After having already markedly dropped Throughout the past week, EUR/USD has been starting to slow down. this new week by new marginal lows, dropping to 1.0848, the lowest since April 10.

Expectations for the next Fed meeting remain in focus, and their slight pullback in recent days has added strength to expectations. the Dollar, to the detriment of the EUR/USD. Indeed, the Investing.com Rate Barometer testifies at the time of writing this article to a probability of 84.5% that the Fed will not raise its rates on June 15, against 91.5% a week ago.

Regarding the probable evolution of the EUR/USD on Monday, we will first note that the empty economic calendar pleads for uncertainty and hesitation.

The program will instead start to run. come alive tomorrow, with the German ZEW business climate index, and with US retail sales.

The subject of the debt ceiling also remains an important subject for the EUR/USD which will have to be watched closely, knowing that US President Joe Biden has announced Sunday that negotiations will take place on Tuesday, and that he is “optimistic”.

Paradoxically, the prospect of a lack of solution on this issue could support the dollar, considered as a safe haven.

Technical thresholds at; watch on EUR/USD

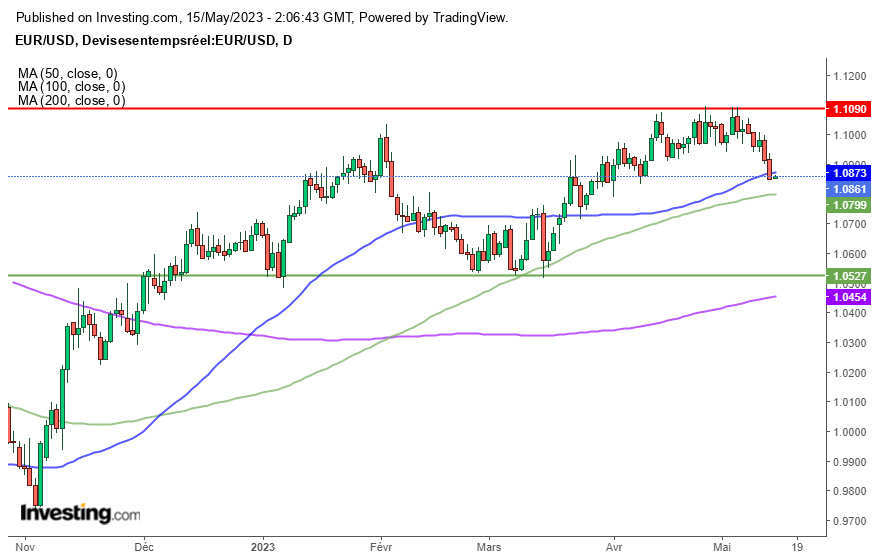

From a graphical point of view, it will be recalled that Friday's fall led to the EUR/USD to; break below the key threshold of 1.09, as well as below the 50-day moving average, which currently serves as immediate resistance, at 1.0876. Above, the 1.09 threshold will be the next hurdle, before the 1.10 area.

À On the downside, the 100-day moving average, currently at the psychological level of 1.08, will be the next major support as EUR/USD continues to correct.

EUR/USD remains under pressure in early trading. a very busy week