The OMXS30 closed finally on the minus in Wednesday’s trading, during a day when several leading european stock indexes showed weakness. Storbolagsindexet fell -0.1 per cent to 1541.76, and turnover on the stockholm stock exchange amounted to sek 15 billion. Sentiment is still slightly positive, to slightly hesitant this morning, and the question becomes if the technical support at 1540 points will keep today…

Get morgonrapporten to your e-mail daily before the stock market opens!

Today’s analysis

It was finally closed in the negative territory in Europe. Late in the afternoon, in conjunction with the united states opened for the leading stock indexes to the south.

The united states, which closed in the minus, was pulled down when the us president, Donald Trump stated that he is skeptical about the united states, Canada and Mexico can agree on a new Nafta agreement.

We highlighted in Wednesday’s morgonrapport that the workshop could be a sector that will contribute positivity to come. Even though the development was shared within the its sector, showed several indextunga engineering strength.

Ahead of Thursday’s opening of more than a couple of hours, it is slightly positive opening is expected. Possibly we will get an opening closer to zero, then the u.s. leading the semester, the S&P 500 is trading at slightly less, which is not too often is a contributing factor.

After overnight trading in Asia, it is a shared image that painted. Japan traded to minus, while Hong Kong is on the plus.

We have a relatively quiet agenda during the day, where there really potential triggers can come at 15:00, when the Swedish finance minister Magdalena Andersson holds press briefing on the economic situation.

Also on Thursday, we get an interesting latecomer clock 07:45, Raysearch leaving the interim report.

It is still an unsettled situation that we find ourselves-even on the purely technical.

We have not experienced any significant köpstyrka since 19 July, in addition to a smaller jolt on Tuesday.

OMXS30 index is nonetheless still below the moving medeltalsvärde 50, 100, but especially to 200 days.

We continue to monitor the mix a little extra, as we believe that the risk is high that it can tip over and cause a decline in 1540, 1527, 1517 points, if not köpstyrka looking up properly shortly.

In particular, we would like to see köpstyrkan stands out properly, and that we in connection with such cases, to step over not only the 1550, 1560, 1580, but also sentimental heltalsnivån 1600 points.

At the more cautious sentiment, a little experienced this morning, it can mean that we get continued movements in the 1517 – 1560 points on the remaining part of the week, which gives excellent opportunities to go long and short for the kortsiktige the investor.

Any positive signals, similar to the workshop we see in some Swedish bank shares. Maybe this can help with further strength, then both the workshop and the bank accounts for a large part of the weight of the OMXS30 index.

Ahead of today’s trade await once again technical resistance at 1550, 1560, 1580 and 1600 points. Technical support levels await hence also in 1540, 1527, 1517, and 1500 points.

What hålltider and the company reports the next weeks you can read here.

Yesterday’s main börshändelser.

