Sharply negative movements dominated Wednesday’s trading around the world. Political unrest over there in the united states regarding Donald Trump ran over to the Swedish trade, and got the OMXS30 to shut the whole -1.49 percent to 1628.37 points. The turnover increased and amounted to just over sek 19 billion on the stockholm stock exchange, and all the companies in the OMXS30 closed at minus when we also knocked out two technical support levels. Thursday’s trading is expected to also initiate further south, further away from the technical nyckelnivån at 1630 points, which are now acting as resistance…

Get morgonrapporten to your e-mail daily before the stock market opens!

Today’s analysis

Sharply negative movements dominated Wednesday’s trading around the world, with broad declines of over 1% for several storbolagsindex.

It is therefore, first and foremost, the dismissal of FBI director James Comey, who made headlines at the same time as secret information leaked at a meeting with the Russian leader last week who had come up to the surface.

Net sales increased to just over sek 19 billion, and when all the companies in the OMXS30 closed at minus gave a fall of -1.49% for the storbolagsindexet OMXS30, we had a closing not only below our technical support level at 1640, but also to 1630 points.

We beat out two technical support levels, in line with that, we got an increase in sales. This was a potential risk we highlighted earlier in the week, which means that a certain amount of caution arises.

At the same time, it is worth noting, by such a significant movement on political concerns may well be temporary, unless nothing new occurs away in the united states.

Leading futures pointing to early this morning on an initially negative movement, at the same time as this case will provide a scenario with the short-term oversold.

U.s. S&P 500 in the semester, it must be noted, however, weak, plus after the night’s trading in Asia, where storbolagsindex had a negative development.

However, we believe that there is a high probability that this will be a temporary phase in the form of abreaction, before the market moves any higher up.

Risk is, of course, however. The week is currently out to be able to switch with any advantage from the sellers. At the same time, we note also that after 10 months of trading on plus, we have now a clearly lower köpvolym than previous months, even if there remains a number of days of trading before month end.

We would close the month as a whole on the minus, occurs in contrast, a negative sentiment that can be difficult to ignore.

Now, when we are expected to open during the 1630 points, increasing the risk for a possible return visit of the sentimental heltalsnivån 1600 points. However, we see a smaller probability for this to happen, then we still have the positive signals on the basis of a longer-term perspective.

Ahead of today’s trade thus has resistance levels at 1630, 1640 and 1650 points.

Support levels are now awaiting the especially during the 1600 points, followed by 1594 and in 1588 points.

What hålltider and the company reports the next weeks you can read here.

Yesterday’s main börshändelser.

Africa Oil soars on oljefynd!

The company has found oil in northern Kenya.

Africa Oil rushed over 5 percent on Wednesday morning, just under the heavy technical branch of MA 200, while the share established itself over the short-term MA 50.

The company get the fuel to rise then the company has found oil in northern Kenya in prospektringsbrunnen Emekuya-1 in block 13T.

”The deposit covers around 75 metres oljepelare net in the two zones. Reservoir sand which has been found to appear also stretched, which further lowers the risk in the area and bodes well for future exploration in the area,” reported the News agency Directly.

On Wednesday came at the same time, Pareto, and raised the recommendation of the company from the keep to buy with lowered target price to 18 crowns.

Wednesday’s rise now looks to be able to challenge the MA 200 on gravity, which would mean the other utmanandet on a month since the previous eruption on the downside in the beginning of april.

We also note that Wednesday’s rise signifies the establishment of significant volume range, which in itself bodes well for a potentially challenging the resistance at 15.50 dollars. On the basis of a negative scenario, we are primarily a check on utbrottsnivån at 14.20 dollars.

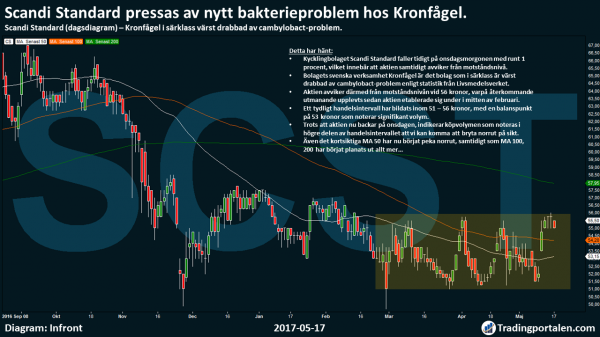

Scandi Standard under the pressure of new bakterieproblem of Kronfågel.

