After an initially negative movement on Wednesday managed the vibes change, for the better. Finally took storbolagsindexet OMXS30 back the decline with a closing +0.15% at 1631 points. The turnover slightly increased slightly to 16.2 billion kronor on the stockholm stock exchange. The united states closed the clearly positive on Wednesday night, and this development has also continued in overnight trading in Asia. Leading futures exhibit positive attitude this morning. Initially, indextunga H&M to be in focus, which delivers interim report at 08:00.

Get morgonrapporten to your e-mail daily before the stock market opens!

Today’s analysis

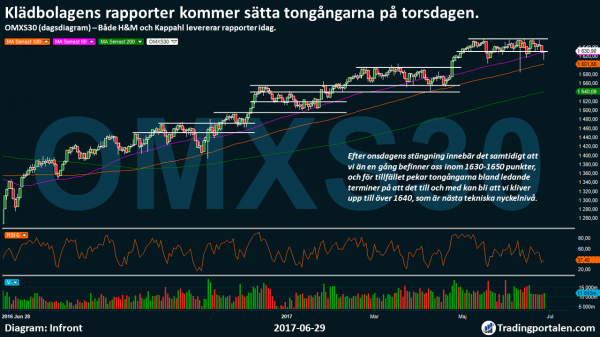

After that, we got a negative movement initially, on Wednesday, after dagslägsta in 1612, it became a turning point in the OMXS30 index, which closed above the technical nyckelnivån 1630 points.

Our short-term technical support level 1616 gave a certain resistance, at the same time as the 1620 and 1625, were the price levels, which posted the highest volume.

In particular, we received the greater part of the volume on Wednesday in the higher part of the handelsintervallet intraday, which is positive.

Even if köpvolymen only be slightly stronger than the previous trading days, we see this still as a sign of strength, and confirmation that a serious köpstyrka is left in the image.

The major sign of strength as we await, is when we erupt out of the 1630-1650 range, and when we look primarily to volume ratio, which then needs to stand out properly in connection with such a motion.

After a clear positive closure in the united states, traded leading indexes in Asia also clearly positive this morning after overnight trading.

Us senior semester, the S&P 500 also notes a rise of more than +0.25% for overnight trading, which contributes a further positive position.

Further the positivity this morning is that the oil traded just below 48 u.s. dollars, and has thereby stepped to the north for the 6th day in a row.

Even if we for the moment are expected to open around 1637 points, ahead interim report from the indextunga H&M, which holds a weight of 7.12 per cent.

With clear disappointment when klädbolaget previously provided sales figures, and with a decline of nearly -20% since the end of the year, are the expectations quite so reduced. This means that the smallest bit of positivity can provide additional fuel to the OMXS30 today, and also mean that we can get a movement that takes us back above the 1640, perhaps, and with 1650.

Nevertheless, it is at the rapportbesvikelse, to a decline in the sek 200 in H&M may possibly create a negative trigger and become a wet blanket on the Thursday, which inhibits the recovery from Wednesday’s trading in 1630 in the OMXS30 index. A little more concise about the expectations you will find below, from yesterday’s play of the day that went out in our social channels.

In addition to H&M, also delivers Kappahl report now by 07:30. It begins now to drop in some reports, while the great ”peeken” does not come until about a little more than a week, with the majority of indextunga companies in the course of a few days.

After Wednesday’s closing means at the same time that we once again find ourselves in the 1630-1650 points, and is currently pointing the vibes among the leading futures that it may even be that we step up to 1640, which is the next technical key level.

Once again awaiting technical resistance levels already in the 1640, 1650, 1658, and 1670 points. Underlying support levels can be found at 1630, 1616 and 1600 points.

What hålltider and the company reports the next weeks you can read here.

Yesterday’s main börshändelser.

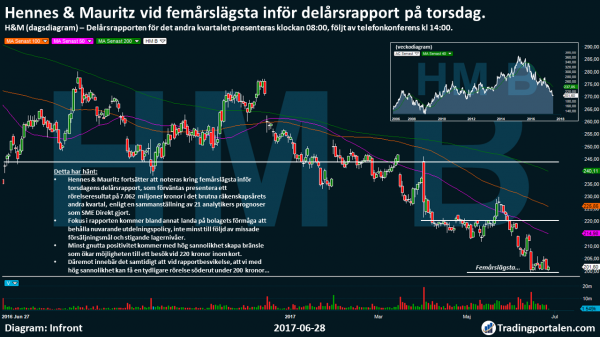

Hennes & Mauritz at femårslägsta before the interim report on Thursday.

