Uncertainty remains the dominant theme in the EUR/USD pair this Friday morning, but the busy economic calendar has slowed down. The day could lead to a more lively weekend.

Indeed, forex traders will be awaiting preliminary data from the Eurozone PMI indices in the morning. month of April, data that could greatly influence the Euro.

>> Consult in real time the results of the European PMI indices as soon as they are published on the Investing.com economic calendar.

We will also continue to closely monitor changes in market expectations; for the next Fed meetings, knowing that currently, the market takes into account a probability of 85.8% from a rate hike of 0.25% in May, and a probability of 18.5% that this rise is followed by a similar rise the following month.

A decline in these expectations would weigh on the Dollar, to the benefit of the EUR/USD, and vice versa.

Technical thresholds at; monitor on EUR/USD

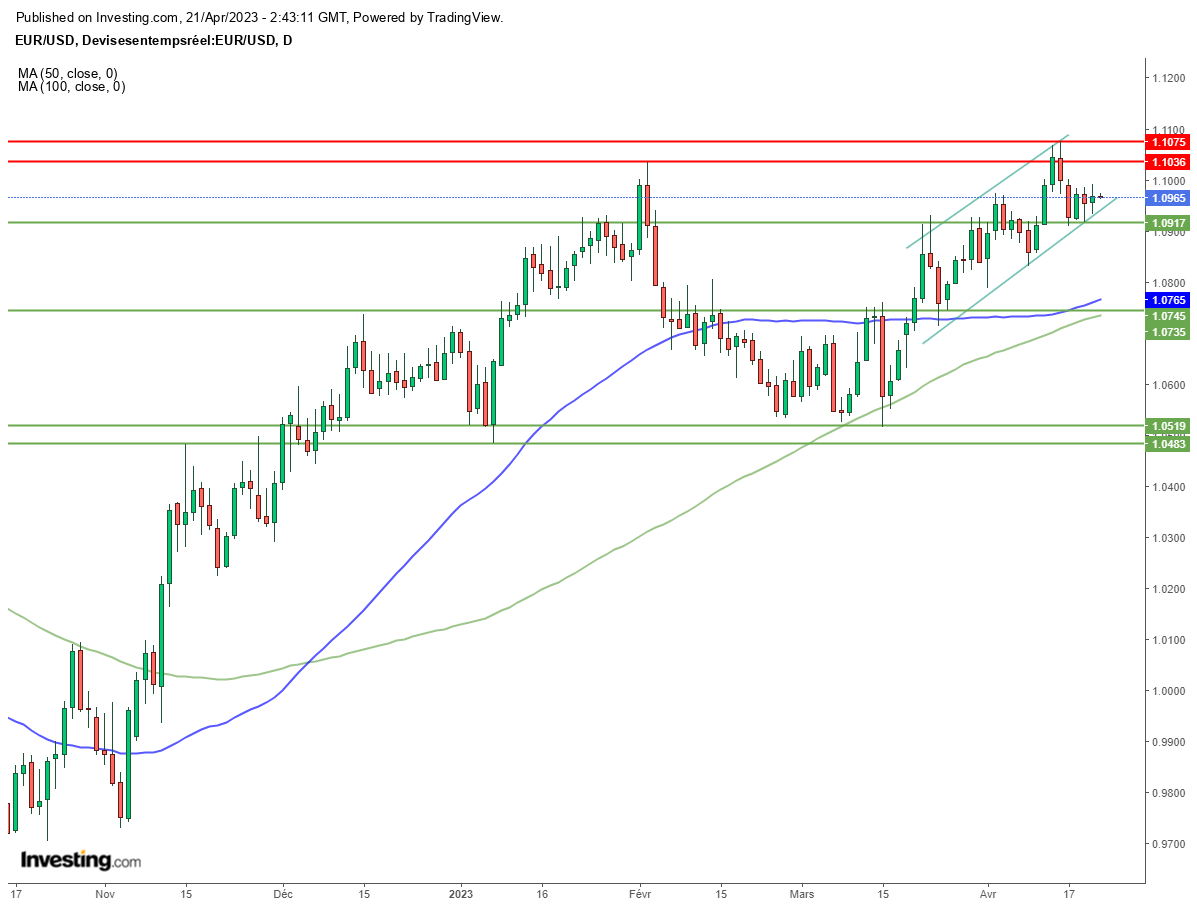

From a graphical point of view, the EUR/USD is still in the bullish channel that we already mentioned. yesterday.

Under 1.0900-1.0915, we can consider that the ;Euro Dollar broke below the lower limit of the channel, which would constitute a bearish signal, which would put in sight the threshold of 1.08, then a more important support towards 1.0750, a framed threshold; by the MM 50 days àgrave; 1.0765 and the 100-day MA at; 1.0735.

On the upside, 1.10 is the first barrier on EUR/USD's path, ahead of last week's peak at 1.0735. 1.1075, then the psychological threshold of 1.11.

EUR/USD: Will the PMI indices give the EuroDollar a clearer direction?