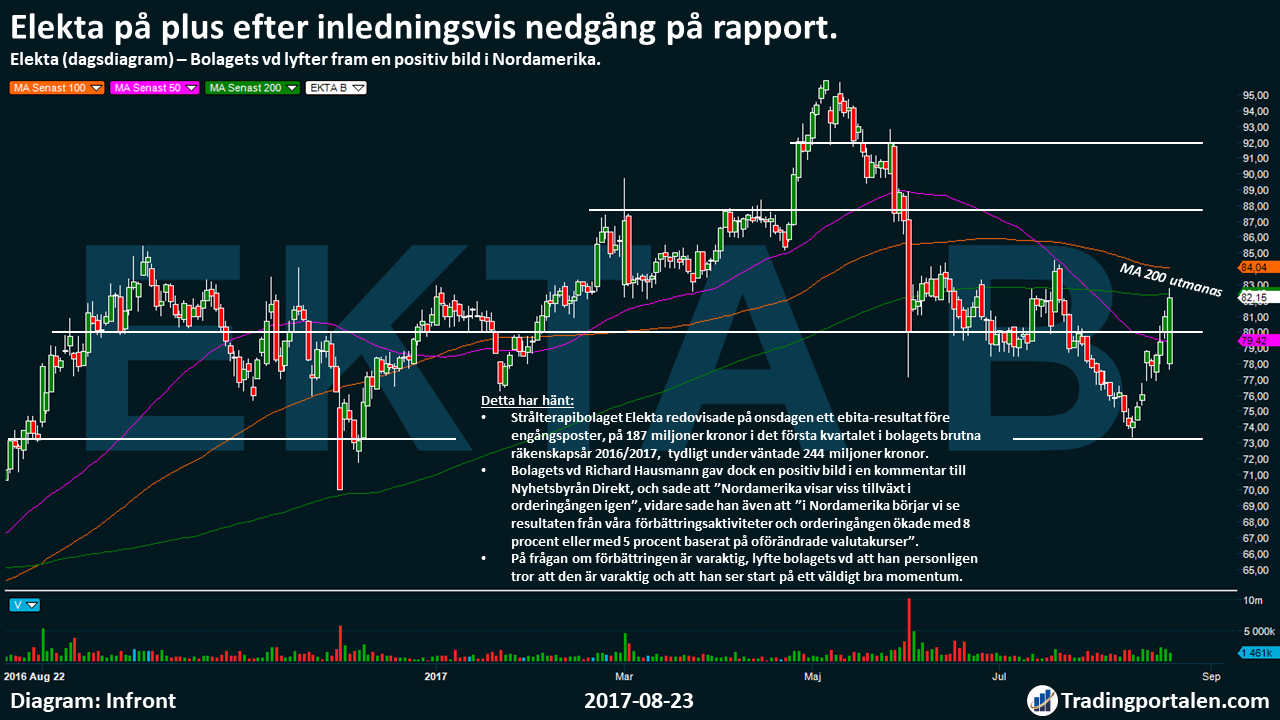

Elekta on the plus after initially decline on the report.

The company’s ceo highlighting a positive image in north America.

Strålterapibolaget Elekta reported on Wednesday an ebita-earnings before non-recurring items, of sek 187 million in the first quarter in the company’s broken fiscal year 2016/2017, clearly below the expected 244 million.

The company’s ceo Richard Hausmann gave a positive picture in a comment to the News agency Directly, and said that ”north America is showing some growth in order intake again”, he said, he also in ”in north America we begin to see the results of our improvement activity and the order intake increased by 8 percent or by 5 percent based on unchanged exchange rates”.

On the question of whether the improvement is lasting, lifted the company’s ceo that he, personally, believe that it is stable and that he sees the start of a very good momentum.

Kycklingbolaget Scandi Standard lifts on the report.

The previously reported bird flu-pressed quarter.

Scandi Standard reported on Wednesday a profit after tax of -19.9 million for the second quarter of 2017.

The previously reported bird flu, affected the adjusted operating income for the quarter by around eur -13 million and can be attributed to Sweden and Denmark. During the third quarter is expected to affect the result in around 3-5 million, then reducing gradually.

In the interim report, it emerged that the company’s ceo Leif Bergvall, expects that the company will sequentially will be able to achieve an improvement in operating income and margin, for the existing operations during the next quarter. Bergvall also recognised the enthusiasm over the acquisition of Manor Farm, which is expected to be completed on August 28, 2017, and will increase the company’s turnover by about 25 per cent.

The oil company EnQuest falls like a rock after produktionssänkning.

Clearly below the previous forecast.

On Wednesday opens the oil company EnQuest, with a decline of over -10%, after the company lowered its production forecast.

It is a lower operational efficiency for the Kraken FPSO, which meant that production volumes have been lower than expected.

”We do not expect that the current operational problems in the upprampningen of the Kraken will continue beyond 2017,” wrote the company.

According to Pareto Securities corresponds to the oil company’s new forecast for 2017 33.000-41.000 barrels of oil per day, which is about 20 percent lower than the earlier forecast of 45.000-51.000.

Pareto believed that Wednesday’s announcement was ”clearly negative”.

Hålltider during the day

Company reports

- Raysearch (at 7.45), Clothes (8.00), FM Mattsson (8.00), Karo Pharma (8.00), MSC Group (8.00), Railcare Group (8.00), Wilson Therapeutics (8.00), Hexatronic (8.30), Systemair (13.00), Limited, Malmberg, Starbreeze

Ex-dividend

- Addtech (3:50 kr.), Elekta (0:50 sek semi-annually)

Macro statistics

- Norway: oljeinvesteringar survey 8.00

- Norway: GDP q2 8: 00 am

- France: industry expectations August at 8.45

- Spain: GDP (def) 2 kv at 9: 00 am

- Statistics SWEDEN: unemployment July at 9.30 am

- SCB: short-term employment statistics 2 kv at 9.30 am

- SCB: vacancies 2 kv at 9.30 am

- Business Sweden: exportchefsindex 3 kv at 10: 00 am

- Uk: GDP (prel) q2 at 10: 30 a.m.