The interim report for the second quarter are presented, at 08:00, followed by a conference call at 14:00.

Hennes & Mauritz continues to be noted around the femårslägsta ahead of Thursday’s interim report, which is expected to present an operating profit of 7.062 million in the broken end in the second quarter, according to a compilation of 21 analyst forecasts that SME made.

The focus of the report will, among other things, land on the company’s ability to maintain current dividend policy, not least due to missed sales targets and rising inventory levels.

At least bit of positivity will with high probability create a fuel that increase the possibility of a visit at sek 220 in the card.

On the other hand, at the same time that at rapportbesvikelse, that we with high probability can get a clearer movement to the south to under 200 bucks…

Scandi Standard, additional air under the wings after the buy recommendation.

Kycklingbolaget Scandi Standard notes a rise of more than +5 per cent on Wednesday morning, after Carnegie raised its recommendation for the company to buy from in the past to keep alive.

Riktkursen be adjusted at the same time, up from the 61 to 70 kronor.

After a dull start to the year with a clear sideways trading within 51-58 crowns, means Wednesday’s rise, we note a clear establishment of the long-term 200-day moving average, at the same time, as we now once again have to step over sek 58.

This means that we are now seeing potentially underlying support to challenge technical resistance levels as 60 and 62 crowns in the future.

Fuel for the upturn that was initiated on Tuesday were acquired in connection with a press release from the Scandi Standard.

Kycklingbolaget buy Ireland’s largest and market-leading kycklingproducenten Manor Farm.

Evolution Gaming is challenging all time high!

SEB and Nordea will contribute with a positive fuel on Wednesday after rising riktkurser.

Evolution Gaming rose initially by over 2 per cent on Wednesday, to once again challenge the all time high of just under 450.

Fuel for the increase was SEB and Nordea for the after rise in riktkurser.

SEB adjusted up riktkursen to 465 from the previous 395 Swedish kronor, at the same time as the purchase was repeated. Nordea adjusted up riktkursen to 480 from the previous 420 sek, and also reiterated this recommendation and the purchase.

As late as the 7th of June stood also Danske Bank positive to livekasinoleverantören, and raised at the same time riktkursen 494 sek.

”Despite a strong performance of the share price, we believe continued strong revenue growth thanks to the company’s well-established position in the market. At the same time, there are more to download from the four new customers before the launch. Finally, we do not rule out that the company can get the Swedish Games as a customer at a reregulation of the Swedish gaming market,” wrote Danske Bank.

Since the end of the year, the company’s share have risen more than +70%.

Hålltider during the day

Company reports

- Kappahl (7.30), H&M (8.00), Bergs Timber (13.00)

Ex-dividend

- Agora (5:00 kr in the preferred share quarterly ), Alm Equity (2:10 sek preference share quarterly), Bosjö real Estate (2:37 sek quarterly), Corem Property (2:50 kr kv.the vis pref.share), Delarka Holding (2:00 £ quarterly), steady Partner (5:00 sek on a quarterly basis in preferred stock), Kallebäck Property Invest (2:50 kr.), Clover (0:10 sek in the common stock quarterly, 5:00 kr in the preference share quarterly), Mälaråsen (2:50 sek quarterly), Pegroco (2:35 sek on a quarterly basis in preferred stock), Quartiers Properties (0:24 sek on a quarterly basis in preferred stock), Sagax (0:50 sek on a quarterly basis in preferred stock), Sagax (0:50 sek on a quarterly basis in the D-share), Southern Home (1:62£, quarterly), Victoria Park (5:00 kr in the preference share quarterly)

Macro statistics

- Japan: retail sales in may at 1.50

- Germany: GfK consumer confidence July at 8.00

- Spain: CPI (prelim) June at 9.00 am

- Statistics SWEDEN: household lending may at 9.30 am

- Statistics SWEDEN: retail sales in may at 9.30 am

- Germany: VDMA machinery orders may at 10.00 am.

- EMU: the indicator of business climate June at 11.00

- EMU: economic barometer June at 11.00

- Germany: CPI (prelim) June at 14: 00

- United states: GDP (def) 1 kv at 14.30

- US: new jobless veckosiffra at 14.30

- United states: Bloomberg consumer confidence veckosiffra at 15: 45

- Germany: CPI Baden Wuerttemberg June

Other

- Kappahl: rapportpresentation 9.00

- H&M: pk at 9.30 am

- H&M: conference call at 14.00

All börshändelser and estimates for the week can be found here!

