A negative sentiment dominated Monday’s trading. Storbolagsindexet OMXS30 index fell -0.51% to 1524.25, while turnover on the stockholm stock exchange amounted to 13.1 billion. The US managed to close slightly in the plus in the evening, and Asia also traded on plus after the night’s trading. A continuation of the negative image painted, and the OMXS30 takes everything closer to the leap year, and traded only +0.98% since the end of the year…

Get morgonrapporten to your e-mail daily before the stock market opens!

Today’s analysis

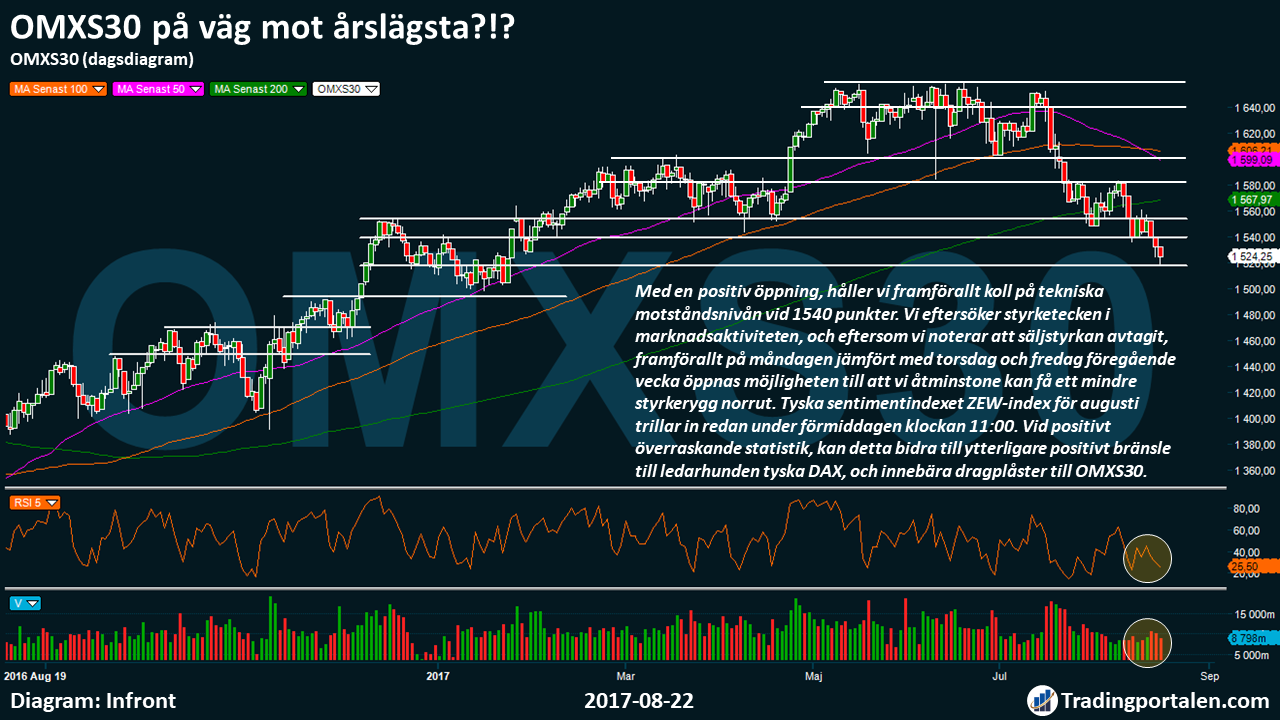

Storbolagsindexet OMXS30 closed on Monday just above the dagslägsta, which meant a decline of -0.51%.

Thus traded, we are still in the negative outbreak we were expecting on Friday.

Leading futures pointing this morning on a positive introduction, about 1529 points at the time of writing. Leading u.s. S&P 500 semester traded +0.22% after overnight trading in Asia, and thus give back to such an anticipated opening.

This could mean that we are leaving three days of trading on the minus. However, there remains a negative image, and an indication that we may get a continued development in the future.

