Historically, the mid-term elections are usually unfavorable to the party who governs the White House. The story will be different this time ?

The voters will decide that Donald Trump actually represents America ? Or will they, on the contrary, give a chance to the camp of the democrats to call into question the policy that Trump applied for the past two years ?

While millions of american voters must go to the polls Tuesday, November 6, for the mid-term elections, the question that everyone arises is whether the republicans will maintain their majority in Congress.

Of course, it is not to choose a new president of the United States, but the impact of this election mid-term could be just as important.

What is meant by the “midterms” in the United States ?

The midterms represent elections that were held in half of the presidential mandate (hence their name) and that allow the american people to elect the representatives of the House of representatives and the Senate.

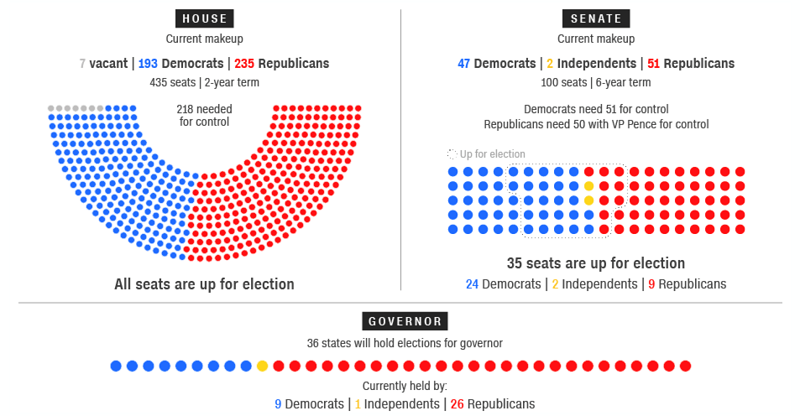

This year, it is necessary to elect the 435 seats in the House of representatives (House), with members who are all 2 years old, and 35 seats in the Senate (Senate), which has 100 members, for a mandate of 6 years. Voters will also elect governors in 36 States.

Why this election is important?

For the President, Trump, the main issue is of course to maintain control of the Congress and the Senate because if the democrats were in the majority, this could not only severely affect his decisions during the last 2 years of his term, but this would affect also the way in which the leaders of the other economic powers of the world to see.

In fact, if the republicans retain the majority with good performance then this will give the impression that Trump has a real grip on his country. Her program “America First” will have more impact on the international scene and he will be able to continue the changes that he wants to operate in the relations between the United States and its allies of the EU and NATO, and challenge even more China on economic and commercial matters.

On the other hand, if the democrats were to take control of the House of representatives or the Senate (or both), Trump would look much weaker on the international scene and other world powers could do more to assert their own interests in the face of a president preoccupied with domestic problems. In fact, his government could be paralyzed by a lack of agreement with the democrats, or because of the many investigations that the democrats wish to lead if they returned to power.

What are the consequences on the financial markets?

According to Goldman Sachs, it is unlikely that trade disputes between the United States and the rest of the world (including China) will be resolved in the near future regardless of the outcome of these mid-term elections.

For the american investment bank, the lack of consensus on trade policy and the right of veto of the president suggest that any of the two parties is not prepared to take positive action. It is also what is pricé by the market : a worsening of the trade conflict between China and the United States, thus increasing the volatility.

The research of Goldman Sachs show that the political uncertainty has reached historically high levels over the past two years, but they also show that the level reached during the period preceding the elections of this year is not much higher.

The bank notes that the market is picking up generally in the 4th quarter when there are mid-term elections because of the many uncertainties dissipate. This year, however, the bank does not expect that the doubts dissipate. She thinks, instead, that the political turmoil and financial market turbulence will intensify, which will reduce the chances that history repeats itself.