Unlike large parts of Europe, completed the stockholm stock exchange on plus in Tuesday’s trade. Storbolagsindexet OMXS30 index closed just below the resistance level of 1640, a rise of +0.48%. The turnover on the stockholm stock exchange amounted even to 15.7 billion on Tuesday. Ahead of today’s opening points leading futures right now on a pending motion, and the question is whether continued consolidation is to be expected, or if Tuesday’s momentum can continue to get a the establishment of 1640 today…

Get morgonrapporten to your e-mail daily before the stock market opens!

Today’s analysis

Sentiment shifted ahead of Tuesday’s opening on the futures market, and we started the day rather than a minus in intensity.

An hour into the Swedish trade had the mood, however, changed, and back on a positive path, we managed to close just below the resistance level of 1640 on Tuesday.

The inledningsvisa decline below the support level of 1630 with a dagslägsta in 1624 did not note any direct volume, which means that it does not displace the long-term positiviteten.

However, there could possibly be a varningsflagga, as we highlighted in Tuesday’s morgonrapport, even intraday. But as we mentioned earlier, we would need to see a clearer strength, with the volume when the trade takes place in such a relationship, and this was not the case.

Ahead of today’s trading is the futures market at the time of writing something more cautious. Both large parts of Europe and the united states received a slightly negative development on Tuesday. Even after the night’s trading in Asia to be presented weak negative progressions. However, traded the u.s. leading the semester, the S&P 500 just above zero for overnight trading, which can possibly be a positive sign.

We do indeed have a clear narrowly handelsintervall last time, with brief visits just above the kanaltaket 1640, and during the kanalbotten 1630.

It is more difficult to foresee the situation right now, even if we are positive in our view. Several exchanges were also closed initially of the week, which makes the trade often receives a lower activity, and abnormal movements than regular trade.

At the same time as several sectors continue to show positive attitude, helps hardly the political situation in the united states, and Brexit in Europe, with Greece in the sidovagnen.

At the same time that we were not able to close during the heavy levels of support, which in itself is positive, we have not gained momentum enough to break the north to establish us over the motståndnivåer.

After three day’s trading, closing on the minus, we finally got the trade on, plus after Tuesday. In the short term, we are not in an overbought territory, giving room for further rise and establishment of 1640 points.

In particular we keep track of the strength in case of a possible outbreak of 1640 today, to await a confirmation to the establishment, and on the rise.

Yet would at the revealed weakness could mean that we get a continued consolidation in the 1630-1640.

For the kortsiktige the merchant is the current trading very pleasant, as it offers nice turning points within this range. Sell on weakness when challenged by 1640, as well as the fake outbreak, and occurs purchase at the challenging and fake outbreaks below the support level at 1630.

We are left in the same box ahead of today’s trading, and the month’s last trading day. Technical resistance levels await already in 1640 and 1650, but also 1670 points. Support levels await at the same time at the 1630, but most of all 1600 points.

What hålltider and the company reports the next weeks you can read here.

Yesterday’s main börshändelser.

Time for Telia to establish itself over $ 40?!?

Strong trend to continue northward after the previous eruption…

Telia continues further to the north on Tuesday with over half a percent, after earlier establishment of the resistance at 37.40 experienced a strong trend.

Since the end of the year, it has risen over +9%, and today’s rise means that the stock continues to exhibit strength to a potential establishment of $ 40, which is considered to be a positive piece of the puzzle for on the rise.

It is soon a year ago, Telia was trading around current price levels, and we see from a holistic perspective, it is positive attitude that is…

On Tuesday, it appeared also in a news release that Telia has together with Telenor assigned to the frequencies of the Norwegian telecoms body in the 900-megahertzbandet, which further contributed to the positivity.

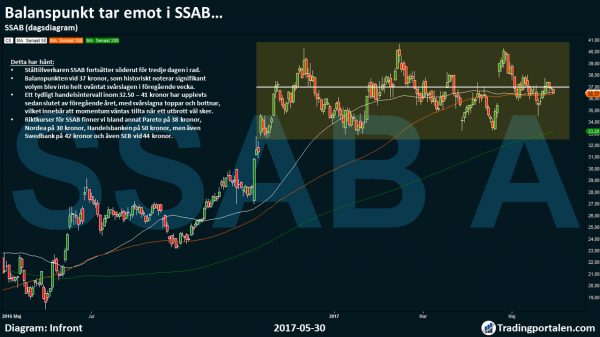

Fulcrum receives in the SSAB…

Steelmaker SSAB continues to the south for the third day in a row.

Point of equilibrium at 37 crowns, as a historical note of the significant volume was not completely unexpectedly hard to beat in the previous week.

A clear handelsintervall within 32.50 – 41 sek has been experienced since the end of the previous year, with the teeming tops and bottoms, which means that momentum is expected to rise when an outbreak occur.

Riktkurser for SSAB, we find, among other things, Pareto on 38 sek, Nordea of sek 30, Handelsbanken of sek 50, but also Swedbank 42 sek and SEB at 44 kronor.

Workshop gearing up for the new tag…?

