Here we have a newcomer on the market of green bonds : German Innogy, a subsidiary to 75% of the giant energy RWE, has just completed its first issuance of green bond for a total amount of 850 million euros. It is the most important operation carried out by an issuer corporate German, in a market dominated by the public sector and the banks : the other two presenting companies were two other specialists of the wind energy, Nordex and Senvion and have already asked investors for amounts of less important (at 550 million in 2016 and € 400 million in may).

“This is the first green bond German size benchmark ever issued and the most important private institution in Germany to this day,” said Société Générale CIB, who was the overall coordinator of the operation and associated advice on the structuring of the obligation to be green.

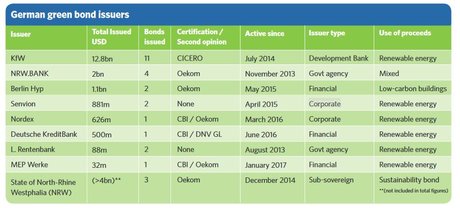

(Broadcasters German green bond. Credits : Climate Bonds Initiative)

“Sustainable by conviction and economic model”

Introduced on the stock Exchange in October as a result of a spin-off from RWE of its activities, networks and renewable energy, Innogy, which is worth some 21 billion euros, which is regularly the subject of rumours of marriage with another big issuer of green bonds sector, the French Engie. This obligation green to a 10-year maturity will be used to refinance four offshore wind power projects in the United Kingdom and Germany, and a project onshore in the netherlands, already operating or under construction.

“Innogy is a company that is sustainable by conviction and by economic model. Put in place a pattern of green bonds and issue the first green bond corporate size benchmark in Germany was a logical next step to underscore our positioning,” explained Bernhard Günther, cfo of Innogy.

The supply of bonds has been widely sursouscrite : the book of orders exceeded 4 billion euros, according to SGCIB.

Innogy observes that it has finalized its financial independence of RWE by raising his own credit line of 2 billion euros the previous week. The group has also announced on 10 October the repurchase by the Norwegian Statkraft of its 50% share in the project offshore wind farm Triton Knoll, Uk.