OMXS30 index is in oversold territory in our RSI indicator, which could mean that we get a break and off back to the north. Similar to Monday’s weekly OMXS30 analysis, does not occur completely unexpectedly less positive back in a negative trend, and the question is if we already started one, or if it only is a contributing factor surrounding the political unrest.

In addition to that, central banks are expected to shift down, remain oroligheten between the united states and north Korea, even if the cover has been on for a week. Early this morning, reported Bloomberg News that north Korea threatens the US with ”merciless revenge” for having ignored its warnings regarding the annual militärövningarna with south Korea.

We simply have to wait and see where everything lands in the week, but it is certainly a negative factor to continue to take into account, and monitor.

With a positive opening, we are primarily a check on the technical resistance level at 1540 points. We are looking for sign of strength in market activity, and because we note that the sales force has slowed down, especially on Monday when compared with Thursday and Friday last week opens the possibility that we can at least get a less styrkeryck to the north.

German sentimentindexet the ZEW index for August to fall into already in the morning at 11:00. In the case of positive surprising statistics, this can contribute to further positive fuel to ledarhunden German DAX, and the mean attraction to the OMXS30 index.

Because we remain in a scenario we should be interpreted as negative, we are primarily an extra eye on the 1500 points. A challenging of this sentimental heltalsnivå would also mean that we test the year low in January.

First and foremost, we do not want to see a challenging and breakthrough of the technical assistance already at 1517 points, then this significantly increases the likelihood that we may be on the way to challenge the 1500 points. Just 1517 points is the lowest since the end of January, and was also a clear fulcrum with significant volume throughout the January this year.

Again, we keep also track of the strength of the connection with that we will challenge the support that resistance, to try and get a guidance if there are temporary challenges that are experienced.

For today’s trading are awaiting the technical resistance at 1527, 1540, 1550, 1560, 1580 and 1600 points. Technical support levels await already in 1517 and 1500 points.

What hålltider and the company reports the next weeks you can read here.

Yesterday’s main börshändelser.

Pressed Ericsson to the new year.

Will the support level at 48 crowns to keep, or is it time to turn the attention to the 46 crowns?

Ericsson continues its journey further to the south on Monday, and get thus down to a new low for the year at 48 kronor, a decline of -1.75%.

The company’s share thereby challenges the technical support level at 48 dollars, that can possibly give a generous köpstyrka, and the increased probability of a turning point.

In the case of continued weakness, we turn our eyes towards the next support is at 46 dollars.

On Thursday 17 August, it was revealed that Ericsson is true smartphonetillverkaren Wiko for patent infringement.

The same day, declined the Ericsson also comment on the current austerity package as the company previously flagged, may be of concern to 25,000 employees, according to the sources, to the Svenska Dagbladet Näringsliv. Total, Ericsson has more than 109.00 employees.