- USA: new unemployed, veckosiffra at 14.30

- United states: Bloomberg consumer confidence, veckoindex at 15: 45

- U.S.: sales of existing homes at 16.00

Other

- Government: press briefing on the economic situation with finance minister Magdalena Andersson on the Harpsund 15.00

All börshändelser and estimates for the week can be found here!

Latest börsnyheterna

A move from Donald Trump appeared again hampering investors ‘ risk appetite on Wednesday and the stockholm stock exchange closed slightly down. Atlas Copco and Sandvik alleviate the decline after president hit on Tuesday.

Storbolagsindexet OMXS30 index closed 0.1 per cent down. The turnover on the stockholm stock exchange have been summarised to 15 billion. On the continent, backed the German DAX, French CAC40, and the regional Euro Stoxx 50 between 0.3 and 0.5 per cent.

The US stock markets started Wednesday trade on the minus in the wake of president Donald Trump said that he is skeptical about the united states, Canada and Mexico can agree on a new Nafta agreement.

Against the current in the OMXS30 went verkstadsbolagen Atlas Copco and Sandvik by 1.7 and 0.5 percent increase since the companies ‘ ceos met with financial market participants on Tuesday.

Mats Rahmström met for the first time, analysts as ceo of Atlas Copco. He made a reliable impression, considered Handelsbanken. Nordea received ”a positive impression” from Sandvik-president and ceo, Björn Rosengren hit with investors.

Among other major engineering companies were ABB and SKF unchanged, while the Alfa Laval dropped close to 1 percent.

Storbolagsindexet was weighed down by telecom operators Tele2 and Telia, which were both down more than 1 percent, while Deutsche Telekom was down one per cent in Frankfurt. In addition, indextunga H&M again down, – 1.5 per cent, after on Tuesday has risen for the first trading day in a week.

Låskoncernen Assa Abloy fell close to 2 percent. The index that measures the level of invoicing by of american architects was 51.9 units in July, down from 54.2 units in June.

Outside of the OMXS30 released the Elekta a report with the expenses that stack out on the high side in the quarter to July. After strålterapibolaget on a rapportkonferens notified that the selling expenses are deemed to be normalized for the current quarter, the share price closed 3.4 per cent higher.

Other rapportvinnare was Electra, B3IT and Lexington with gains of 2.1, the 5.7 and 6.0 per cent. Kycklingföretaget Scandi Standard closed unchanged in rapportflödet.

The heavier the had VA Automotive it, with a fall of 24 per cent since it flipped to a loss in the second quarter when changes in the organization led to restructuring charges.

Another loser was the oil company Enquest, with close to 9 percent, retreating after a reduced production forecast.

Bilbesiktningsföretaget Opus rose 8.5 per cent after receiving a överklagningsbart of the award decision from the state of New Jersey in the united states with an annual value of 20 million dollars.

Vindkraftsaktören Arise got wind in the sails of a advice in the Business world, and lifted more than 5 per cent.

After a limited movement in the wake of the report on Tuesday advanced Balder around 3 percent. On Wednesday it was informed that the company is investigating the possibility to implement the bond issuance and plans to redeem outstanding preferred shares. It would improve cash flow and increase financial flexibility, said the company.

In the real estate sector reported the Capital on Wednesday. Shares closed down 0.3 per cent.

Get morgonrapporten to your e-mail daily before the stock market opens!

Recent trends (~there is a 06:40)

The OMXS30

EURO STOXX 50

Frankfurt DAX

The London FTSE 100

THE S&P 500

The DJIA

The Nasdaq Comp.

The NIKKEI 225

HANG SENG

EUR/USD

EUR/SEK

USD/SEK

WTI Semester

Brent Semester

1541.76

3438.63

12174.3

7382.65

2444.04

21812.09

6278.41

19377.47

27560.91

1.18

9.51

8.06

48.39

52.57

-0.13%

-0.49%

-0.45%

0.01%

-0.35%

-0.40%

-0.30%

-0.29%

0.58%

-0.05%

-0.05%

-0.01%

-0.04%

0.00%

Stock and Technical Analysis each day at 10.00 am

By: Michael Andersson for Tradingportalen/Agency Directly.

Questions and comments always welcome in the newsroom[at]tradingportalen.com

Click on the link for more information about ”Focus, strategy and ansvarsbeskrivning”

Upcoming course

“Learn to support Yourself on Your Trading – a complete three-day course!” – see the next course!