Investing.com – EUR/USD continued to rebound yesterday, reaching a high of 1.0977 in the afternoon, but the underlying trend remains broadly uncertain, the outlook for the release of key data on the inflation on Friday prompting forex traders to hold back.

Recall that the Euro Dollar benefited in the first part of the day on Tuesday from hawkish statements from members of the ECB, before solid US statistics came to a halt the rise by strengthening the Dollar.

The ECB supports the Euro, but positive surprises in the US limit the gains

In a jumble, Kazaks said the markets are wrong to bet on a rate cut in early 2024, while De Cos confirmed that the central bank plans to hike rates in July.

Simkus meanwhile warned that at least one rate hike will still be necessary, saying it is not excluded that rates will be raised again in September. Finally, ECB President Christine Lagarde reiterated that inflation remains too high, and reiterated that the central bank will keep rates high for as long as necessary to bring inflation back to target.

>

Recall that these statements came in the wake of disappointing European PMI indices last Friday, publications which had caused the Euro to fall, investors having feared that this would encourage the ECB to adopt a less hawkish position so as not to affect too much the economy.

Yesterday's statements by ECB members, who disregarded signals of economic weakness, showed that inflation remains the ECB's number one priority , and encourage us to believe that it will not weaken, despite the risks of recessions.

However, after the EUR/USD took advantage of these statements, a series of better than expected US data came to reinforce the expectations of further rate hikes from the Fed, and therefore the Dollar. It will be recalled that consumer confidence, durable goods orders and new home sales surprised positively.

What are the events to watch this Wednesday?

When it comes to potentially influential EUR/USD events on Wednesday, the economic calendar will be lighter, with the only significant statistic on the agenda being the US trade balance.

In contrast, several speeches by members of the ECB are still expected, with De Guindos at 10 a.m., Lane at 12:30 p.m., Enria at 2:30 p.m., and Lagarde at 3:30 p.m. and 5 p.m.

However, as was the case yesterday, EUR/USD moves should remain limited as traders should exercise restraint ahead of the key events scheduled for Friday.

Indeed, Eurozone inflation data, as well as the US PCE price index, the Fed's preferred inflation index, will be released.

Technical thresholds to watch on EUR/USD

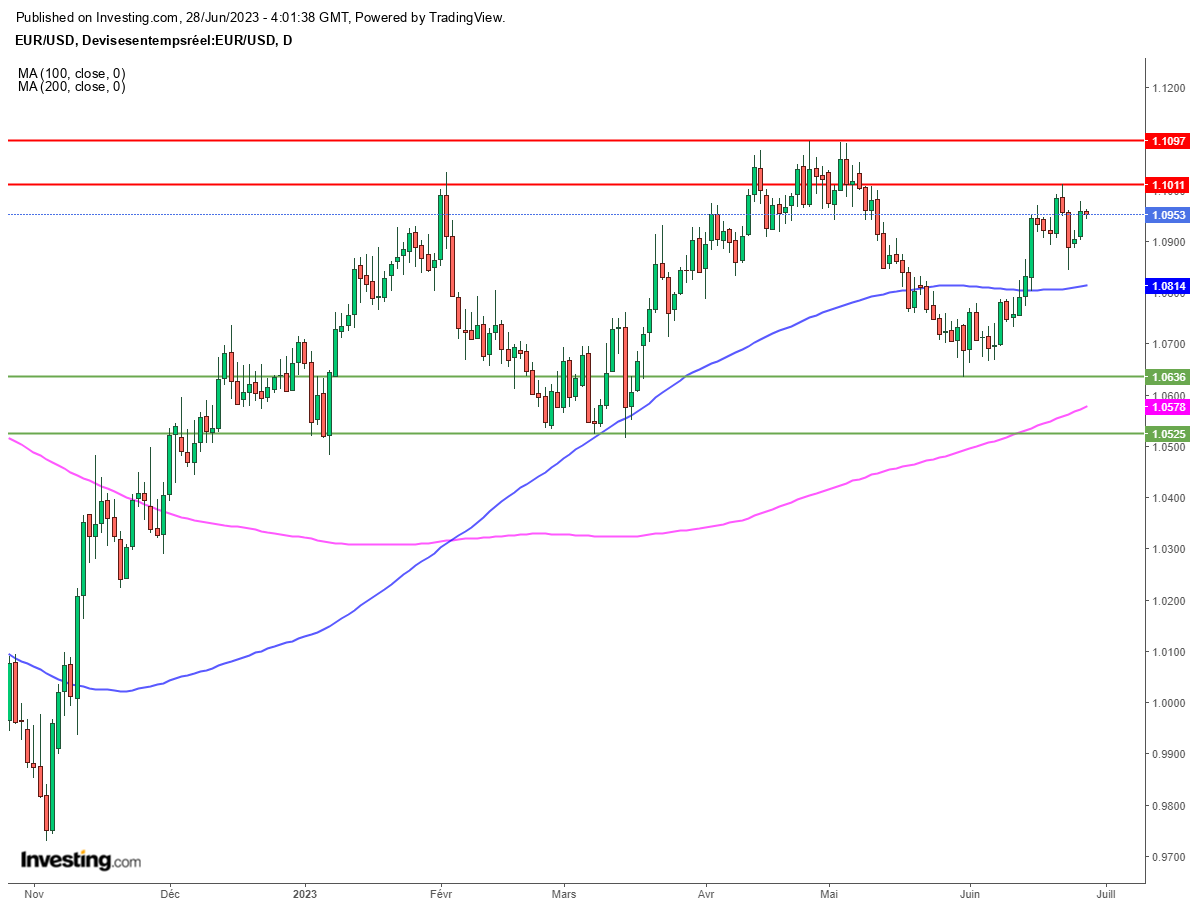

From a chart perspective, the EUR/USD background was little affected by yesterday's gains, and therefore remains uncertain.

The psychological level of 1.10 and last week's high at 1.1012 form an immediate resistance zone ahead of the top this year at 1.1095.

On the downside, 1.09 is the first potential support, before last Friday's low at 1.0843, then the 100-day moving average at 1.0814 currently.

EUR/USD : Hawkish ECB backs Euro, but trend remains uncertain