A small break on Thursday meant that storbolagsindexet OMXS30 fell -0.49% to 1642.49. The turnover on the stockholm stock exchange amounted to just over sek 12 billion. The united states closed slightly positive on Thursday night, and börshumöret has continued in overnight trading in Asia. We expect a slightly positive to any pending motion for the present, and the focus lands on the SEB’s interim report already before the börsöppning.

Morgonrapporten now take a summer break, but is back again on Monday 14 August. The undersigned wish everyone a really happy summer!

Get morgonrapporten to your e-mail daily before the stock market opens!

Today’s analysis

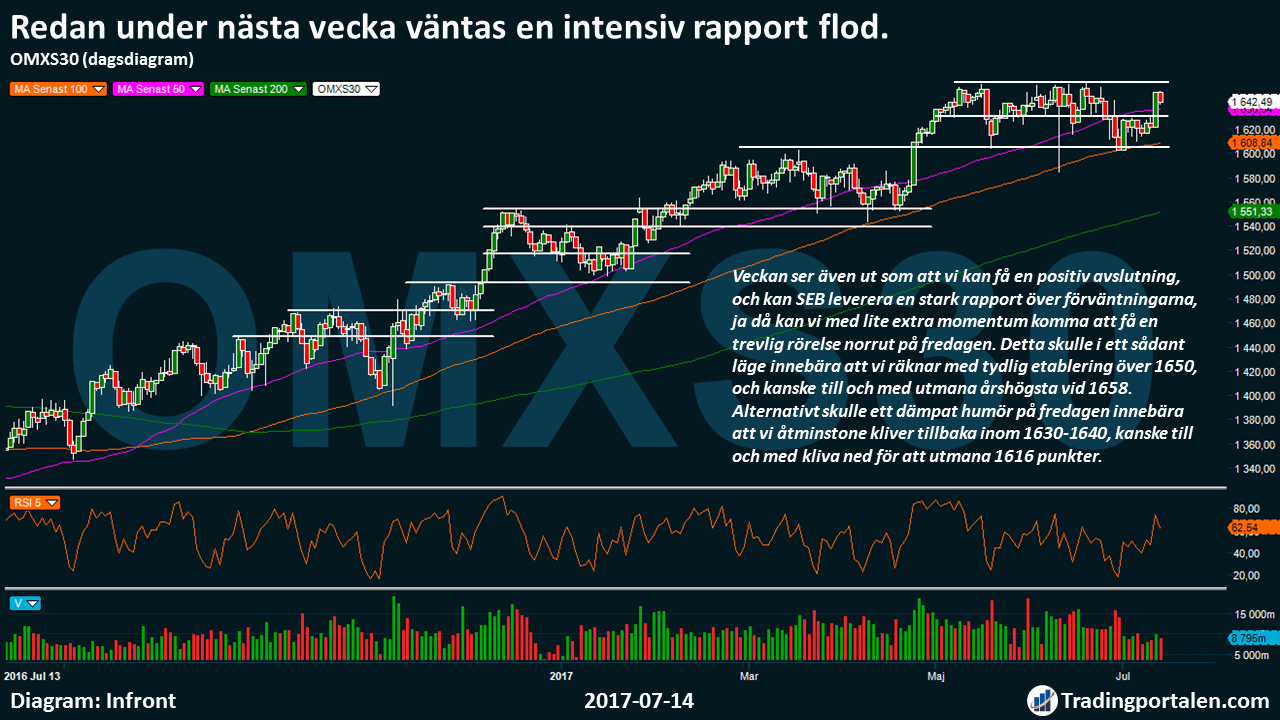

After a small break on Thursday, which meant that the OMXS30 left a short-term overbought territory, so we shut down just over 1642 points.

We got a large portion of today’s volume in the lower region, but we never challenged the technical support level at 1640 points is positive.

However, are seeking we are still a distinctive volume during the outbreak, to get a more clear direction of travel.

Already before the börsöppning will SEB interim report, and therefore today’s big focus since this will put an initially sentiment for the coming interim reports within indextunga the banking sector.

Even if the report will now clock 07:00, so keep the major banks have not rapportpresentation until börsöppning at 09:00.

The indextunga the banking sector has a large impact on the index, thus we have also experienced a ”standby” ahead of today’s report earlier in the week.

However, we expect rather that the larger movements may be during the next week, particularly on Wednesday and Thursday, then we get a large number of indextunga interim reports.

