EUR/USD continued to decline. to fall on Wednesday, the currency pair having marked a new low at 1.0810, the lowest since April 3.

Recall that the Euro Dollar reacted little yesterday morning to inflation figures for the euro zone, with a CPI of 7% for the month of April, as expected.

Indeed, the fall of the currency pair on Wednesday seemed rather related to a strengthening of the Dollar, due to investors' doubts about a pause in the Fed's rate hike.

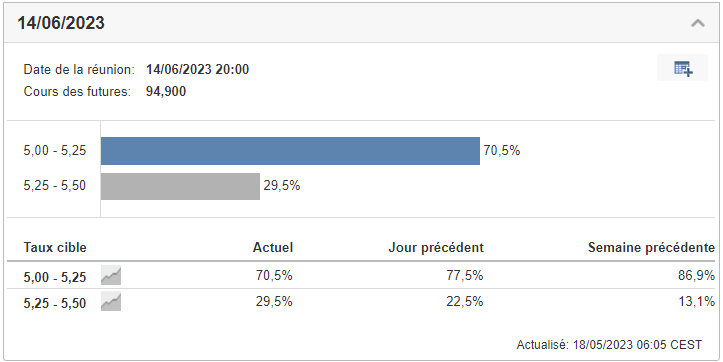

The Investing.com Rate Barometer indeed shows a probability 70.5% no rate hike for the next Fed meeting on June 15, a figure down sharply from 77.5% the day before and 86.9% a week ago.

that the Fed proceeds again to a 0.25% rate hike next month is now close to 30%.

Turning to the day on Thursday, forex traders will be watching for a speech by ECB President Christine Lagarde at the conference. 11 a.m., then the weekly US jobless claims and the Philadelphia Fed index at 11 a.m. 2:30 p.m., to end with the sales of existing US homes at 2:30 p.m. 4 p.m.

>> Find the results of important EUR/USD statistics in real time on the Investing.com economic calendar

These statistics could contribute to; further influence expectations for the next Fed meeting. monitor on EUR/USD

From a graphical point of view, it will be noted that the EUR/USD has sent a bearish signal yesterday by confirming the break below the long-term trend line visible since the end of September 2022.

However, the 100-day moving average, currently at 1.0806, seems for the moment to have stopped the fall, and is at consider as immediate support. Lower, it’s the threshold of 1.07 which will be the next support.

À the upward trend, the 50-day MA to; 1.0891 and the 1.09 level form the first major resistance area for the Euro Dollar, before the key level. of 1.10, then the peak of this year at 1.1095.

EUR/USD sends key bearish signal as forex doubts Fed pause