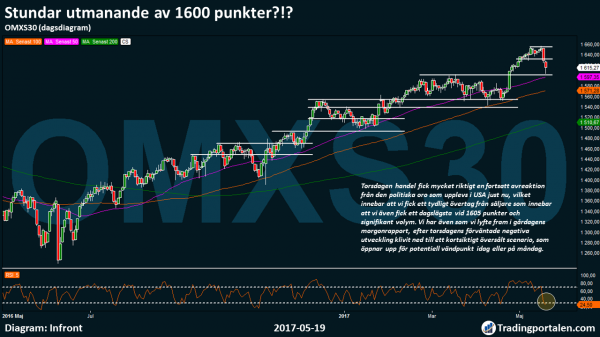

The OMXS30 continued further to the south on Thursday, and storbolagsindexet closed finally -0.80 per cent at the 1615 points. Continued political turmoil from the united states, coupled with profit-taking meant an increase in sales to the entire 24.7 billion kronor on the stockholm stock exchange. Despite the fact that the united states and Asia have shown positive development since yesterday’s close, pointing to the futures market this morning that we may get an initially cautious movement on Friday.

Get morgonrapporten to your e-mail daily before the stock market opens!

Today’s analysis

Clearly the negative sentiment that has emerged in the week, shows no sign of parcel before the day’s trading.

Leading futures pointing to a pending motion in limine, with a couple hours left until the Swedish trade open.

Despite the fact that we experienced a slightly positive development in both the united states yesterday evening, but also in Asia, during the night, we note that the u.s. S&P 500 shows a trade with the pendant around zero at the time of writing.

We have, therefore, despite some positive signs, no clear signals right now that are pointing to a rebound and recovery for today’s trading.

On Thursday, trading was much really a continuation of the abreaction from the political turmoil experienced in the united states right now, which meant that we got a clear advantage from the sellers, which meant that we also got a dagslägsta at 1605 points and significant volume.

We have also, as we highlighted in yesterday’s morgonrapport, after Thursday’s expected negative development stepped down to a short-term oversold scenario, which opens up for a potential turning point today or on Monday.

For today’s trading are looking for a clear volume and recovery with the closure, which preferably should be above the 1630 points, not to challenge our positive outlook.

This is because we can get to get a week, with a closing where the sellers have the upper hand for the first time in five weeks, which increases the risk for potentially negative conclusion of the month in its entirety. Like previously touched on, we have not received a negative finish on a monthly basis since 10 months back…

In particular, a seriously challenging, followed by the establishment during the 1600 points, during high trading activity to be a clear element of risk that can set our positivity on its edge.

With two days of trading with the clear advantage and the pressure from the sellers, actually increases the concerns on the possible breakthrough of this heavy sentimental price as 1600 points.

Early this morning we note that Nordea had a height price target from ABG Sundal Collier, which can possibly put a positive progression for our indextunga banking sector ahead of today’s trading.

Ahead of today’s trading can be found technical resistance levels at 1630, 1640 and 1650 points

Support levels await even primarily for 1600 points, followed by 1694 1588 points.

What hålltider and the company reports the next weeks you can read here.

Yesterday’s main börshändelser.

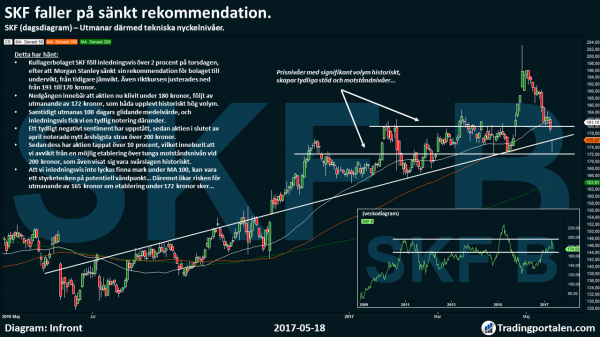

SKF falls on lowered recommendation.

Thereby challenges the technical key levels.