Kronfågel by far the worst affected of the cambylobact problems.

Kycklingbolaget Scandi Standard fall early on Wednesday morning with around 1 per cent, which means that the share at the same time differs from the resistance level.

The company’s Swedish operations Kronfågel is the company which, by far, are the worst affected by cambylobact-problems according to statistics from the Swedish national Food administration.

The share thus deviate from the resistance level at sek 56, whereupon the recurring challenging experienced since the share, has established itself in in the middle of February.

A clear handelsintervall has been created in the 51 – to 56 sek, with a fulcrum at 53 sek notes the significant volume.

Despite the fact that the share is now backing on Wednesday, indicating köpvolymen as noted in the higher part of the handelsintervallet that we can get to break to the north in the long term.

Even the short-term MA 50 has now started to point north, while the MA 100, 200 has begun planats out all the more…

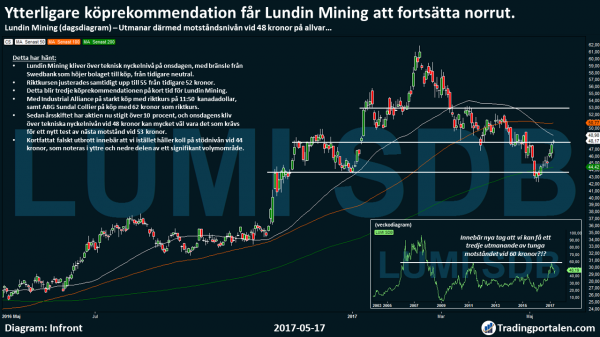

Further purchase recommendation may Lundin Mining to continue north.

Challenges thus resistance level at 48 sek seriously…

Lundin Mining step of the technical key level on Wednesday, with fuel from Swedbank, which raises the company to purchase, from the previous neutral.

Riktkursen was adjusted at the same time, up to 55 from the previous sek 52.

This will be the third köprekommendationen in a short time for Lundin Mining.

With Industrial Alliance at strong buy with a target price at 11:50 kanadadollar, and ABG Sundal Collier on the purchase, with 62 crowns as a price target.

Since the end of the year, the shares have now risen over 10 percent, and Wednesday’s stride over technical nyckelnivån at 48 crowns may very well be what is required for a new test of the next resistance at 53 sek.

Briefly the false outbreak means that we instead keep track of the support level at 44 kronor, which is noted in the outer and lower part of the a significant volume range.

Catena Media will fall to the technical key level after the report.

Fell initially over 11 per cent to challenge the MA 100.

Catena Media which is active in the performance marketing of online casino, reported a profit after tax of 4.41 million for the first quarter of 2017 on Wednesday.

Operating profit amounted to 6.64 million, clearly better than the same period of the previous year. The operating margin was slightly improved and amounted to 44 per cent.

In the context of Wednesday’s report, it appeared from the report from the ceo firing on the move from First North at the stockholm stock exchange for the second half of the year.

”The decision allows us to keep a clear focus on the business and our growth strategy, while we take advantage of upcoming opportunities. The company has already done most of the necessary preparations and is in a good position for the move,” wrote company ceo Robert Andersson.

The company also recognised in connection with the report that you want to take on a leading role, and are mainly on the larger assets, then you are well positioned to capitalize on the growing market.

Hålltider during the day

Company reports

- Besqab (7.30), Black Earth (8.00), English school, (8.00), Humana (8.00), Oncopeptides (8.00), Multiq (8.30), Neurovive (8.30), the SSM (at 7.15)

- Aptahem, Combigene, Crowdsoft Technology, the Generator Vallentuna, Eurocine, Interfox Resources, Net Gaming, Pharmalundensis, Vadsbo Switch Tech, the WNT Research

- Wal-Mart (13.00), GAP (at 22.15)

Ex-dividend

- AAK (8:75 kr), Bahnhof (3:25 kr.), Genova Property (2:63 usd in preferred stock), Leo Vegas (1:00 sek), Tethys Oil (1:00 kr)

Macro statistics

- Japan: GDP (prelim) 1 kv at 1.50

- China: property prices april at 3.30

- France: unemployment 1 kv 7.30

- Austria: CPI april at 9.00 am

- Statistics SWEDEN: new construction of housing 1 kv at 9.30 am

- Uk: retail sales april at 10.30

- United states: new job vacancies to unemployed, from weekly data at 14.30

- USA: Philadelphia Fed index may at 14.30

- United states: Bloomberg consumer confidence at 15: 45

- USA: leading indicators april at 16.00

All börshändelser and estimates for the week can be found here!