Clear kraftsamlingsfas among several engineering companies.

Perhaps it is sektorrotation at the time, where indextunga verkstadsbolagen contributes with strength to the OMXS30?!?

Clear the tension forces to the average, maintaining a positive undertone during the kraftsamlingsfas…

Hålltider during the day

Company reports

- Rocket Internet (the results for some of the portfolio companies)

Ex-dividend

- A City Media (2:50 kr)

Macro statistics

- United kingdom: GfK consumer confidence, may at 1.01

- Japan: industrial production (prelim) april at 1.50

- China: industry-PMI may at 3.00

- China: the services PMI may at 3.00

- Estonia: GDP 1 kv at 7.00

- Germany: retail sales april at 8.00

- France: CPI (prelim) may at 8.45

- Denmark: GDP (prel) q1 9.00

- Austria: GDP (def) 1 kv at 9: 00 am

- Germany: unemployment may at 9.55

- Poland: GDP (def) 1 kv at 10: 00 am

- EMU: unemployment rate april at 11.00

- EMU: CPI (prelim) may at 11.00

- Italy: CPI (prelim) may at 11.00

- Latvia: GDP (def) 1 kv 12.00

- USA: THREE weekly statistics at 13.45

- The united states: Redbook weekly statistics at 14.55

- Belgium: GDP (def) 1 kv 15.00

- U.S.: Chicago purchasing managers ‘ index may at 15: 45

- USA: contracted house purchase april at 16.00

- United states: oil (API), the weekly statistics at 22.30

Other

- The Fed: Robert Kaplan, the Fed chief in Dallas, speaking in New York at 14: 00

- The Fed Beige Book at 20: 00

All börshändelser and estimates for the week can be found here!

Latest börsnyheterna

The stockholm stock exchange was traded after a tentative start on Tuesday at higher rates. Swedbank and several workshops, stated the rise while H&M and the Fingerprint Cards were among the laggards. The leading european exchanges had a lower development than in Stockholm.

At the time of closing was storbolagsindexet OMXS30 index up 0.5 per cent. Shares 15.7 billion had changed hands.

Out in Europe was the bank the weakest performing sector in the region.

In Stockholm it was noted Swedbank up 2.3 per cent while the other three major banks traded just above unchanged levels. Carnegie writes in a weekly update for hybrid to Swedbank during the last week, when the share was down 0.6 per cent, was weighed down by expectations of interest rate hikes pushed forward in time as well as increased competition within the mortgage loan. Carnegie’s assessment was that the share was traded below its rightful value.

Several workshops showed a good development. Including Electrolux and Volvo, which rose by 1.9 and 1.6 per cent respectively.

H&M was reduced to 1.2 percent as the weakest share in the OMXS30-index. Carnegie writes, in an analysis of a greater concern for the lower sales per store. An improvement of the klädkedjans sales or profit is not seen as imminent. The investment banking säljrekommendation.

Among the companies outside the storbolagsindexet was Sectra and Anoto both slightly down after quarterly reports. Sectra was down 2.5 per cent, and the Group declined more than 1 per cent.

Xvivo climbed over 2 per cent to sek 95. Pareto has initiated coverage of the shares with a buy recommendation and sek 120 to which the specified price target.

Systemair ticked down 0.3 per cent. Swedbank has lowered the recommendation on the shares to neutral from buy.

Today’s Industry, pointing out the newcomer SBB and Amasten as riskbyggen among real estate companies on First North. SBB lost a bit under 2%, and Amasten was down less than 3 percent.

On the First North has been trading in the Lundbaserade mjukvaruteknologibolaget Terranet launched just over 17-sek level, thus clearly higher than the issue price of sek 13.

One of Monday’s winners, mobilspelbolaget Leo Vegas, trading up 1.3 per cent. Danske Bank puts the purchase of the share in the premiäranalysen with reference primarily to the company’s, according to the bank, good growth prospects.

In the same sector, increased the Betsson 3.4 per cent.

On makrofronten the krona has weakened slightly since the GDP growth has been weaker than expected in the first quarter.

Wednesday’s reports rounds off the rapportsäsongen for the first quarter of 2017.

Get morgonrapporten to your e-mail daily before the stock market opens!

Recent trends (~there is a 06:40)

The OMXS30

EURO STOXX 50

Frankfurt DAX

The London FTSE 100

THE S&P 500

The DJIA

The Nasdaq Comp.

The NIKKEI 225

HANG SENG

EUR/USD

EUR/SEK

USD/SEK

WTI Semester

Brent Semester

1639.74

3561.22

12598.68

7526.51

2412.91

21029.47

6203.19

19621.45

25680.59

1.12

9.76

8.73

49.31

51.95

0.48%

-0.50%

-0.24%

-0.28%

-0.12%

-0.24%

-0.11%

-0.29%

-0.08%

-0.05%

0.00%

0.04%

-0.70%

-0.56%

Stock and Technical Analysis each day at 10.00 am

By: Michael Andersson for Tradingportalen/Agency Directly.

Questions and comments always welcome in the newsroom[at]tradingportalen.com