Uncertainty remained the buzzword in EUR/USD on Monday as the currency pair moved higher. in a very narrow range, forex traders are waiting for important events today and later in the week to know in which direction to push.

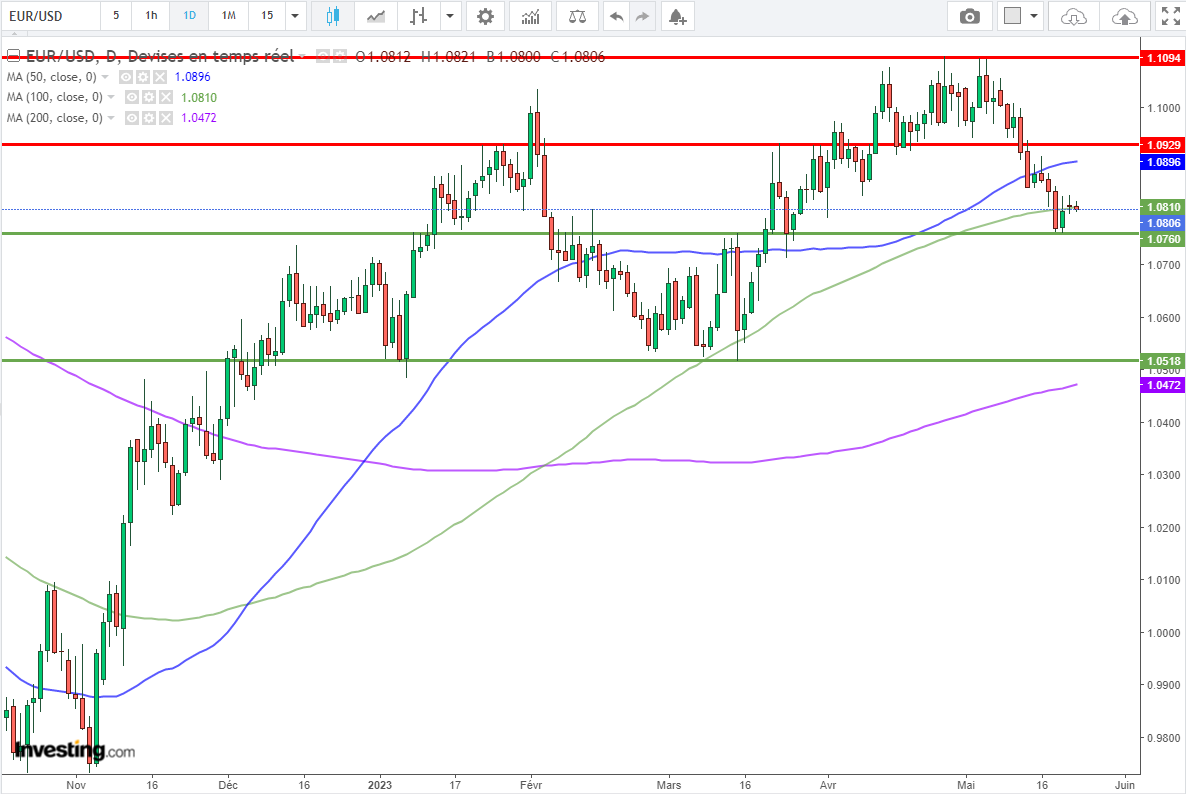

Recall that the EUR pair /USD has passed yesterday’s day at hesitate around 1.08, where is currently the moving average 100 days (1.0810).

The European PMI indices firmly expected by Forex traders

However, the day of this Tuesday could turn out to be quite different, with a much busier economic calendar.

Forex traders positioned in EUR/USD will have to watch the preliminary European PMI indices for the month of May during the morning, while this afternoon the attention will turn to several US statistics with building permits, preliminary PMIs for May, and new home sales.

>> Consult in real time the result of important statistics for EUR/USD on the Investing.com Economic Calendar

Remember that the main issue of US economic publications lately is their impact on Fed rate expectations. This Tuesday morning, the Investing.com rate barometer shows a probability of 79% that the Fed will not raise its rates in June, a stable figure over one week.

If the data expected on Tuesday lowers this probability; for the benefit of the possibility that the Fed goes back to its rates again, the Dollar would rise, with à the key a negative impact on EUR/USD. On the other hand, knowing that a break is widely anticipated, disappointing statistics which would confirm this prospect could only have a limited impact. watch on EUR/USD

From a graphical point of view, we note that the next support for EUR/USD is the threshold of 1.0760, before the psychological threshold of 1.07.

À upwards, the 50-day moving average to 1.0896 joins the 1.09 level to form the first significant resistance in the path of the currency pair. Then 1.0930, 1.10 and the yearly high at 1.1095 will be the following bullish targets.

EUR/USD: Will the PMI indices succeed in waking up the price of the Euro Dollar?