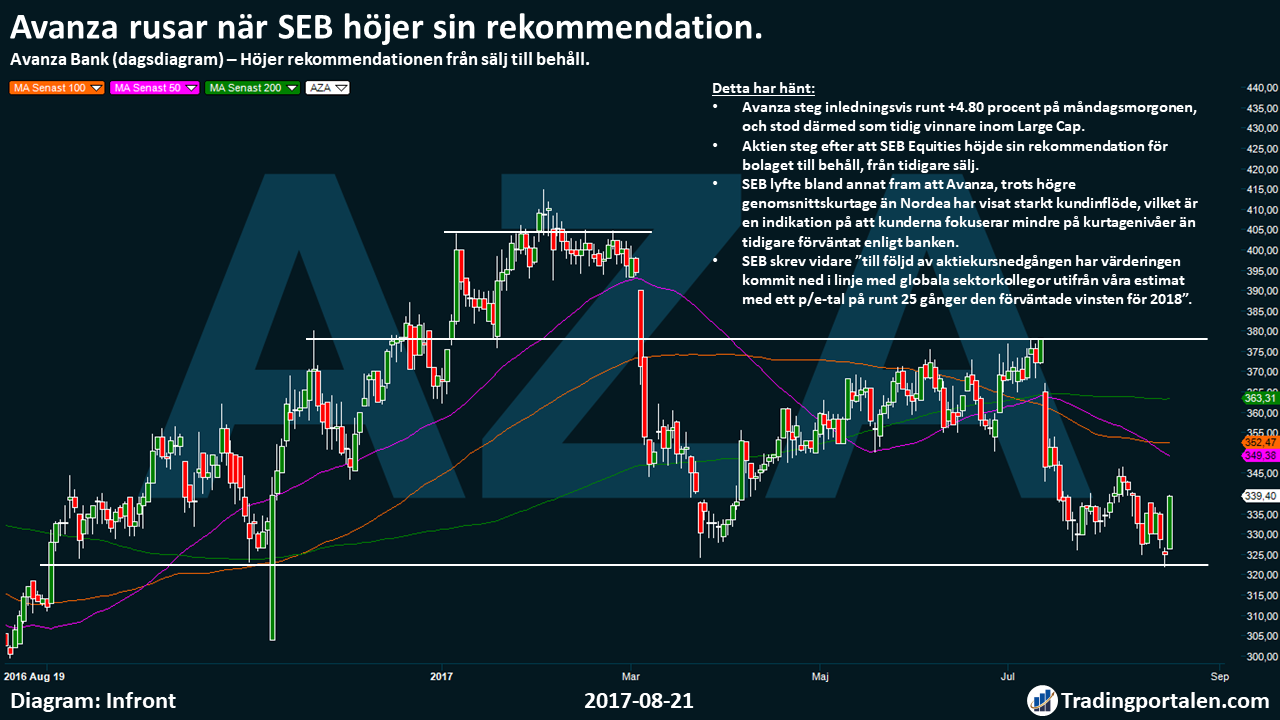

Avanza rush when SEB raises its recommendation.

Raise the recommendation from sell to keep.

Avanza step initially around +4.80 percent on Monday morning, and stood thus as the early winner in the Large Cap.

The stock rose after SEB Equities raised its recommendation for the company to retain from the previous sell.

SEB highlighted, among other things, Avanza, despite the higher genomsnittskurtage than Nordea has shown a strong kundinflöde, which is an indication that the customers focus less on kurtagenivåer than previously expected, according to the bank.

SEB wrote further, ”as a result of it has the valuation come down in line with the global sektorkollegor on the basis of our estimates with a p/e ratio of around 25 times projected profit for the year 2018”.

NIBE turn on the intensity after the buy recommendation.

Step initially over +2.0% on Monday.

After the previous week’s rapportfall, turn NIBE north on Monday.

Handelsbanken raises the recommendation for the company to purchase, from the previous increase, at the same time as riktkursen remains at sek 98.

The major banks have believe that Nibe will succeed well in the future, with a continued acquisition-driven growth.

Värmeteknikbolaget has, as previously reported acquired several companies, and as late as 8 June, it was revealed that the company bought canadian ventilationsbolaget Tempeff, which has a turnover of just over sek 70 million, and has more than 50 employees.

The company presented the previous week a profit before tax of 481 million in the second quarter, below the consensus of 518 million, according to a summary that SME made.

The share is still trading after earlier rapportfall below the long term MA 200, but turned at 71.50 kroner, which is a technical key level, with significant volume last year.

Hålltider during the day

Company reports

- BTS (8.00), Avega Group (8.30), Latour (8.30), Ortivus (8.30), Multiq (12.30 pm), VBG (13.00), Balder (14.00), Nordic Mines

- Medtronic (12.45), Accuray (after the united states-the exchange closing), BHP Billiton

Ex-dividend

- Autoliv (0:60 usd quarterly)

Macro statistics

- SCB: investment funds 2 kv at 9.30 am

- Statistics SWEDEN: the industrial capacity utilization rate q2 at 9.30 am

- Germany: the ZEW index in August, 11.00

- Uk: CBI industritrender August at 12.00

- USA: THREE veckoindex at 13.45

- The united states: Redbook weekly statistics at 14.55

- United states: FHFA house price index June at 15.00

- United states: oil (API), the weekly statistics at 22.30

All börshändelser and estimates for the week can be found here!

