OMXS30 index started the new week with a new tag. Storbolagsindexet step +1.55% to 1627 points, and stepped thus of the technical resistance level 1616 points. Sales amounted to sek 13 billion. American exchanges have closed, and closed during the day on Monday mixed. After overnight trading in Asia is the negative attitude that prevails, and leading futures point to a slightly negative introduction ahead of the Riksbank’s interest rate announcement at 09:30.

Get morgonrapporten to your e-mail daily before the stock market opens!

Today’s analysis

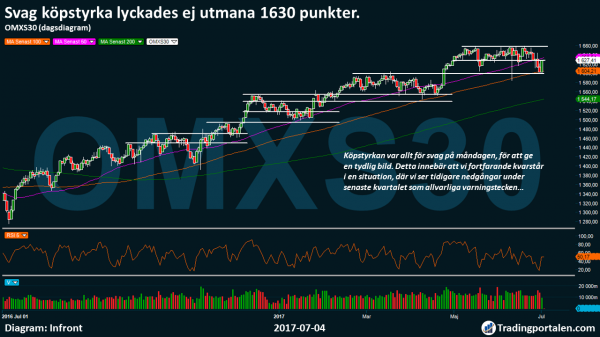

Köpstyrka stepped back into the picture on Monday, which was storbolagsindexet OMXS30 index to climb back above technical resistance at 1616 points.

The OMXS30 closed at dagshögsta of 1627 points, but never managed to step over 1630 points. Sales, but also köpstyrkan on the stockholm stock exchange was also significantly lower than in previous trading days.

Leading futures point to a slightly negative start on Tuesday, and this morning the focus lands on the interest rate announcement from the Riksbank at 09:30.

Neither the policy rate or tillgångsköpprogrammet is expected to change this time.

The big question will instead be mainly about the Riksbank will hang at the international centralbankstrenden, with the signals of the monetary policy stance may be on the way in a somewhat less expansionary direction.

It may in this case be done by the Riksbank adjusts the repo rate path upwards in the short term so that it is no longer possible in the current repo. According to a survey from the SME Directly, think nine out of ten economists that the Riksbank will do just that.

We expect no major volatility with the occasion of this announcement, but we expect something lower trading activity also on Tuesday, then the american exchanges keep closed on Tuesday because of Independence Day.

Senior semester the S&P 500 are traded, indeed, to the minus after the night’s trading in Asia, but the exhibits at the time of writing suggests that we may get a initially motion ever closer to zero.

This means that we can possibly challenge the 1630 points, and possibly the indicative negative introduction at the time of writing points to 1624 points, rather be a short-term break and profit taking from Monday’s big rise.

Would the negativity, instead, rise on Tuesday, then lands instead, 1616 points of focus.

Köpstyrkan was too weak on Monday, to give a clear picture. This means that we still remain in a situation, where we see the previous declines during the most recent quarter, which is a serious warning sign.

We are also preparing for that we very well may get a decline during the 1600 points, but want to in such a scenario get a decline with a relatively high sales value and turnover on the stockholm stock exchange, in order to get a clearer picture.

Then it is on the northbound journey we have ahead of us, and approaching even the majority of reports within a short time, and already next week it will begin in earnest, followed by several indextunga company the week after.

For today’s trading are awaiting the technical resistance levels, 1630, 1640, 1650, 1658, and 1670 points. Underlying support levels, we find that around 1616 and 1600, then 1594, 1588 1580 points.

What hålltider and the company reports the next weeks you can read here.

Yesterday’s main börshändelser.

Fingerprint Cards alone on the minus after lowered price target.

On the road, stepping in the 30 crowns on the new…?

Fingerprint Cards takes everything closer to the step 30 kronor, and traded early on Monday, just above this heltalsnivå.

SEB came on Monday, with a lowered price target for the company to 32.50 dollars, and repeated at the same time, recommendation keep.

After the fall on Monday, was the company early alone on the minus in the storbolagsindexet OMXS30 index.

On Thursday, it emerged that the serious fraud office has decided to discontinue an investigation of a suspected market abuse in the company’s share in 2016.

”The investigation has shown that it no longer exists, the reason that the offences have been committed,” wrote deputy chief prosecutor Jan Tibbling on the EBM:s finansmarknadskammare.

The company’s share establishes itself at the same time below the MA 50 on Monday, after a fall of -2.0 per cent, and the challenge now 30 sek seriously.

Since the middle of march, we have experienced a clearly narrow handelsintervall, and an outbreak and the establishment outside, increases the likelihood of a great momentum, to the north as to the south.

Köpstyrka back in Ericsson when Cevian increased.

Köpstyrka back in Ericsson when Cevian increased.

Ericsson step initially, +1.66% on Monday morning, and shifts thus to the positive noises after the five previous nedgångsdagar.

Fuel for the increase is Cevian Capital, which, after Friday now increased its holding in the company, and become the largest shareholder in Ericsson.

”That we increase the have only that we see it as a good deal,” said Christer Gardell to the Swedish newspaper svenska Dagbladet, after it increased its holding to 200 million shares in Ericsson.

Monday’s rise at the same time means we leave the short-term 50-day moving average, which was challenged in last Friday.

Among the latest riktkurserna for the company, we find that the SEB of 50 sek, Nordea sek 65, Societe Generale 63 crowns, as well as Citi sek 75.