We were up and tested the 1650 on Thursday shortly before noon, was somewhat unexpected after the inledningsvisa decline. However, the signals remain clear willingness to step to the north.

The week also looks like we can get a positive ending, and SEB deliver a strong statement of expectations, yes then we can with a little extra momentum to get to get a nice movement to the north on Friday.

This would such a position mean that we anticipate with the clear establishment of 1650, and perhaps even challenge the high for the year at 1658.

Alternatively, a subdued mood on Friday mean that we at least step back in 1630-1640, maybe even stepping down to challenge 1616 points.

During the next week, we get a real rapportflod, in particular during Wednesday and Thursday from most of the indextunga companies. In the usual order are you going to rapportkalendern here.

For today’s trading are now awaiting the technical resistance for the OMXS30 already at 1650, 1658, and 1670 points. Underlying support levels await at the same time at 1640, 1630 1616 and 1600 points.

What hålltider and the company reports the next weeks you can read here.

Yesterday’s main börshändelser.

Astra Zeneca continues further to the south on Thursday…

Establishing itself thus clearly below the MA 100.

Astra Zeneca stand early on Thursday as one of today’s sole loser, with an initially decline of -4.0 percent.

The underlying fuel for the decline occurred in connection with the Israeli company Teva Pharmaceuticals is expected to appoint the Astra Zeneca ceo Pascal Soriot as its next ceo.

”Given Soriots background in innovation and branded pharmaceuticals, would a move to the Teva surprise us, given Teva’s mix of generics and special drugs, and, above all, just before the data from the Astra critical Mystic study with durvalumab and tremelimumab shall be released”, said Credit Suisse.

Credit Suisse lifts at the same time until the israeli affärnyheterssajten Calcalist, reported data, the site which previously reported to Teva’s chief financial officer leaves the company a few months ago, which means that it can be the basis for Soriot-data.

Norwegian rages on rapportbesvikelse.

The Norwegian airline has now lost the entire -26% since two weeks back.

Norwegian airline Norwegian reports on Thursday, the EBITDA of 58.5 million Norwegian kroner for the second quarter, below the expected 535 million, according to SME direkt.

In Thursday’s report shows at the same time that the Norwegian airline adjusts up previous guidance at a unit cost of 0:39-0:40 to 0:42 Norwegian kroner, and is justified by the effects of lower production (ASK), the sale and leaseback business, and the currency and bränsleeffekter”.

”According to our estimates the changing kostnadsguidningen have a negative effect on the earnings per share, sek 15, of which sek 11 per share was realized during the second quarter,” commented Pareto after the report.

Avanza falls sharply after the report.

Maintains, however, land within the handelsintervallet 355-375 sek despite an initially decline at -4.84%.

On Thursday, left the internet bank Avanza operating income of 103 million for the second quarter of 2017, clearly below the expected 115 million, according to SME direkt.

In the second quarter had 5.5 fewer trading days compared with the first quarter, also contributed to lower brokerage income.

”Costs increased in the quarter primarily due to increased development and investment in growth, which resulted in more employees with, inter alia, larger premises as a result. Kostnadsguidningen, with a growth rate of 15-20 per cent compared with the year 2016, remains,” writes the company’s outgoing managing director Johan Prom.

Hålltider during the day

Company reports

- (D) Carnegie (at 7.00), SEB (at 7.00), Uniflex (at 7.25), Nordax (7.30), Duni (at 7.45), Dedicare (8.00), JM (kl 8.00), Mycronic (8.00), NP3 (8.00), Qliro (8.00), Addtech (8.30), Beijer REF (8.30), Creades (8.30), Ortivus (8.30), Vitrolife (8.30), Xvivo (8.30), Formpipe (at 8.45), Axfood (13.00), Beijer Electronics (13.00), Lammhults (13.00), Sagax (13.00), Traction (13.00), NAXS (before börsöppning), Oscar Properties (before börsöppning), Trention (before börsöppning)

- JP Morgan (12.45), Citigroup (14: 00), Wells Fargo (14: 00)

Ex-dividend

- Solnaberg Property (4:00 sek quarterly)

Macro statistics

- Mäklarstatistik: housing prices, June at 6.00

- Japan: industrial production (def) may at 6.30

- Finland: CPI June at 8.00

- Finland: GDP and indicator may at 8.00

- Valueguard: housing prices, June at 9.00 am

- EMU: trade balance may at 11.00

- Ireland: GDP 1 kv 12.00

- United states: CPI June at 14.30

- U.S.: retail sales June at 14.30

- United states: industrial production, capacity utilization June at 15: 15

- USA: Michiganindex (tbc) July 16: 00 pm

- United states: stock of unsold goods may at 16.00

Other

- The Fed: Robert Kaplan speaks at 15.30

All börshändelser and estimates for the week can be found here!