Kullagerbolaget SKF fell initially more than 2 percent on Thursday, after Morgan Stanley lowered its recommendation for the company to underweight, from the previous equilibrium. Also riktkursen was adjusted down from 193 to 170 crowns.

The decline means that the stock now stepped over sek 180, followed by challenging of sek 172, both of which experienced historically high volume.

At the same time challenged the 100 day moving average, and initially we got a clear listing below.

A clear negative sentiment has arisen, since the share at the end of april reached a new high for the year of just over sek 200.

Since then, the shares have lost over 10 per cent, which meant that we deviated from a possible establishment of the heavy resistance level at 200 sek, which also proved to be hard to beat, historically.

We initially did not manage to find land below the MA 100, can be a sign of strength on the potential turning point… However, increase the risk for challenging of 165 Swedish kronor for the establishment during the 172 kronor is…

A large part of this year’s rise is gone when the Intrum Justitia fall like a stone…

Backed initially -10% on news that the company proposes the disposal of units in order to meet the EU requirements.

Intrum Justitia fall initially -10 per cent on Thursday, after it stated in a press release that the company is proposing the divestment of some units, in order to meet the EU-requirements in preparation for the upcoming merger with Lindorff.

The EUROPEAN commission has informed the parties about the potential objections on the playing field. Intrum and Lindorff proposes a divestiture of lindorff’s entire operations in Sweden, Denmark, Finland and Estonia, and also Intrums entire business in Norway. The units proposed disposed of, however, is less than the devices that will be left, except in Estonia.

The relevant devices can potentially affect a total of more than 850 employees.

The decline means that the company’s share at the same time challenging the support level at 317 sek, when the big part of this year’s rise had been washed away.

Establishment 317 sek, can come to mean a challenging of 302 sek in the long term, where the MA 200 at the moment, are, nevertheless, a price level which is also the last year holds the most volume.

Rebound at the current level at the new revealed köpstyrka, on the other hand, we keep an extra eye on the resistance level at 331 sek.

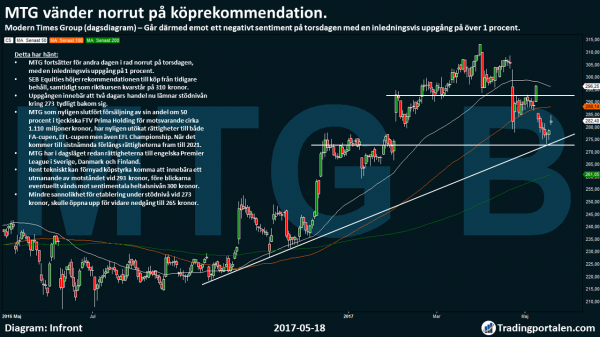

MTG turn north on the “strong buy” recommendation.

Is thus received a negative sentiment on Thursday with an initially increase of over 1 per cent.

MTG continues for the second day in a row to the north on Thursday, with an initially rise at 1 per cent.

SEB Equities raises recommendation to buy from in the past the keep, at the same time as riktkursen remains at 310 crowns.

The rise means that the two-day trade now leaves the support level around 273 clearly behind him.

MTG recently completed the sale of its share of 50 per cent in the Czech FTV Prima Holding for the equivalent of about 1.110 million, have recently expanded rights to both the FA cup, EFL cup, but also the EFL Championship. When it comes to the latter extended the rights until 2021.

MTG currently has already the rights to the English Premier League in Sweden, Denmark and Finland.

Technically, can re köpstyrka come to mean a challenging of the resistance at 293 kronor, before the eyes possibly turning against the sentimental heltalsnivån 300 sek.

Less probability of establishment intensity at 273 kronor, would open up for further decline to 265 kronor.

Hålltider during the day

Company reports

- CLX (7.30), Raysearch (at 7.45), Consilium (13.00)

Ex-dividend

- Avensia (0:15 kr), Bjorn Borg (the first day of trading without the right to redemption shares. The redemption amount 2:00 sek/share), Drillcon (0:30 kr.), Humana (0:50 kr.), Sintercast (2:50 kr + 1:50 sek extra), Volati (0:50 sek ordinary shares)

Macro statistics

- Germany: PPI april at 8.00

- EMU: current account balance of march at 10.00

- Uk: CBI industritrender may at 12.00

- EMU: consumer confidence (prelim) may at 16.00

All börshändelser and estimates for the week can be found here!

