Investing.com – After rebounding slightly on Friday, EUR/USD posted moderate gains again on Monday morning, at the start of a week that will be much busier than the previous one.

Recall that the Euro Dollar had suffered throughout the past week from market doubts regarding the end of the Fed rate hike.

Indeed, several better than expected statistics had caused the market to question its certainty of a pause in the Fed's rate hike for the month of June.

Consequently, the Dollar strengthened, mechanically pushing the EUR/USD lower. However, Friday was the occasion for a speech by Powell in which he implied that the Fed still intended not to raise rates next month, which had caused a rebound in the Euro against to the Dollar.

This week, several events could still significantly influence expectations for the next Fed meeting, starting with the FOMC Minutes expected on Wednesday evening.

Thursday will also be an important day, with a new estimate of Q1 US GDP, while Friday will see the release of the PCE price index, said to be the Fed's favorite inflation gauge.

>Technical thresholds to watch on EUR/USD

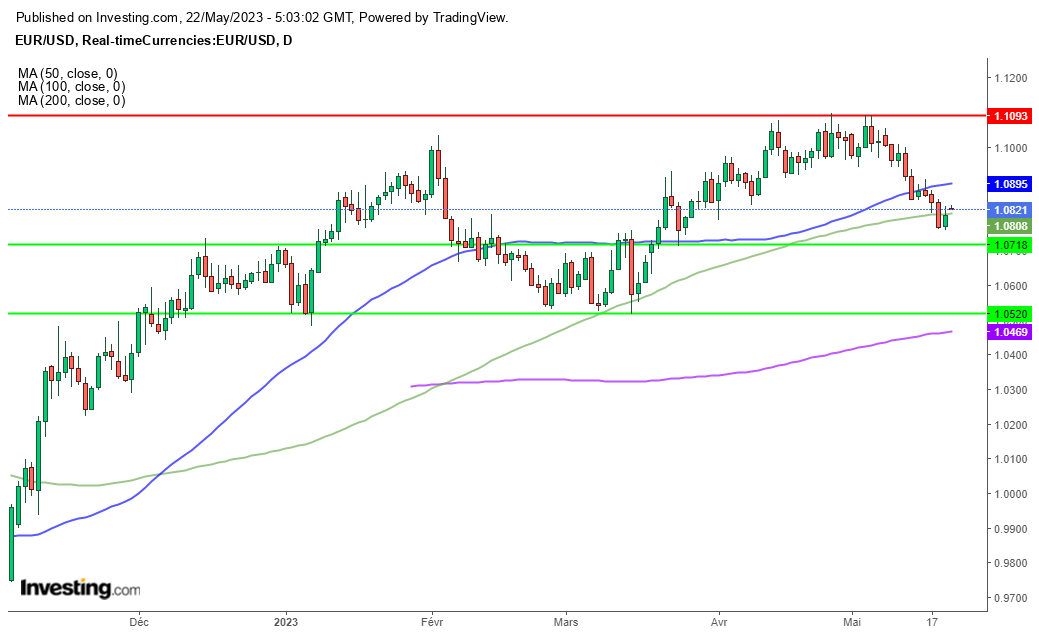

From a graphical point of view, we note that the EUR/USD is back above its 100-day moving average lost at the end from last week.

Currently at 1.0808, this 100-day MA, coupled with the psychological threshold of 1.08, is now immediate support for EUR/USD. In the event of a breakout, few supports can be identified before the 1.07 zone.

Finally, on the upside, the 50-day moving average at 1.0895 and the psychological threshold of 1.09 form the first potential resistance to consider on the EUR/USD.

EUR/USD rallies slightly at the start of a very busy week