Last week has been broadly bearish for EUR/USD as the currency pair marked a hollow at 1.0845, the lowest since June 7, after starting at 1.0845 the week around 1.0950.

Let us recall that the Dollar had been favored by several solid US statistics, with positive activity figures; manufacturing, as well as retail sales and wage growth, helping the US dollar gain ground for the fifth straight week.

In addition to this favorable data for the US dollar, the attenuation of the dovish bias of the Federal Reserve (Fed), which investors have inferred from the last minutes of the Fed, also weighed on the EUR/USD price.

Indeed, the last few minutes from the Fed showed that most policy makers preferred to support the fight against “sticky” inflation, although they were divided on the impending increase in interest rates.

>

Another factor weighing on the Euro Dollar of late has been the decline in risk appetite and the rise in Treasury bond yields.

Program loaded for the Euro Dollar this week

As for the next events most likely to influence the course of the Euro Dollar, we will watch the preliminary European PMI indices for the month of August on Wednesday morning, before the orders of durable goods, and the start of the Jackson Hole symposium on Thursday, which will give way to; numerous speeches by central bankers, including Largarde (ECB) and Powell (Fed), the next day.

>>Find all the important EUR/USD statistics and real-time results on the Investing.com Economic Calendar!

In this regard, it should be noted that the bank Goldman Sachs (NYSE:GS) declared; in a note published last weekend that she does not expect that Powell provides clear signals in his speeches this week. Indeed, GS believes that the central bank will wait for the July PCE index and NFP report to be released the following week to more clearly communicate its intentions to the market. watch on EUR/USD

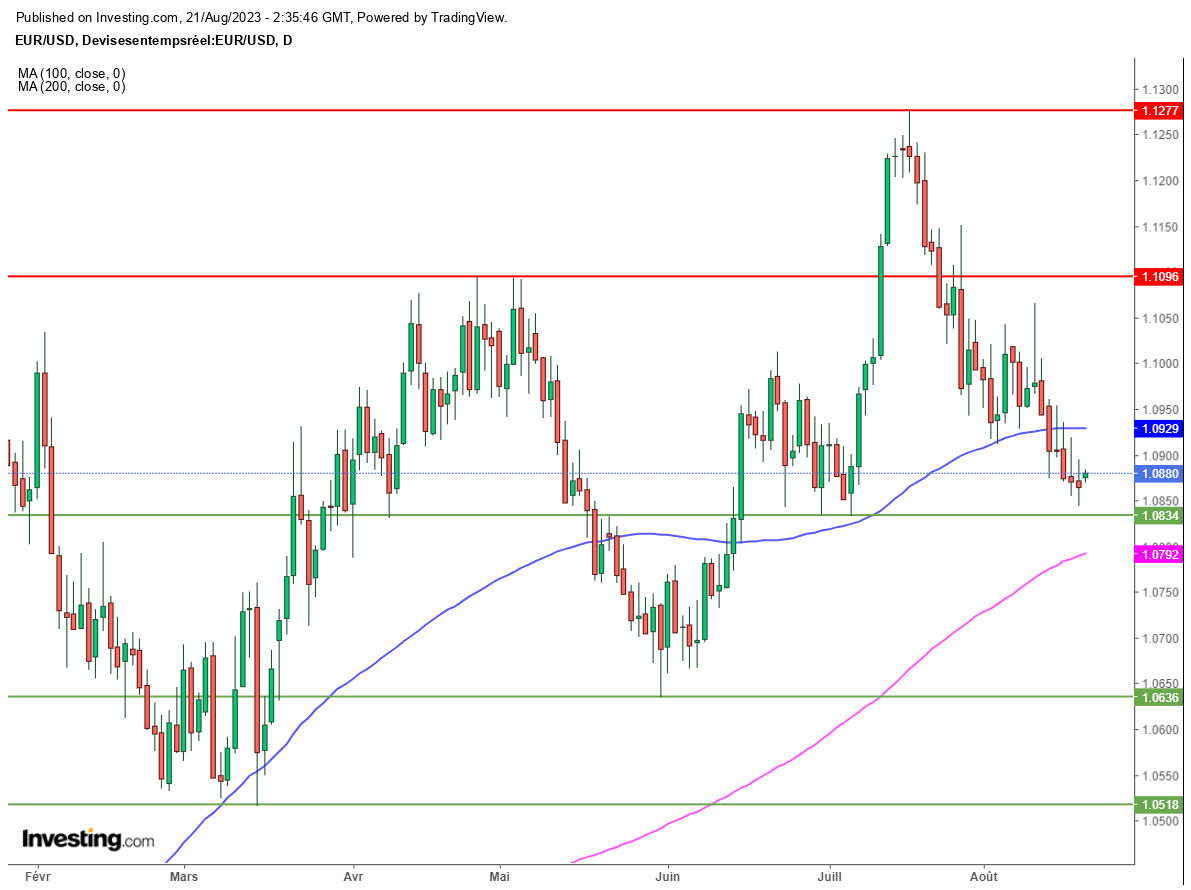

From a graphical point of view, it will be recalled that the EUR/USD has sent a major bearish signal at the beginning of last week, with the breakout below its 100-day moving average.

Now, the next potential support is the 1.0830 zone, before the psychological threshold of 1.08, then the 200-day moving average at 1.0792. In the event of a rebound, the 100-day MA will now be at a higher level. 1.0930 will be the first potential hurdle before the major psychological level of 1.10.

EUR/USD remains under pressure at the start of an important week, after a key signal