EUR/USD corrected sharply Monday as the currency pair retreated up to a hollow at 1.0909 in the afternoon, after losing the key threshold. of 1.10 in the morning.

Remember that the Euro Dollar had already started to decline on Friday, while the increase in Fed rate expectations had supported the Dollar, following a hawkish words from the Fed.

Yesterday, the Dollar therefore continued to rise, the favor of a New York Fed index much higher than expected (10.8 points against -18 points anticipated and -24 points previously), which convinced the market even more ; that the Fed will once again raise its rates by 0.25% in May.

The Fed's Investing.com rate barometer also shows a probability of 23% that the Fed will do the same in May, a probability which was close to zero a week ago.

As for the day on Tuesday, the EUR/USD will be likely to be influenced. by the ZEW index of the German business climate at; 11 a.m., then by building permits and US housing starts at; 2:30 p.m.

>>Find the results of important statistics for EUR/USD as soon as they are published on the Investing.com Economic Calendar

Technical Thresholds at; keep an eye on EUR/USD

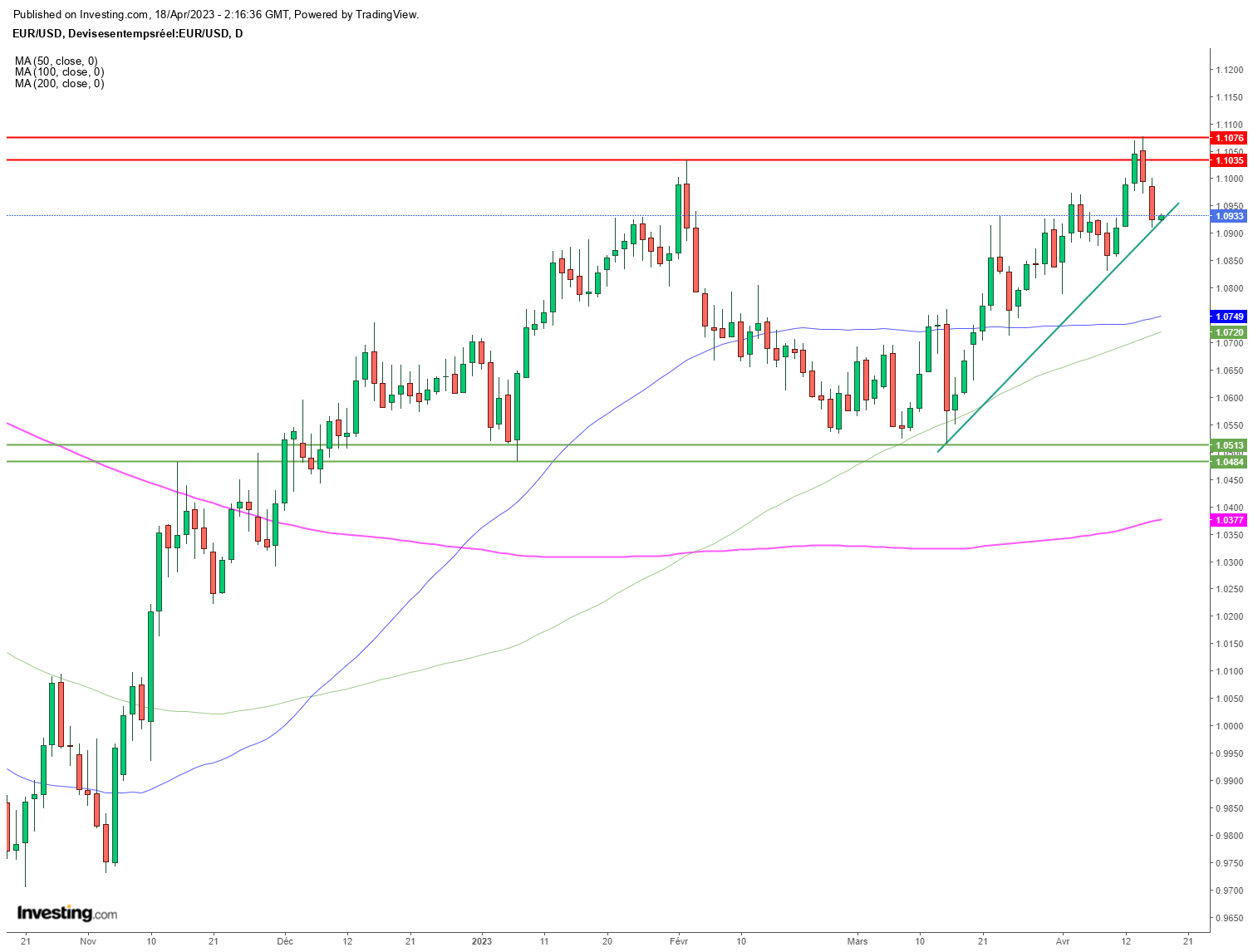

From a graphical point of view, we note that EUR/USD is touching the rising trend line that has accompanied its rise since mid-March.

A Euro Dollar break below 1.09 would confirm the break below this line of trend, which would constitute a bearish signal which would encourage to consider a drop towards 1.08.

À the rise, the key threshold; from 1.10, last Friday's high at 1.10; 1.1076 and the psychological threshold of 1.11 are the first potential obstacles to consider on EUR/USD.

EUR/USD tumbles as US data cast doubt on Fed pause