Latest börsnyheterna

The stockholm stock exchange was trading during the first part of Thursday’s trade to the lower courses. A positive start of trading in the U.S. dampened the downturn. Verkstadsbolagen had at the side of the Intrum Justitia a heavy day.

At the time of closing had storbolagsindex OMXS30 index has fallen by 0.8 per cent to the level of 1.615. The stockholm stock exchange had traded 24.7 billion.

Intrum Justitia and Lindorff open for disposals equivalent to 30% of the estimated kostnadssynergierna and 12-13 per cent of the combined ebitda pro-forma the merger, in order to meet the konkurrenskrav before slutbesked from the EU commission on 12 June. Lindorff in Sweden, Denmark, Finland and Estonia, and Intrum in Norway proposed to be sold. The shares fell 12 per cent.

H&M’s chairman of the board and storägaren Stefan Persson has purchased additional shares in the clothing chain to a value of almost sek 1.1 billion. At the latest during the last week he bought shares for approximately sek 1.2 billion. Investors, however, appeared not to be convinced, but traded on the stock 0.4 per cent.

Sensys Gatso Group cancels a program for speed cameras on the interstate highways in Iowa, then a court decided that an authority determines hastighetskamerornas placement. The annual revenue from this program is 24.5 million. Impact 2017 is expected to be 16.6 million less revenue than forecast. Sensys dropped 11 percent.

Several workshops had it tough. Including Volvo and Electrolux, with declines of just over 2 per cent each.

Morgan Stanley lowered its recommendation for SKF to underweight from equilibrium. Riktkursen was lowered to 170 from 193 sek. SKF backing of over 1.6 percent, to 176:20 sek.

Better it went for Nordea, with a rise of just over 1 per cent since Danske Bank Markets raised its recommendation to buy from the keep. Shares topped the turnover in Stockholm.

Bostadsutvecklarna Besqab and the SSM declined to 3.6 and 0.5 per cent, having come up with their quarterly reports. Both companies reported lower operating profit.

SEB Equities lowered Bilia to keep from buy. Riktkursen was down to 195 from 200 sek. Bilia was trading nearly 4% lower at 174:50 sek.

The bank will also raise its recommendation for the MTG to buy from the keep. Riktkursen is continued 310 sek. MTG advanced 1.3 per cent to 282:10 sek.

SEB Equity take up its surveillance of the friskvårdskedjan Actic by putting a buy recommendation. Riktkursen is located at 67 dollars. Actic rose over 6 percent to 51:75 sek.

Nexar Group, which hosts a talent competition, and among other things, to make money on ads, premiärhandlades on the NGM Nordic MTF. The share closed at 2:38 kronor, a race with more than 60 per cent of the subscription price, 6:30 sek.

Get morgonrapporten to your e-mail daily before the stock market opens!

Recent trends (~there is a 06:40)

The OMXS30

EURO STOXX 50

Frankfurt DAX

The London FTSE 100

THE S&P 500

The DJIA

The Nasdaq Comp.

The NIKKEI 225

HANG SENG

EUR/USD

EUR/SEK

USD/SEK

WTI Semester

Brent Semester

1615.27

3562.22

12590.06

7436.42

2365.72

20663.02

6055.13

19570.81

25215.45

1.11

9.77

Recording 8.79

50.07

52.9

-0.80%

-0.63%

-0.33%

-0.89%

0.37%

0.27%

0.73%

0.09%

0.31%

0.11%

-0.01%

-0.16%

0.83%

0.74%

Stock and Technical Analysis each day at 10.00 am

By: Michael Andersson for Tradingportalen/Agency Directly.

Questions and comments always welcome in the newsroom[at]tradingportalen.com