The OMXS30 was able to find the strength to rebound on Friday, and storbolagsindexet closed finally, just below the resistance at 1630 points. The turnover amounted in the same period on Friday to 17 billion kronor on the stockholm stock exchange. Positive attitude is early this morning, with trading on plus in Asia who took over a trading on plus in the U.S. on Friday. Leading futures indicates that we may have an opening above the resistance at 1630 points, with a couple hours left until the stockholm stock exchange opens.

Get morgonrapporten to your e-mail daily before the stock market opens!

Today’s analysis

Despite the fact that we did not see the early signs of strength, we got the fuel to rise already initially on Friday.

Köpstyrkan got us to close just below 1630 at 1629.21 points, but just before the shutdown we got a dagshögsta listed at 1632 points.

This we saw as a positive sign ahead of today’s trade, and after a positive finish in the US followed by trading on plus after the night’s trading in Asia, it is very really a slightly positive opening leading futures indicate this morning.

Leading u.s. semester the S&P 500 also traded weak on the plus this morning, while Brent oil, for the first time since the middle of april traded over 54 dollars.

This means that we have the positive sign of strength, which could mean the establishment of 1630 points today. However, the question is if it is a genuine köpstyrka that emerged…

There are vulnerabilities that are worrying. The strength of the decline, especially in the end of the previous week was something we highlighted as a disquieting sign.

The week as a whole ended a little more than -1% on the minus, for the first time in five weeks. This also means that we still have an early indication, that köpstyrkan during may possibly will be the second month in a row we can get a declining köpstyrka, alternatively, closing at minus.

We see this as one of the potential elements of risk, which may mean that we may force to come. But for this question our positivet, are seeking as mentioned previously, we touched on an establishment, especially during the 1600 points at the high trading activity.

Just 1600 points is a price level that a few years ago, notes a significant volume, which means that this price level is expected to be hard to beat.

In the short term we have just left oversold territory, which in itself provides a positive piece of the puzzle when we are now expected to open in plus around 1633 points on Monday.

Worth noting is that the week is slightly shorter than usual. Thursday is also the day of the Opec meeting in Vienna, is a day when we are closed due to ascension day. Even Wednesday’s trading is half day, then the stock market closes at lunchtime. It also is a squeeze day on Friday, means that we expect that trading activity will be slightly weaker on the stockholm stock exchange than usual.

For a little more than a year ago we were in a situation with a clear correlation to oil over a period of time, and even if a prolonged produktionsfrysning is expected to be executed on Thursday, are seeking participants for a further reduction against current levels. Absent this, we can very well come to be slightly more volatile movement, which means that we find ourselves in an interesting position.

In addition to this, the eurogroup meeting on Monday’s makroagenda, with Greece the son of major focus in the usual way.

Greece had previously agreed reform measures (mainly a significant reduction of pensions) has a chance, according to EU sources, 50/50 for the eurogroup on Monday, can agree on this bout of reform for Greece, including debt relief.

In addition to the focus on Greece, Spain on the agenda, where you will also verify that the follow-up of the country’s bankräddningsprogram runs on the good.

Ahead of today’s trading can be found technical resistance levels at 1640, 1650, but especially to 1670 points.

Support levels await also at 1630, but above all 1600 points.

What hålltider and the company reports the next weeks you can read here.

Friday’s main börshändelser.

Nordea, a new all time high!

Clear köpstyrka revealed in connection with the outbreak over the previous record high.

Nordea enjoying a rise of more than 12 per cent this year, step on Friday at a new all time high when renewed köpstyrka occurs.

A closure and the setting up of this price level of sek 113, could be a sign of strength that is needed for further rise.

This, in turn, would be both good for storbolagsindex as OMXS30, Nordea has a more significant now when the stock has a dominant weight of 11.01%!

H&M, which had previously been a real heavyweight is now in second place with 7.64. the percent, which means that Nordea has a great importance for the index as a whole at the sharp movements to the north as well the south.

Qliro rushing when SEB almost see a doubling of the share price.

The bank raises the recommendation for the company to purchase from the keep, at the same time as riktkursen be adjusted up from 10 to 18 crowns.

E-commercial group to Qliro soars sharply on Friday after SEB Equities raises recommendation to buy from earlier keep.

Riktkursen be adjusted sharply up from the 10 to 18 crowns, which caused the stock to initially rush over 7 percent to just below the high for the year on Friday.

A lot has happened in the last two weeks, not the least, the company has sold shoppingklubben Members.com to Campadre for more than 10 million.

The company has also entered into a partnership with Campadre, in its business area Nelly to conduct shoppingklubbsförsäljning in the nordic countries.

Qliro announced in the beginning of may, that the company will offer consumers savings account with state deposit guarantees in the future.

On Thursday, it was revealed according to the Swedish financial supervisory authority insynslista to the company’s chief financial officer purchased 25.000 shares, the company’s ceo, 30,000 shares in the company.

