The technical resistance level 1650 points proved to be hard to beat on Monday, and trading was conducted largely below this level. The OMXS30 closed finally, +0.21% to 1649.84 points, when the turnover on the stockholm stock exchange amounted to 15.2 billion. Today’s trading may be a utbrottsdag through an opening just above the 1650 points, then the leading futures pointing to a slightly positive mood this morning.

Get morgonrapporten to your e-mail daily before the stock market opens!

Today’s analysis

This week’s first trading day opened much really just in the technical resistance level 1650 points. The greater part of the day was conducted, however, trade below this level, in a narrow handelsintervall in 1645-1650.50 points.

To leading futures early this morning indicate that we may get an opening just above the resistance level at 1651 points, strengthens our belief that Monday’s trading was a tongång of gaining strength.

Although turnover was not unusually high with a little more than 15 billion on the stockholm stock exchange, we have experienced increasing köpvolym past two trading sessions which is positive.

U.s. stock exchanges ended Monday night, more than half a percent up, but after the night’s trading in Asia, it is slightly up in Tokyo, while the Hang Seng is slightly down.

The oil that gave the attraction on Monday, traded, however, just under 52 dollars, even if we see a weak rise after the night’s trading.

The leading u.s. semester the S&P 500 traded this morning to slightly less, and the question is whether this will give any effect to today’s trading. It is not unusual that this term produces a certain effect, possibly we can get down to a slightly lower opening than expected.

If köpstyrkan keeps itself on Tuesday, will also mean that we can become short-term overbought in the OMXS30 index.

Out of the makroagendan is German sentimentindexet ZEW in focus, and a strong, surprising, or worse than expected figure could provide the drawcard to the north as to the south on Tuesday.

Primarily, it would give an effect on the German DAX initially, and this index is usually called ”the German ledarhunden”, which means that the OMXS30 index in the a certain extent, is expected to be affected in such a case.

We are expected to open just above the technical resistance level 1650 points, which bodes well for today’s trading. This opens initially up for an outbreak and the challenging of 1670 points, which in the past eftersökts. However, we need in such a scenario succeed in establishing ourselves over the high for the year at 1655 points first.

It means at the same time that we continue to find ourselves in the 1640-1670 points, as before, is highlighted as a high probability.

Space is available for two to three days of trading, closing on the plus side, before it is seen as a greater probability that we get the rebound and profit taking at a possible clearly short-term overbought scenario, before it opens up for additional tag to the north.

Perhaps despite everything, we will succeed with the challenge in 1670 points already this week, to turn the attention to the all time high of 1720 points?

Then we are expected to open above the resistance level 1650 points, does this mean that in the face of today’s trading we hold nearby resistance levels at 1670 points, followed by 1682, and in the past 1720 points. Briefly, high for the year at 1655 points give a certain opposition, and even sentimental heltalsnivån 1700 points is estimated to give at least brief resistance at a possibly challenging future.

The underlying technical support levels can be found 1650, 1640, followed by both the 1630, but above all 1600 points.

What hålltider and the company reports the next weeks you can read here.

Yesterday’s main börshändelser.

Lundin Mining continues to the north after the buy recommendation.

Challenging the resistance level at 48 crowns on the time?!?

Lundin Mining continues to the north on Monday, after the Industrial Alliance raised the company’s recommendation from buy to strong buy.

Riktkursen was adjusted up from 11:20 to 11:50 kanadadollar, which got the shares to initially rise over 3 percent on Monday.

Already on Friday had to Lundin Mining of fuel to rise, which caused the stock to turn your back to the MA 200 ABG Sundal Collier raised its recommendation to buy from earlier keep. Riktkursen was adjusted up from 55 to 62 crowns.

After an acid drop from the year high at 62 kronor earlier in the year, also the highest level since January 2008, swept this year’s rebound away. New tag now means that the shares currently notes an increase since the end of the year of +6.71%.

Perhaps it is the technical resistance level at 48 crowns we are on the road to challenge, to return to a handelsintervall within 48-53 crowns?

If the current köpstyrka subside, possibly at the resistance level 48 sek, increases the risk, however, of a rebound back to support level at 43.50 dollars.

The rise in the oil provides the fuel to Lundin Petroleum.

Stepped on Monday over the 200 day moving average, after an initially increase of 1 per cent.

Lundin Petroleum fuel on Monday to rise from the oil, which continues to take back land.

Brent semester are traded for the first time since may 1, over 52 dollars, which spreads positivity in the oil sector.

Lundin Petroleum has now risen to 6 of a total of 7 trading days, and we take every closer step 50 day moving average.

We now stepped over the MA 200, pointing to the north could possibly be additional positive factor for the potential further rise.

Would Opec surprise at the end of the month with both a strong produktionsförlängning, where both saudi Arabia and Russia said on Monday that the two countries favour extension of the fall running out in the summer with a further nine months, but also an expanded freezing increases, then the probability of an upturn, and the establishment of 60 sek.

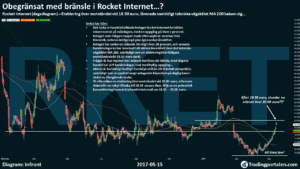

Unlimited fuel in Rocket Internet…?

The establishment of the resistance at 18.50 euros, left at the same time, technological fork in the road MA 200 behind…

The German e-commercial company Rocket Internet, continues further north on Monday, with a rise of over 2 per cent.

The company, which earlier lost ground after divested holdings of Kinnevik, be noted finally in the plus again since the end of the year.

The company has over a month’s time have risen over 20 per cent, and the latest trading days has meant that the share even stepped over the technical branch of MA 200, while an establishment over the previous resistance level 18.50 euros has been made.