Latest börsnyheterna

The stockholm stock exchange recorded a decline on Monday. Thus, in principle, the entire year the rise in the OMXS30-erased, excluding secluded dividends. The Fingerprint belonged to the losers.

At the Stockholm stock exchange’s closing had storbolagsindex OMXS30 index has declined 0.5 per cent to the level of 1.524 and shares for 13.1 billion had changed hands.

Värmeteknikbolaget Nibe went against the tide and rose more than 2 percent to 72 kronor. Handelsbanken has raised its recommendation for Nibe to buy from increase. The bank feels confident that Nibe will continue to show good margins and grow with acquisitions, which, in turn, will provide the fuel for strong profit growth. Riktkursen remains at sek 98.

Even Avanza went better than the index and went up over 5 per cent. SEB Equities has drawn up its recommendation for Avanza to keep from sell.

Fingerprint Cards led the decline on Monday, down 2 per cent. Even Ericsson had it’s heavy and backed off to 1.7 per cent.

The government and the party agree to submit a proposal against profits in welfare later in the autumn, reported the daily News. It will not be a total vinstförbud, but severe restrictions waiting välfärdsbolagen if the proposal goes through.

Among the stockholm stock exchange välfärdsbolag backed Attendo, Dedicare, and Academedia, 0.4 to 2.3 percent and Humana was down 1.7 per cent.

Nilörngruppen got the thumbs down after this morning’s quarterly report. The shares fell 14 percent. Label and förpackningsbolaget saw a sequential deceleration in the growth rate in the second quarter. The order intake increased by 4 per cent in the quarter, and sales by 12 per cent. The corresponding figures for the first quarter was 35 and 33%.

Base metal prices rose once again on Monday. On the stock market rose Lundin Mining with less than 3 percent. Sektorkollegan Boliden managed to fly with a decline of 0.3 per cent. The price of oil lifted sharply on Friday after riggstatistik. During the Monday bounces oil prices down again. Lundin Petroleum slipped down by 0.2%, while Enquest rose 2 percent.

Among the big plus was the Assa, and Swedish Match, with gains of 0.2 and 0.4 per cent.

H&M, which was the most traded share in Stockholm, was listed again on the minus, down 0.7%, after having traded down eight of the nine recent trading days.

Biotech company Oncopeptides is Börsveckans new buy recommendation and share price low high on vinnarlistan with a rise of 8 per cent. The magazine has also been reinforced in its positive opinion of the Actic and Transtema, and the shares were up 7 and 6 percent, respectively.

Even DI’s formulation of the golden köpläge in the New Wave had an impact and its shares advanced 6 per cent.

On the NGM-list raged, the game developer Three Gates share 45 per cent after a report of increased loss in the second quarter.

On Tuesday is expected to reports from Latour, Balder and VBG.

Get morgonrapporten to your e-mail daily before the stock market opens!

Recent trends (~there is a 06:40)

The OMXS30

EURO STOXX 50

Frankfurt DAX

The London FTSE 100

THE S&P 500

The DJIA

The Nasdaq Comp.

The NIKKEI 225

HANG SENG

EUR/USD

EUR/SEK

USD/SEK

WTI Semester

Brent Semester

1524.25

3423.53

12065.99

7318.88

2428.37

21703.75

6213.13

19406.18

27437.76

1.18

9.54

8.08

47.72

51.83

-0.51%

-0.65%

-0.82%

-0.07%

0.12%

0.13%

-0.05%

0.07%

1.04%

-0.05%

0.02%

0.05%

0.40%

0.33%

Stock and Technical Analysis each day at 10.00 am

By: Michael Andersson for Tradingportalen/Agency Directly.

Questions and comments always welcome in the newsroom[at]tradingportalen.com

Click on the link for more information about ”Focus, strategy and ansvarsbeskrivning”

Upcoming course

“Learn to support Yourself on Your Trading – a complete three-day course!” – see the next course!