Latest börsnyheterna

The stockholm stock exchange dropped on Wednesday, in line with several of the major european exchanges, burdened with the weight of continued reports about what the president of the united states Donald Trump is doing.

At the time of closing was storbolagsindexet OMXS30 1.5 per cent down to 1.628. The turnover on the stockholm stock exchange reached almost sek 19 billion. No share in the OMXS30 step. The worst, the day went on, Alfa Laval and Sandvik, which dropped close to 3 per cent.

The New York Times reported that Donald Trump tried to persuade the fired FBI director James Comey to close down the investigation of former national security advisor Michael Flynn. And that Israel was behind the secret data that Donald Trump was at a meeting with the Russian leader last week.

In Betsson bought ceo Ulrik Bengtsson shares for 2.3 million.

”We have sown many seeds which will soon be ready to be harvested”, he commented for the News agency Directly. The operator’s shares closed 0.8 per cent higher.

Catena Media operating profit increased to eur 6.6 million and reached an operating margin of 44%. Ceo Robert Andersson anticipates continued to deliver on the goal of an underlying operating margin of 50 per cent in the year. But the move to the stockholm stock exchange may be postponed and the shares declined 13 percent.

”We are largely done with our job before listningsbytet but we want to get through our bonds, and the acquisition first”, said Robert Andersson to News agency Bloomberg.

Autoliv can get to sell cameras to the japanese Subaru as the car manufacturer renews its active safety systems, Eyesight, according to Bloomberg First Word. Almost ten years back, Hitachi Automotive supplied the camera system to the Subaru, but now evaluated both the manufacturers ‘ products before an upgrade planned to the year 2020. Autoliv was trading 0.3 per cent higher.

Africa Oil have found oil in exploration well Emekuya-1 in block 13T in northern Kenya. The deposit comprises around 75 metres oljepelare, net, in the two zones. Shares traded up 5 percent.

Ahlsell’s majority owner CVC has sold about 90 million shares in the company, of its holding of 263 million shares. The item corresponded to more than 20 per cent of Ahlsell, the course was 58:50 sek per share and It dropped 4.7 per cent to sek 58.

Sensys Gatso fell 11 percent after its report. Continuing macroeconomic challenges contributed according to the company, to result declined to loss of sek 17.3 million. Ceo Torbjörn Sandberg said that the company will explore various opportunities to strengthen the financial structure to cope with the fluctuations in the business.

Peptonic Medical’s depressed share rushed 143 per cent after the company confirmed the negative results of the phase 2b for the Vagitocin (oxytocin). Despite Wednesday’s rise, the company has a market value of only 40 million on Aktietorget.

Leovegas rose 2.5 percent after a buy recommendation in the Business world.

Get morgonrapporten to your e-mail daily before the stock market opens!

Recent trends (~there is a 06:40)

The OMXS30

EURO STOXX 50

Frankfurt DAX

The London FTSE 100

THE S&P 500

The DJIA

The Nasdaq Comp.

The NIKKEI 225

HANG SENG

EUR/USD

EUR/SEK

USD/SEK

WTI Semester

Brent Semester

1628.37

3584.83

12631.61

7503.47

2357.03

20606.93

6011.24

19517.59

25234.34

1.12

9.74

8.73

49.2

51.97

-1.49%

-1.57%

-1.35%

-0.25%

-1.82%

-1.78%

-2.57%

-1.50%

-0.23%

-0.12%

-0.02%

0.07%

-0.43%

-0.46%

Stock and Technical Analysis each day at 10.00 am

By: Michael Andersson for Tradingportalen/Agency Directly.

Questions and comments always welcome in the newsroom[at]tradingportalen.com