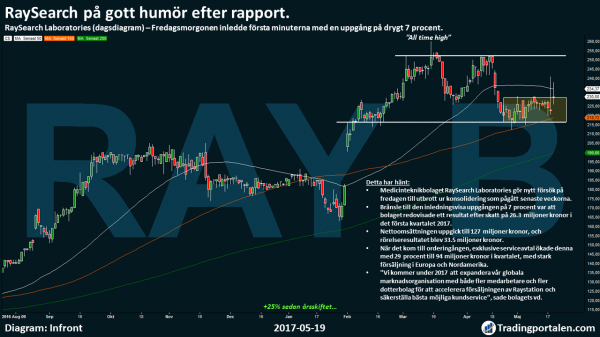

RaySearch in a good mood after the report.

Friday morning began the first few minutes with a rise of just over 7 per cent.

The medical technology company RaySearch Laboratories makes new attempt on Friday to the outbreak out of the consolidation that have been going on in recent weeks.

Fuel to the inledningsvisa rise of 7 per cent was that the company reported a profit after tax of 26.3 million in the first quarter of 2017.

Net sales amounted to sek 127 million, and operating income was 33.5 million.

When it came to order intake, excluding service contract increased by 29 per cent to 94 million in the quarter, with strong sales in Europe and north America.

”We will in 2017 to expand our global marketing organisation with both more employees and more of the subsidiaries to accelerate sales of Raystation and ensure the best possible customer service,” said the company’s ceo.

Hålltider during the day

Ex-dividend

- Consilium (2:00 kr), Skåne Energy (2:00 kr)

Macro statistics

- United kingdom: Rightmove house prices may at 1.01

- Japan: trade balance april at 1.50

- AF: the weekly statistics at 10.45

Other

- EMU eurogroup meeting at 15.00

All börshändelser and estimates for the week can be found here!

Latest börsnyheterna

The stockholm stock exchange rebounded on Friday after a week of uncertainty surrounding the Donald Trump. Munters rose during the high sales of the first trading day and Nordea dominated before flyttbesked.

At the time of closing was storbolagsindexet OMXS30 0.9 per cent higher to the level of 1.629. The turnover on the stockholm stock exchange passed 17 billion.

Oil prices continued upwards with 2 per cent for north sea oil for 53:50 dollars per barrel. Lundin Mining rose 2.6%.

Nordea rose 2.2 per cent to close at sek 115 with ABG Sundal Collier and Danske Bank as large net buyers. ABG raised riktkursen to 117 sek 105 sek. Danske upgraded on Thursday, the recommendation for Nordea to buy on the prospect of the head office was moved from Stockholm, sweden. Flyttbeslutet is taken and the hammer will fall on 30 may, according to Svenska Dagbladet, which referred to the sources.

Engineering companies regained lost ground after a heavy Thursday. Volvo rose 2.1 per cent, Sandvik 1.1 per cent.

Fingerprint bounces continued on Friday, just over 3 per cent after several days of decline before Thursday.

Klimatkontrollbolaget Munters made his first day on the stock market after almost seven years with Nordic Capital as owners. The share was with Carnegie that by far the largest buyers, among the most actively traded and closed at 66:05 sek, 20 percent up from the share subscription price of sek 55.

Raysearch operating income increased by 43 per cent to 33 million in the first quarter, supported by increased revenues from dosplaneringssystemet Raystation in radiation therapy. Cancerbehandlingsenheten MD Anderson to become a partner of information system Raycare. The shares advanced 1.8 percent.

CLX nearly doubled its operating income in the first quarter with significantly increased sales. The company set new financial targets. The adjusted ebitda to grow by 20% annually by 2016 as a base. At the same time dropped goal for organic revenue growth which in the past would be at least 20 per cent. Investors responded by trading the stock 2.4 per cent.

Brandsäkerhetsbolaget Consilium reported increased order intake and net sales by 3 percent and 4 percent respectively in april compared with the previous year, but shares lost almost 1 per cent.

Lundin Mining gained height the recommendation to purchase from keep of Berenberg. The share was strengthened 3.6 percent.

SEB raised its recommendation for Qliro to buy from the past keep. The share increased to 9 percent.

Ahlsell received a buy recommendation from Deutsche Bank, up from earlier keep. The stock rose 2 per cent.

Tethys Oil nedgraderades to keep from the purchase of the GMP, but was up 1 percent, with rising oil prices.

Redwood Pharma plummeted 27 percent after the notice of a rights issue of up to eur 24.2 million.

Mobiplus made its first trading day on Aktietorget. The subscription price in a small issue was a 7:30 crowns, and which also shut share.

Get morgonrapporten to your e-mail daily before the stock market opens!

Recent trends (~there is a 06:40)

The OMXS30

EURO STOXX 50

Frankfurt DAX

The London FTSE 100

THE S&P 500

The DJIA

The Nasdaq Comp.

The NIKKEI 225

HANG SENG

EUR/USD

EUR/SEK

USD/SEK

WTI Semester

Brent Semester

1629.21

3587.01

12638.69

7470.71

2381.73

20804.84

6083.7

19674.91

25412.26

1.12

9.77

8.73

51.08

54.02

0.86%

0.70%

0.39%

0.46%

0.68%

0.69%

0.47%

0.43%

0.94%

-0.13%

0.03%

0.12%

0.81%

0.76%

Stock and Technical Analysis each day at 10.00 am

By: Michael Andersson for Tradingportalen/Agency Directly.

Questions and comments always welcome in the newsroom[at]tradingportalen.com