Latest börsnyheterna

The stockholm stock exchange was negatively impacted by the declines on Wednesday but managed to, thanks to idog climbing during the day, finishing with a final sprint clear from a third minusnotering in a row. H&M took the lead before the report on Thursday, while the banking sector performed well.

The OMXS30 closed 0.2 per cent up on the level 1.631, with a turnover of 16.2 billion kronor on the stockholm stock exchange. H&M accounted for sek 1.4 billion of this, 55 per cent more than omsättningstvåan Nordea.

Sectoral claimed to the european banking sector relatively well after centralbanksuttalanden in the tightening direction. The Bank of England’s boss said, for example, that interest rate hikes might soon become necessary, as well as a certain reduction of the stimulus, and the sector with a rise of just over 1 per cent, twice as strong as the runner-up in the Stoxx Europe 600 index, the primary sector. The development of banks in Sweden was more modest, was however, of the consumer sector, thanks to H&M’s rampage.

Klädaktien rose 1.9 per cent to 204:sek 60, as the lowest during the day have changed hands for sek 200. Before Thursday’s report is the expectations set on, among other things, an operating profit of 7.1 billion during march-may, slightly higher than the 7.0 billion reached in the same period of the previous year and an increase far from the approximately 10 per cent, the number of stores has increased.

Nordea was indextvåa with plus 1.6 per cent, and all the other major banks kept themselves at a safe distance from the negative territory.

There, in the bottom of the OMXS30, was housed in the place, Astra Zeneca and ABB on the minus just over 1.5 per cent, but to have been guilty of some special news. ABB announced that, contrary to managed to get in a elforskningsinstitut in Inner Mongolia in the client list. It may be noted that the health sector was the worst in both the Stockholm and the Stoxx Europe 600, while verkstadssektorn was down slightly less.

Lundin Petroleum was successful despite a rising oil price did not continue upwards, and instead dropped the share 0.2 per cent after the last two days of gains. The oil company has sold 39% of a licensandel in the Norwegian Brynhildfältet to Cape Omega for 774 million Norwegian crowns, a fraction of the market capitalisation of almost 57 billion Swedish kronor. North sea oil rose about 2 percent to 47 dollars per barrel. According to this afternoon’s government, which gave a particular boost in the price of oil, increased US oil inventories unexpectedly last week, while gasoline supplies fell more than expected.

Elsewhere in the råvarubolagssektorn proposed, the First North-listed Russian guldproducenten Auriant Mining a partially guaranteed rights issue of sek 178 million, more than three times the market capitalization of the 47 million. At the same time left the mining company forecast ebitda of $ 14 million for 2017. Fjolårsfacit was 22 million, and the stock was punished with a decline of almost 25 percent.

The business community has in the latest issue of the magazine recommended sell for, among others, Peab, whose course is deemed to have been lifted to unprecedented heights by the company’s exposure to the housing sector, which the paper describes as a ”scalding pressure cooker”. The stock was down almost 3%, but besinnade and closed at minus 0.8 per cent.

Scandi Standard advanced additional nearly 8 percent, after Tuesday’s plus 6 percent. Kycklingproducenten, which on Tuesday announced an acquisition in Ireland, I got to see the Carnegie – whose analysts were the only one to ask questions on analyst conference on the acquisition, raising its recommendation to buy from the keep.

The First North-listed energiteknikbolaget Salt X rose 17 per cent, without any published news, and have thus the lifting 144 per cent in June. Compared to twelve months ago is the share’s rise of 881%.

Get morgonrapporten to your e-mail daily before the stock market opens!

Recent trends (~there is a 06:40)

The OMXS30

EURO STOXX 50

Frankfurt DAX

The London FTSE 100

THE S&P 500

The DJIA

The Nasdaq Comp.

The NIKKEI 225

HANG SENG

EUR/USD

EUR/SEK

USD/SEK

WTI Semester

Brent Semester

1630.98

3535.7

12647.27

7387.8

2440.69

21454.61

6234.41

20238.35

25910.58

1.14

9.72

8.52

44.95

47.68

0.15%

-0.07%

-0.19%

-0.63%

0.88%

0.68%

1.43%

0.54%

0.88%

0.23%

0.01%

-0.22%

0.47%

0.29%

Stock and Technical Analysis each day at 10.00 am

By: Michael Andersson for Tradingportalen/Agency Directly.

Questions and comments always welcome in the newsroom[at]tradingportalen.com