Betsson step down to 11 månaderslägsta…

The game company’s Dutch profits of around 300 million are threatened by stricter rules, according to the article from SvD on Saturday.

Betsson continues further to the south on Monday, with the fuel from this weekend’s article in SvD, which highlights the concern around the company’s Dutch profits.

”More than 300 million. So great is estimated the company’s profit will be from the Dutch market. It is now under threat after the tightening of the rules in the country. Also speljättens the opportunity to get a legal license in the Netherlands is being questioned.”

Betsson has during recent years received harsh criticism for its Turkish business type Travel, and are now another setback.

Initially fell Betsson of -3.0 per cent to just under sek 70 on Monday, and 11 månaderslägsta, and traded, thereby, also during the technical nyckelnivån 73 sek.

In the beginning of June launched the Pareto coverage of several gaming companies, including Betsson, which got the recommendation keep, and a guide price of 85 kronor.

Hålltider during the day

Company reports

- Firm Partner (noon)

Ex-dividend

- Heimstaden (5:00 kr in the preference share quarterly), SBB (8:75 kr in the preference share quarterly)

Macro statistics

- STATISTICS, vehicle statistics June at 9.30 am

- EMU: PPI may at 11.00

- United states: oil (API), the weekly statistics at 22.30

Other

- Australia: interest rate announcement at 6.30

- Riksbank: interest rate announcement and monetary policy report at 9.30 am

- Lining: monthly statistics from Germany by Textilwirtschaft

- USA: closed due to Independence Day

All börshändelser and estimates for the week can be found here!

Latest börsnyheterna

The stockholm stock exchange in the beginning of July with a rebound led by Boliden, SSAB and Lundin Petroleum.

At the time of closing on the Monday was storbolagsindexet OMXS30 index up 1.6 per cent to the level of 1.627 shares for 13 billion traded on the stockholm stock exchange. The rise was the biggest since april 24, when the Emmanuel Macron looked to win the French elections. On the continent was the leading indices also up 1.5 per cent higher. Best went to the commodities sector with gains of more than 3 per cent.

In Stockholm increased Boliden 3.2 per cent and the FEDERATION of 3.1 per cent, as well as Lundin Petroleum. The price of north sea oil passed 49 dollar platter.

Even the banking sector was strong with gains of 2.7 percent for Nordea and 2.5 per cent for Swedbank.

Among the winners were also klädjätten H&M, as reported in the last week, and now closed 2.2 per cent up.

ABG Sundal Collier downgraded its recommendation for NCC to sell from the keep and raised the Company to buy from keep. Skanska rose 2.3 per cent while NCC declined 0.1 per cent.

Christer Gardells aktivistfond Cevian Capital has taken its position as the largest owner of Ericsson, according to SvD. Telecom rose 1.3 percent.

Volvo rose 1.9 per cent. The company has appointed Höganäs ceo of Melker Jernberg to the new head of anläggningsmaskindivisionen Volvo Construction Equipment, VCE.

SEB Equities lowered riktkursen for the Fingerprint Cards to the 32:50 sek 36 sek, continued with the recommendation keep. Shares lost 1.4 per cent to just over 30 dollars.

Nobina, which fell 6 per cent on its report on Friday, fell a further 5 per cent after the notice of that Swebus will be integrated in the Nobina Sweden. Nobina expect to need to reserve non-recurring costs of sek 15 million during the second quarter (June-August).

Inwido dropped 0.4 per cent. Fönstertillverkaren merge their Swedish and Norwegian part of a new business area.

Maha Energy rose 8 per cent on First North since it announced that the previously announced acquisition of the Gran Tierra business completed, for net total of $ 35 million.

SEB and Jefferies, both of which acted as adviser in the Medicovers ipo, has initiated coverage of vårdkoncernen with buy recommendations. The stock rose 2.6 per cent.

It consultants have an exaggerated bad reputation as equity investments. Buy both Acando and Hiq, advised Today’s Industry in Monday’s edition. The shares advanced more than 6 and 3%, respectively. Proact followed by 5 per cent up.

Pareto Securities has initiated coverage of the Powercell with the recommendation, purchase and riktkursen 65 sek. Shares lifted 10 per cent to over sek 35.

A series of purchasing managers ‘ index came on the Monday before the Riksbank’s interest rate announcement on Tuesday. The purchasing managers ‘ index for the Swedish industrial sector rose to 62.4 in June, from 58,8 in may, as expected, was a more marginal increase to 59,3, according to SME direkt.

Get morgonrapporten to your e-mail daily before the stock market opens!

Recent trends (~there is a 06:40)

The OMXS30

EURO STOXX 50

Frankfurt DAX

The London FTSE 100

THE S&P 500

The DJIA

The Nasdaq Comp.

The NIKKEI 225

HANG SENG

EUR/USD

EUR/SEK

USD/SEK

WTI Semester

Brent Semester

1627.41

3491.81

12475.31

7377.09

2429.01

21479.27

6110.06

20051.1

25497.94

1.14

9.65

8.48

46.83

49.41

1.55%

1.45%

1.22%

0.88%

0.23%

0.61%

-0.49%

-0.02%

-1.11%

0.11%

0.08%

0.00%

-0.51%

-0.54%

Stock and Technical Analysis each day at 10.00 am

By: Michael Andersson for Tradingportalen/Agency Directly.

Questions and comments always welcome in the newsroom[at]tradingportalen.com