the end of last week was brutal for the EUR/USD pair, which went from a high to a low. 1.1010 Thursday at mid-day at a hollow at 1.0845 just under 24 hours later, for a weekly close just below 1.09.

À the reopening of Forex on Sunday evening, the Euro Dollar posted slight gains, and is trying to regain the psychological threshold of 1.09, in a movement that is still far too hesitant for us to be able to risk it. bet on a rebound.

Recall that the EUR/USD had started to falling on Thursday as the test of the 1.10 threshold drew sellers. The fall in the currency pair was then accentuated on Friday morning, against the negative. disappointing European PMI indices.

Turning to Monday, the main statistic that matters for the Euro will be the German IFO Business Climate Index. Other important statistics will be released throughout the week, but we will have to wait until Friday to see the most crucial data for the EUR/USD, at know the CPI of the Euro Zone and the Core PCE US price index, the preferred measure of inflation of the Fed.

>> Find in real time the result of all important statistics for EUR/USD in the Investing.com economic calendar

We will also closely monitor the evolution of expectations for the next meeting of the Fed, knowing that the Investing.com rate barometer shows this Monday morning a probability of increasing. 71.9% of a rate hike of 0.25% next month, a probability stable for more than a week.

Technical thresholds at; watch on EUR/USD

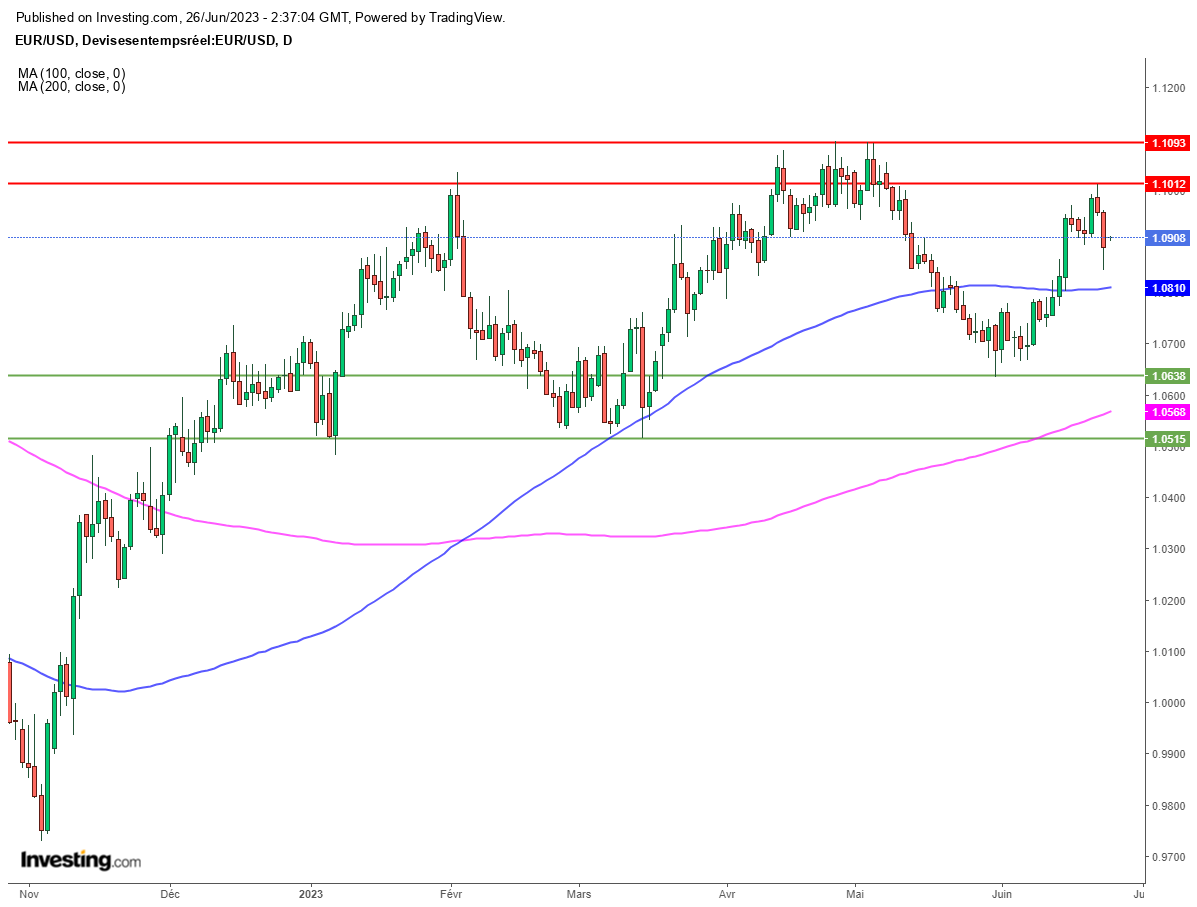

From a graphical point of view, the area around the key threshold of 1.10 remains an immediate resistance. Beyond that, the currency pair should directly target the yearly high of 1.1095 and the round threshold of 1.11.

À the downside, the 100-day moving average at 1.0810 is the first credible support, before 1.07, then the trough of May 31 at 1.07. 1.0635.

Bank ratings for the Euro Dollar have improved

It is also interesting to note several recent commentaries which show that the opinion of analysts to EUR/USD has been improving lately. that “ The series of higher highs (in January and April) followed by higher lows (in March and May) since the start of the year shows that the bullish trend is growing. re remains in place ».

The bank therefore provides that « the pair will return to pre-Ukraine levels in early 2022 when it was trading closer to the 1.1500» level.

On their side , Nordea analysts wrote that « EUR/USD will continue to appreciate in the second half in the face of; a weaker dollar, but also in the face of a still restrictive ECB, which will lead to a narrowing of the gap between US and European interest rates ».

They have elsewhere estimated that “ the euro will be supported by the resistance of European growth in the second half, while the American economy will be in recession », as well as by « the expected improvement in the Chinese economy. »

EUR/USD threatens to deepen its correction at the start of a very busy week