profit warning, and the outgoing ceo.

The company, which is listed in the leading british index, the FTSE 100 fell early on Tuesday over -50%, and traded, thus, around the lowest levels since 7 years back.

Already since the end of the year, the company is down over 70 percent, but traded a good bit from the all time high in 2015, around 3650 pounds.

Provident Financial was founded in 1880, and specializes in, inter alia, credit cards and the financing of car loans.

Balancing around the crossroads, continue in Sandvik.

A break for further decline, or focus before the new tag?!?

Sandvik continues on Tuesday to be balanced on the fork in the road in the form of MA 200.

The company has experienced a steady decline during the summer at just over 10 percent, without any direct persuasive köpstyrka stepped back into the picture.

The risk is that we are experiencing a temporary break before the onward journey to the south, and that we anything positive in the news feed is required to obtain a turning point.

Nearby technical resistance levels await already a short-term at 130, but in particular at sek 132 is expected to be the heavier of the two.

On Monday, it was revealed in a press release that the company’s business area Materials Technology, SMT, has given notice 210 officials about the termination. This after second-quarter report showed that the business area’s profitability was unsatisfactory due to weak customer activity in the energy segment, and weak demand when it came to the standard selection of pipes.

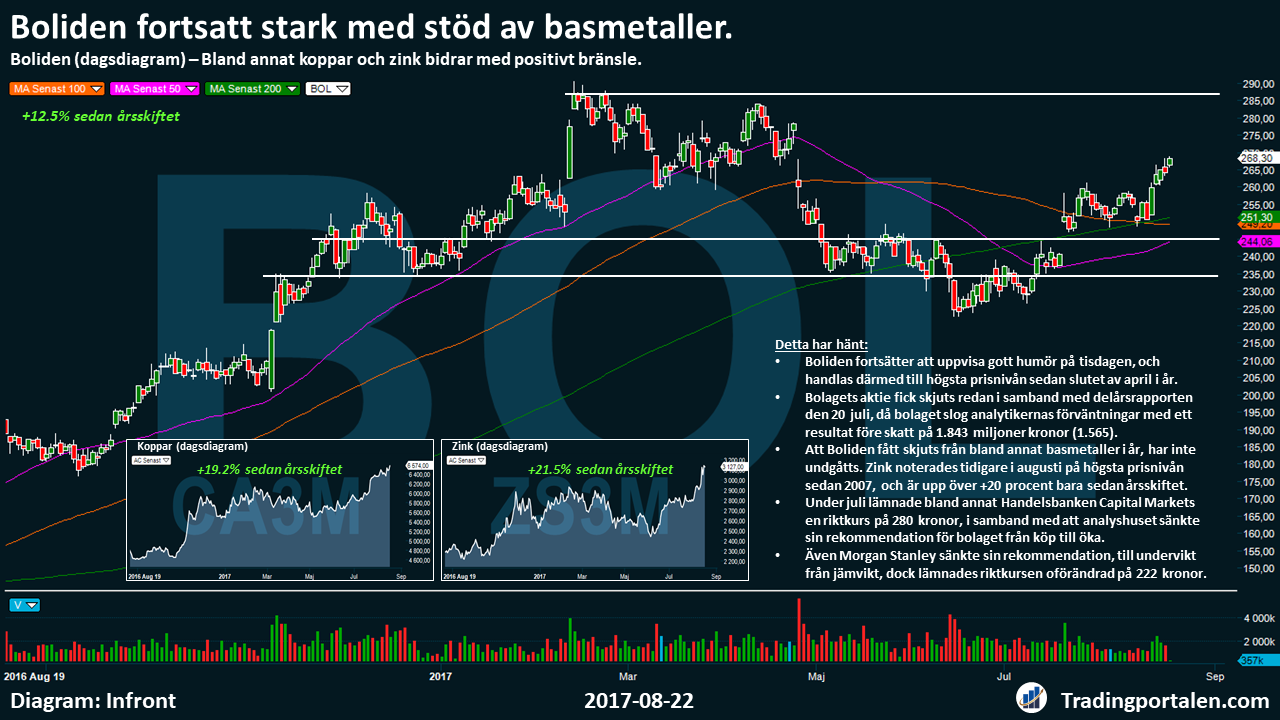

Boliden continued to be strong with the support of the base metals.

Among other things, copper and zinc contributes with positive fuel.

Boliden continues to show a good mood on Tuesday, and traded hence to the highest price level since the end of april this year.

The company’s share was given a ride already in connection with the interim report on 20 July, when the company beat analysts ‘ expectations with a profit before tax of eur 1.843 million (neg: 1,565).

Boliden received a boost from, among other base metals in the year, has not undgåtts. Zinc was noted earlier in August at the highest price level since 2007, and is up over +20% just since the end of the year.

During July, the among other things, Handelsbanken Capital Markets has a price target on 280 in connection with the by cut its recommendation for the company from buy to increase.

