Broad downs dominated the global trading on Tuesday, and storbolagsindexet OMXS30 closed finally after the difficulties to the establishment during the heavy intensity -0.91% at 1628.5. Sales amounted to 15.4 billion kronor on the stockholm stock exchange, and after the night’s trading in Asia is the continued weak negative progressions. This means that the journey initially is expected to continue further south on Wednesday…

Get morgonrapporten to your e-mail daily before the stock market opens!

Today’s analysis

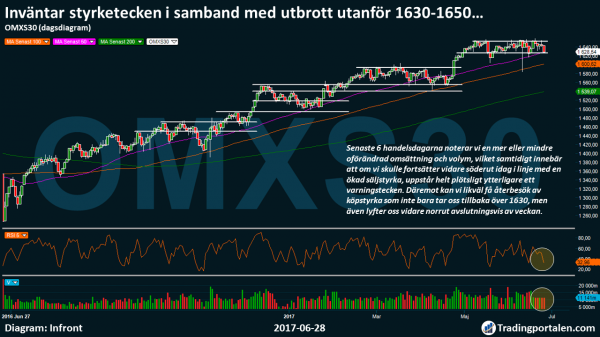

Despite the fact that we on Tuesday experienced broad declines that took us finally, under the technical support level of 1630 points, it was not with any significant strength from the seller.

Buyers ran a valiant fight against the vendor, and it was not until the conclude of the day, which we got a close below support level at 1628.5.

We highlighted in yesterday’s morgonrapport that we could potentially get a drop to test the 1630 points, however, thought we’re never going to get a closure just below.

Short-term means the decline from just below the high for the year at 1655 points on Monday, that we, through only a small decline will be in an oversold territory.

At the same time, it is worth to emphasize that we are now challenging the short-term 50-day moving average joined the game.

We have in the previous two cases, scored a rebound on this average. On June 12, in the diagram, we see a decline in, however, this is misleading and an error on the basis of market data and we got a split after the spin-off of Essity from the SCA, which means that we ignore this.

This means that we have two slightly heavier levels of support in the back behind us, which can contribute to a vändpunk, MA 50 and 1630 as the two significant key levels.

We have also not received a proper sign of strength in the short trading outside of our handelsintervall 1630-1650 points that have been going on for a long time, means that the likelihood is increased that we will return to a consolidation.

Despite this, the points leading futures this morning we will have a continued weak negative introduction.

For the moment indicates the leading futures that we will open around 1622 points, which means that we in such a case, in all probability, will step down to a short term oversold scenario.

We would love to see a sign of strength when we get an outbreak outside the 1630-1650, in order to get any kind of confirmation of the strength of buyers or sellers.

By this we mean that we right now not have got a clear picture of whether the negative outbursts that occurred during the technical support level of 1630 is a temporary thing.

Last 6 trading days, we note a more or less flat turnover, and of volume, which at the same time means that if we would continue further south today, in line with an increased sales force, occurs suddenly, another warning sign.

However, we can as well get the return visit of the köpstyrka that not only takes us back over the 1630, but also lifts us further to the north conclude of the week.

To its it means that we hold a cautious sentiment, which means that we instead see the purchase and sales opportunities-in the context of rebounds on technical key levels.

We hold no heavy makrobesked during the day which is expected to contribute with surprising movements.

For today’s trade we have also technical resistance levels at 1630, 1640, 1650, and 1658. The nearest support level, we find that around 1616, and then await the particular a heavy sentimental support level at 1600 points.

What hålltider and the company reports the next weeks you can read here.

Hålltider during the day

Company reports

- Venue Retail Group

Macro statistics

- United kingdom: Nationwide house price index June at 8.00

- Germany: import prices may at 8.00

- France: consumer confidence June at 8.45

- EMU: M3 may at 10.00 am.

- Italy: CPI (prelim) June 11: 00 am

- United states: trade balance of goods of may at 14.30

- United states: wholesale stock (prelim) may at 14.30

- The USA contracted the purchase of a house may at 16.00

- USA: oil stocks (DOE), weekly statistics at 16.30

Other

- The government: minister of finance Magdalena Andersson presents new economic forecast at 10: 00 am

- AF: presents the new report ”Where are the jobs?” at 10: 00 am

All börshändelser and estimates for the week can be found here!

Latest börsnyheterna

The stockholm stock exchange had a sur development on Tuesday. SKF was in the vanguard of the decline after a profit warning from the German sektorkollegan Schaeffler. Boliden went in the opposite direction bolstered by rising metal prices.

At the close of trading had OMXS30 index dropped 0.9% to 1.629. The turnover on the stockholm stock exchange was 15.4 billion.

SKF fell nearly 4 percent, while the Schaeffler dropped about 12 percent in Frankfurt after the German company, on Tuesday lowered its forecast for adjusted operating income. Increased price pressure in the automotive sector and rising costs for new product launches cited as causes.

A weaker trend was also noted for Astra Zeneca as, with a decline of 2 per cent. The pharmaceutical company is approaching the important data from the trial for immunterapistudien Mystic that is expected by the middle of the year.

Rising basmetallpriser provided support to mining companies. Boliden rose 2.5 percent and Lundin Mining was up 0.1 per cent. Within the broader sector step SSAB with just under 2 per cent.

Crude oil prices were up by around 2 per cent for north sea oil Brent and WTI. Lundin Petroleum, increased 0.5%, Africa Oil rose 2 per cent and Enquest improved 2.6 per cent.

Scandi Standard, which so far has only had operations in the Nordic region, has purchased the irish producer Manor Farm for 94 million euros (920 million dollars). Kycklingaktien reacted positively to the news and strengthened almost 6 percent.

Ögonstyrningsbolaget Tobii advanced 2.6 per cent. Contributing to this was that Apple should have bought the German ögonstyrningsföretaget Sensomotoric Instruments.

Bactiguard has signed a framework agreement with Region Skåne on urinkatetrar. The shares responded with a rise of 2.7 per cent.

Bure has sold its holding of around 11 per cent of the capital and votes in Catella. Bure declined 1 per cent and Catella rose 1.4 per cent.

SEB has in välfärdsrelaterat lowered its recommendation for Attendo to sell from the keep, while the Academedia was raised to buy from keep. Attendo fell over 2 per cent, while the Academedia went the other way and was up 0.9 per cent.

Aktietorgsnoterade Redwood Pharma dropped after the company left the message that their issuance is only signed to 74 percent after the guardians come in and taken his part. The share was reduced to less than 7 per cent.

Get morgonrapporten to your e-mail daily before the stock market opens!

Recent trends (~there is a 06:40)

The OMXS30

EURO STOXX 50

Frankfurt DAX

The London FTSE 100

THE S&P 500

The DJIA

The Nasdaq Comp.

The NIKKEI 225

HANG SENG

EUR/USD

EUR/SEK

USD/SEK

WTI Semester

Brent Semester

1628.54

3538.32

12671.02

7434.36

2419.38

21310.66

6146.62

20159.55

25747.9

1.14

9.76

8.6

44.07

46.88

-0.91%

-0.66%

-0.78%

-0.17%

-0.81%

-0.46%

-1.61%

-0.32%

-0.36%

0.14%

-0.01%

-0.15%

-0.38%

-0.09%

Stock and Technical Analysis each day at 10.00 am

By: Michael Andersson for Tradingportalen/Agency Directly.

Questions and comments always welcome in the newsroom[at]tradingportalen.com