After falling up to a hollow at 1.0834 Friday in the first part of the day, the EUR/USD rebounded, at the favor of a slightly weaker-than-expected US PCE price index.

However, the rebound remained. limited, especially since the figures released on Friday had no impact on market expectations. for the next Fed meeting. Indeed, the Investing.com Fed rate barometer testifies this Monday morning to a probability of of 86.8% that the Fed raises its rates by 0.25% on July 26, a probability which has not evolved since Friday morning.

This week, the attention of forex traders will be mainly focused on US employment, with the ADP report (EPA:ADP) on Thursday and the NFP report on Friday.

Prior to that, EUR/USD will also be likely to be influenced. by new European PMI estimates, as well as by the US manufacturing ISM on Monday, as well as by the Fed minutes on Wednesday.

>> Find in real time the result of all important statistics for EUR/USD in the Investing.com economic calendar!

Technical thresholds at; monitor on EUR/USD

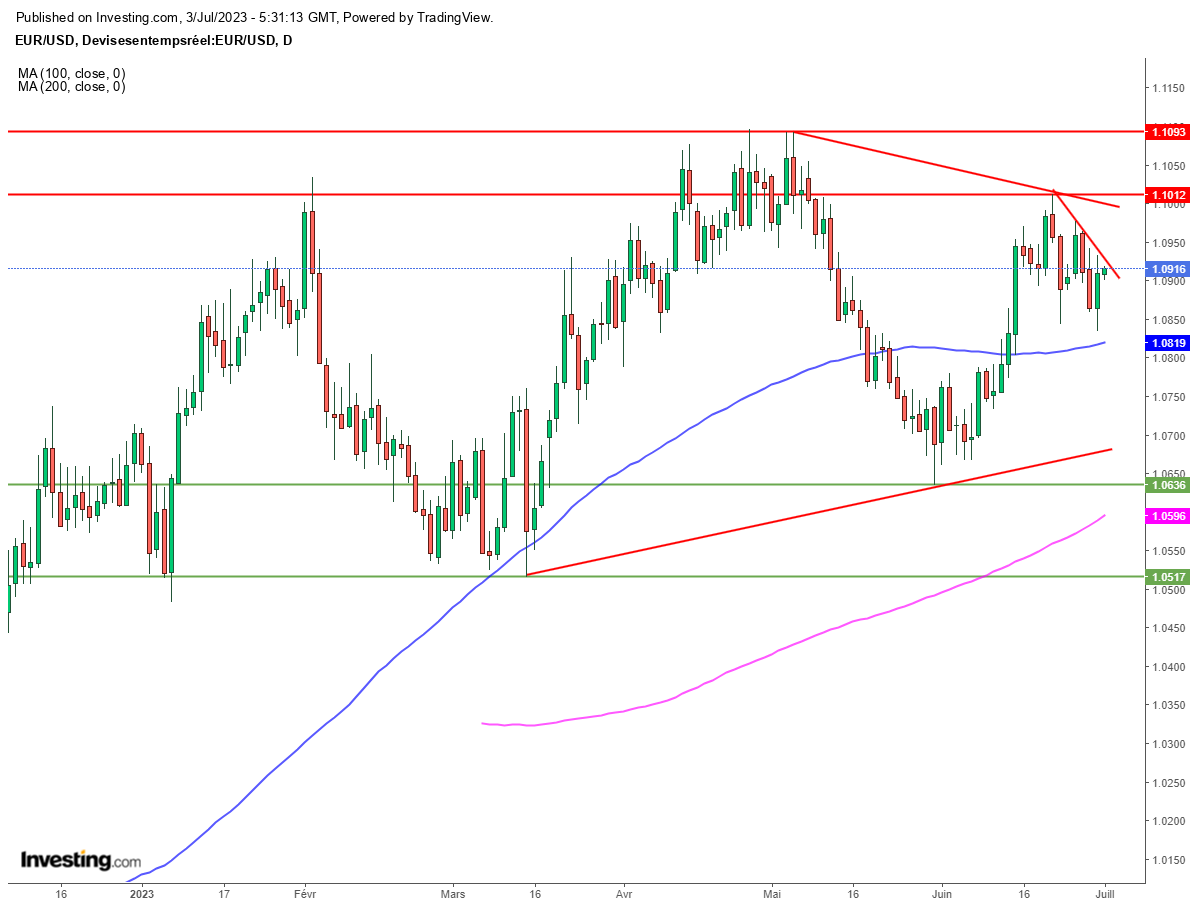

From a graphical point of view, it will be recalled that the Euro Dollar is in a large triangle visible on the daily chart.

A lasting crossing of the major psychological threshold of 1.10 would be equivalent to an exit from the top of this triangle, which would constitute a bullish signal inciting to; aim for this year's record at 1.1095 and the psychological level at 1.11.

On the downside, last week's low at 1.11. 1.0834 and the 100-day moving average at 1.0819 forms the first area of support at 1.0819. take into account on EUR/USD, before 1.08, 1.07, then the trough at the end of May at the end of May. 1.0635.

EUR/USD: Technical backdrop remains uncertain ahead of week focused on US employment 1