The question is how much more fuel there is to download, with today’s trading, we have 9 trading days in a row, with a clear rise…

The share is short-sighted heavily overbought from a technical perspective, while we have experienced slightly declining köpvolym on a daily basis at the end of the previous week.

We are looking for an establishment above the resistance at 20.00 euro, because the risk of a rebound back to 18.50 otherwise increase, followed by a potential consolidation in this handelsintervall if 18.50 – 20.00 euro.

Hålltider during the day

Company reports

- Precise (8.00), Kabe (16.00), Arctic Paper, Karolinska Development (after börstängning), Rottneros

- Vodafone (8.00), Home Depot (15.00), Stratasys (before the US stock exchanges opening)

Ex-dividend

- Autoliv (0:60 usd quarterly ), the East Cap Explorer (0:90 kr.), Enea (the first day of trading without right. The payment for each

share is 2:00 kr ), Opus (0:12 sek), Pandora (9:00 dkk extra dividend paid quarterly)

Macro statistics

- Finland: GDP and indicator march at 8.00

- Norway: GDP 1 kv 8.00

- France: CPI (def) april at 8.45

- Netherlands: GDP (prelim) 1 kv at 9.30 am

- SCB investment funds, the assets and liabilities of 1 kv at 9.30 am

- Statistics SWEDEN: labour force survey 1 kv at 9.30 am

- Poland: GDP (prel) q1 10.00

- Uk: CPI and PPI of april at 10.30

- Uk: house price index march at 10: 30 a.m.

- EMU: trade balance of march at 11.00

- EMU: GDP (prel) q1 11.00

- Germany: the ZEW survey of may at 11.00

- USA: THREE weekly statistics at 13.45

- USA: residential construction april at 14.30

- The united states: Redbook weekly statistics at 14.55

- United states: oil (API), the weekly statistics at 22.30

Other

- Oil: the IEA monthly report at 10: 00 am

All börshändelser and estimates for the week can be found here!

Latest börsnyheterna

The stockholm stock exchange was traded in a narrow range near unchanged levels on Monday. Oil companies rose, with the support of a higher oil price. The leading european exchanges also showed less movement on the upside.

OMXS30 was at closing up 0.2 per cent to the level of 1.650. Shares for approximately sek 15.2 billion kroner was traded on the stockholm stock exchange. The German DAX and the british FTSE 100 listed of both record highs during the morning, strengthened by higher commodity prices.

Astra Zeneca rose over 1%, after that during the ongoing trade recorded a rise of around 2.5%, and noted then halvårshögsta. Solve the speculation in the united kingdom, alleged that Glaxosmithkline is considering buying out samriskpartnern Novartis share of 36.5 per cent in the two companies ‘ joint konsumenthälsovårdsbolag. The swiss Novartis would then be able to use the proceeds from the sale to a bid of Astra Zeneca mediespekulationerna.

In the commodities market caused the oil price support that saudi Arabia and Russia wants to extend the time with produktionstak into next year, and oil/gas was the best sector in Stockholm. Lundin Petroleum rose 1.4 per cent, Enquest almost 7 per cent higher and the Africa Oil was up nearly 5 percent.

Lundin Mining was up less than 3 percent. The share has received a recommendation of ”strong buy” of Industrial Alliance. At the same time, advanced metal prices.

Fingerprint development was weak and fell 1.4 per cent to sek 30.86. Late Friday screwed Redeye down his reasonable value for the share to sek 58.

Rapportfloden has begun to fade, but, among others, the Vostok New Ventures and Storytel reported, with kursnedgångar at slightly under 3 percent and 4 percent respectively as the reaction in spite of greatly increased revenue in the e-commerce Avito respectively, from the streaming of audiobooks.

Clas Ohlson’s sales performance in april, plus 1% in total, was about as expected, and its shares fell 1 per cent. Swedols försäljningstapp of almost 8 per cent in the same month, led on the contrary to that the share fell over 2 per cent.

Midsona bid on Bringwell worth 1 penny per share or 0,0213 B-shares in Midsona. The premium thus becomes 40 per cent compared with Friday’s closing price of Bringwell. Bringwell rose 45 per cent to the 1:12 crowns and Midsonas B shares advanced 7 per cent.

DGC has received Scandic Hotels driftkund, with an order value of sek 40 million in three years. IT shares rose 2 per cent.

Myfc shall, in addition to the telecoms market begin to focus on the automotive industry. Bränslecellsbolaget rose less than 2 percent.

SBB is preparing a new issue of ordinary shares of sek 500 million, excluding any övertilldelningsoption about 75 million. Fastighetsaktien was down 4.5 percent.

Börsveckans buying advice at Rejlers and Transtema gave gains of 7.5 and 12 percent, respectively.

Integrum, which develops and markets systems for skelettförankrade dentures, made it’s debut on First North. The share ended at 22:50, well above the listing price of sek 20.

Get morgonrapporten to your e-mail daily before the stock market opens!

Recent trends (~there is a 06:40)

The OMXS30

EURO STOXX 50

Frankfurt DAX

The London FTSE 100

THE S&P 500

The DJIA

The Nasdaq Comp.

The NIKKEI 225

HANG SENG

EUR/USD

EUR/SEK

USD/SEK

WTI Semester

Brent Semester

1649.84

3641.88

12807.04

7454.37

2402.32

20981.94

6149.67

19907.59

25308.29

1.1

9.69

8.82

48.94

51.89

0.21%

0.12%

0.29%

0.26%

0.48%

0.41%

0.46%

0.19%

-0.25%

0.10%

0.03%

-0.07%

0.18%

0.14%

Stock and Technical Analysis each day at 10.00 am

By: Michael Andersson for Tradingportalen/Agency Directly.

Questions and comments always welcome in the newsroom[at]tradingportalen.com