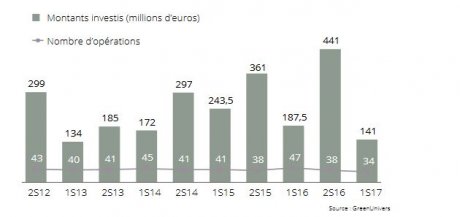

Hard waking up after the euphoria of the COP21 or simple slowdown temporary ? The fund-raising capital-innovation and capital development in green technology in France have reached 141 million euros in the first half-year to 31 operations, a decline of nearly 25% in value compared to the same period last year, where they had already dropped 22%, according to the latest barometer cleantech AFIC (the French Association of investors for growth). This is its lowest level since four years.

Made with the firm EY and the site GreenUnivers, this barometer focuses on renewable energy, energy efficiency, transport and treatment of water, air, soil, and recycling, and does not take into account that the actors of the capital investment, and not the investments of corporate venture industry.

“There are cyclical elements related to the seasonality and the record level of the year 2016” notes Sophie Paturle, president of the commission Transition energy environment, ACEC, and associated infrastructure fund Demeter Partners.

“There is also a structural reason reflecting the evolution of the funding of renewable energies, now more and more realized by the infrastructure funds, which are not part of the perimeter of the barometer,” she adds.

By the end of the year, the barometer should incorporate investment in the green technologies of these infrastructure funds.

Internet of things and mobility of the future

In the transport and renewable energy, which between them accounted for half of the funding to the same period last year, the amounts invested have been divided by more than three. Even if the res market does not seem to slow down.

“This development shows the growing maturity of the sector of the production of renewable energy. An actor like Quadran [acquired by Direct Energie, ed] will no longer be funded by the capital investment, but by the financial markets “, analysis Sophie Paturle.

On the other hand, the startups developing energy efficiency technologies, in the image of Actility, a competitor of Sigfox, which has raised € 70 million to fund and industrial companies including Bosch and Inmarsat, have the wind in their sails.

“It is the energy efficiency sector that has attracted the most capital, in terms of amounts invested and number of operations, in the first half of the year, it now sees the wholesale table rounds as one of the breton Actility, and that a barometer,” says the president of the commission Transition energy environment of the ACEC.

In second place comes the start off of green chemistry M2iLife Sciences, which has raised € 12 million from Idinvest to develop pheromones that can protect the agricultural crops. In third place the project a bit crazy to SeaBubbles (10 million from the Maif), which wants to reinvent mobility with its taxis flying over the Seine river.

After the break the first half, the planets seem aligned to give a new impulse to these investments to prepare for the transition energy, between the new plan of Nicolas Hulot and the mobilization of the president Macron, which was announced at the close of the G20 held a summit on climate change next December in France.