Also, Morgan Stanley lowered its recommendation to underweight from equilibrium, however, submitted riktkursen unchanged at 222 crowns.

Hålltider during the day

Company reports

- Elekta (7.30), Scandi Standard (7.30), B3IT (8.00), English school, (8.00), Saniona (8.00), Alligator (8.30), Electra (about 8.30), Hufvudstaden (8.30), Just (8.55), Lundberg (lunchtime, approx 12-12.30), the Mermaid, Sintercast, Sotkamo Silver, Hewlett Packard (following the united states-the exchange closing)

Macro statistics

- Japan: industry-PMI (prelim) August at 2.30

- France: overall PMI August (tbc) at 9.00 am

- Germany: weighted PMI August (tbc) at 9.30 am

- EMU: weighted PMI August (tbc) 10.00

- United states: Markit weighted PMI August (tbc) at 15: 45

- U.S.: sales of new homes, July at 16.00

- USA: oil stocks (DOE), weekly statistics at 16.30

Other

- ECB: Mario Draghi speaks in Lindau, Germany 9.00

All börshändelser and estimates for the week can be found here!

Latest börsnyheterna

The stockholm stock exchange went strongly ahead on Tuesday. The upturn was broad, and led by verkstadsbolagen. Among individual shares had Fingerprint Cards a good momentum while Ericsson belonged to the losers. Rapportsäsongen suffering now coming to an end, but a number of small companies have not yet reported.

At the close of trading was storbolagsindexet OMXS30 index up by 1.3 per cent to the level of 1.544. The turnover on the stockholm stock exchange is low at 15.4 billion.

Fingerprint Cards, which had a weak Monday, led the rise among large corporations and was quoted 7 per cent higher.

Sandvik and Atlas Copco grew by 3.6 per cent and nearly 3 per cent. Although Volvo was strong, up 2.8 per cent.

Autoliv increased 0.1 percent. Bilsäkerhetsbolagets share was traded without the right to a dividend of about 4:87 sek per share (0:60 dollars per share).

SSAB noted almost 3 per cent higher. The company raises the price further on heavy plate in north America to compensate for higher raw material prices. If the raise is successful or not can be determined by the president of Donald Trump’s investigation of U.S. steel imports, writes Dagens Industri.

Rapportfloden starts so slow its also on a number of smaller companies delivered delårssiffror.

The consulting firm BTS rose 10 percent after having reported an improved result and the raising of its profit forecast for the full year 2017.

Industrial VBG, with its registered office in Vänersborg, nearly doubled its earnings in the last line bolstered by the acquisition of the Mobile Climate Control. Shares were rewarded with a rise of 2 per cent.

Tobii ögonstyrningsteknologi will be used in the u.s. e-sporteventet Eleague, an event with a mångmiljonpublik, something that can contribute significantly to increase the interest for the eye tracking in the ”PC gaming”, says the company. Shares were up almost 6 per cent.

Avega Group advanced 19 percent. The company’s second quarter showed a rise in operating profit, up to 12.1 million compared with 10.3 million in the corresponding period of last year.

Simris Alg dropped 6 percent after an operating loss in the second quarter of sek 5.0 million (-4,3). According to the company, it is likely that the agm’s authorisation to issue new shares utilized in the autumn.

THQ Nordic has bought the German game developer Black Forest Games for the 900,000 euros and a performance-based additional purchase price. The gaming company improved by 3% and thus has climbed 134 per cent since the end of the year.

Strålterapibolaget Scandidos may sell the product Delta4 Phantom+ to all eight hospitals in the private sjukhuskedjan Baylor Scott & White in the united states. The shares climbed 14 percent.

Xbrane Biopharma rose 9 percent. Share handelsstoppades afternoon, after a rise of 14 per cent. The company presented the progress of their utlicensieringsdiskussioner.

On Wednesday, the waiting strålterapileverantören Elektas report for the first quarter from may to July 2017.

Get morgonrapporten to your e-mail daily before the stock market opens!

Recent trends (~there is a 06:40)

The OMXS30

EURO STOXX 50

Frankfurt DAX

The London FTSE 100

THE S&P 500

The DJIA

The Nasdaq Comp.

The NIKKEI 225

HANG SENG

EUR/USD

EUR/SEK

USD/SEK

WTI Semester

Brent Semester

1543.76

3455.59

12229.34

7381.74

2452.51

21899.89

6297.48

19450.19

27401.67

1.18

9.53

8.1

47.73

51.75

1.28%

0.94%

1.35%

0.86%

0.99%

0.90%

1.36%

0.34%

0.91%

-0.03%

0.07%

0.09%

-0.21%

-0.23%

Stock and Technical Analysis each day at 10.00 am

By: Michael Andersson for Tradingportalen/Agency Directly.

Questions and comments always welcome in the newsroom[at]tradingportalen.com

Click on the link for more information about ”Focus, strategy and ansvarsbeskrivning”

Upcoming course

“Learn to support Yourself on Your Trading – a complete three-day course!” – see the next course!