Latest börsnyheterna

After a tentative morning took Thursday’s stockholm exchange a southerly direction, where Astra Zeneca was pushed sharply on concerns that the estimated ceo Pascal Soriot to stop. Among the winners among the big H&M was one that followed the positive Europatrenden among detaljhandelsaktierna.

Of the Thursday reporting company stack Avanza, Cloetta and the group out as a loser.

At the time of closing had the OMXS30 index decreased 0.5 percent to 1.642 and the trading volume remained at slightly more than sek 12 billion. In Europe stock markets overall, a more positive mood with the 0.3 per cent up in Paris and an unchanged development in Frankfurt.

Astra Zeneca was the most traded share and the clear loser in the OMXS30 index with a decline of 3.7 per cent. According to mediauppgifter is expected to Astra Zeneca ceo Pascal Soriot become the israeli pharmaceutical company Teva’s new ceo. Credit Suisse finds it surprising if mediauppgifterna would sue, but points out at the same time to the source of origin, the israeli affärsnyhetssajten Calcalist, seems to have good transparency.

Among other downs tagged Fingerprint and Assa Abloy, who both lost around 2 per cent.

H&M topped the OMXS30 index with a rise of 1.6 per cent. The entire european retail sector was strong, with the uk Next and the German Zalando up around 2 percent each.

Although Telia was strong, like their foreign competitors, up 1.2 per cent. The sector was a winner in all Europahandeln with BT Group up 4 percent in London and Telenor was up about 3 percent in Oslo.

Also, Lundin Petroleum was placed on the plus, up 0.5 percent, after climbing alongside a rise in oil prices during the afternoon.

Avanza fell more than 8 percent, after having reported kurtageintäkter as low 9 per cent lower than expected, according to SME direkt, and an operating profit that deviated about as much.

Castellum’s report contained the slightly lower rental income but överskottsgraden exceeded expectations significantly. The shares fell 1.2 per cent.

The market didn’t think, either, that The report be tasted anything further, and traded down the share close to 12%. The confectionery and snacksbolaget, whose earnings fell, describes the second quarter as ”challenging”.

The for Net Ent, which strengthened to 6.5 per cent. Spelbolagsunderleverantörens operating margin improved and the company sees good prospects for continued growth in the second half of 2017. In gamblingsektorn in general was Betsson, Evolution Gaming up with 1.4% and 2.8%.

Company Camurus fell more than 5 percent after having reported an increased loss.

Doro, whose sales fell during the quarter, weighed down by a negative development in the united states, declined to 6.7 percent.

On the Oslo stock exchange plummeted Norwegian close to 15 per cent after its quarterly report, which included the lowered guidance for growth in capacity and a weak result.

Aktietorgets two newcomers went in different directions. Omnicar, which develops a software solution for the automotive sector, had an issue price of 5: £ 50 and traded up to 7:15 sek.

Nextcell Pharma traded in turn to the 3:35 sek, which was clearly below the subscription price of sek 5 per share.

Get morgonrapporten to your e-mail daily before the stock market opens!

Recent trends (~there is a 06:40)

The OMXS30

EURO STOXX 50

Frankfurt DAX

The London FTSE 100

THE S&P 500

The DJIA

The Nasdaq Comp.

The NIKKEI 225

HANG SENG

EUR/USD

EUR/SEK

USD/SEK

WTI Semester

Brent Semester

1642.49

3527.83

12641.33

7413.44

2447.83

21553.09

6274.44

20127.57

26364.21

1.14

9.53

8.35

45.99

48.35

-0.49%

0.36%

0.12%

-0.05%

0.19%

0.10%

0.21%

0.14%

0.07%

0.06%

0.06%

-0.04%

-0.20%

-0.14%

Stock and Technical Analysis each day at 10.00 am

By: Michael Andersson for Tradingportalen/Agency Directly.

Questions and comments always welcome in the newsroom[at]tradingportalen.com

Click on the link for more information about ”Focus, strategy and ansvarsbeskrivning”

Upcoming course

“Learn to support Yourself on Your Trading – a complete three-day course!” – see the next course!