Investing.com – After a bullish Monday, and further gains Tuesday morning, to a high of 1.0930, EUR/USD reversed sharply lower, reaching a low of 1.0833 in the afternoon, and remains close to this threshold on Wednesday morning, at around 1.0860.

However, the reasons for this plunge remain unclear, knowing that the only significant US statistic published yesterday, which concerned sales of existing homes, was rather disappointing.

However, there was general strength in the Dollar on Forex, which is explained by the increase in Treasury yields observed yesterday.

Looking ahead to Wednesday, EUR/USD will likely be influenced by early European August PMIs in the morning, while in the US it's mostly sales of new homes that Forex traders will be watching.

Tomorrow will then see the start of the Jackson Hole symposium, as well as US durable goods orders.

Technical thresholds to watch on EUR/USD

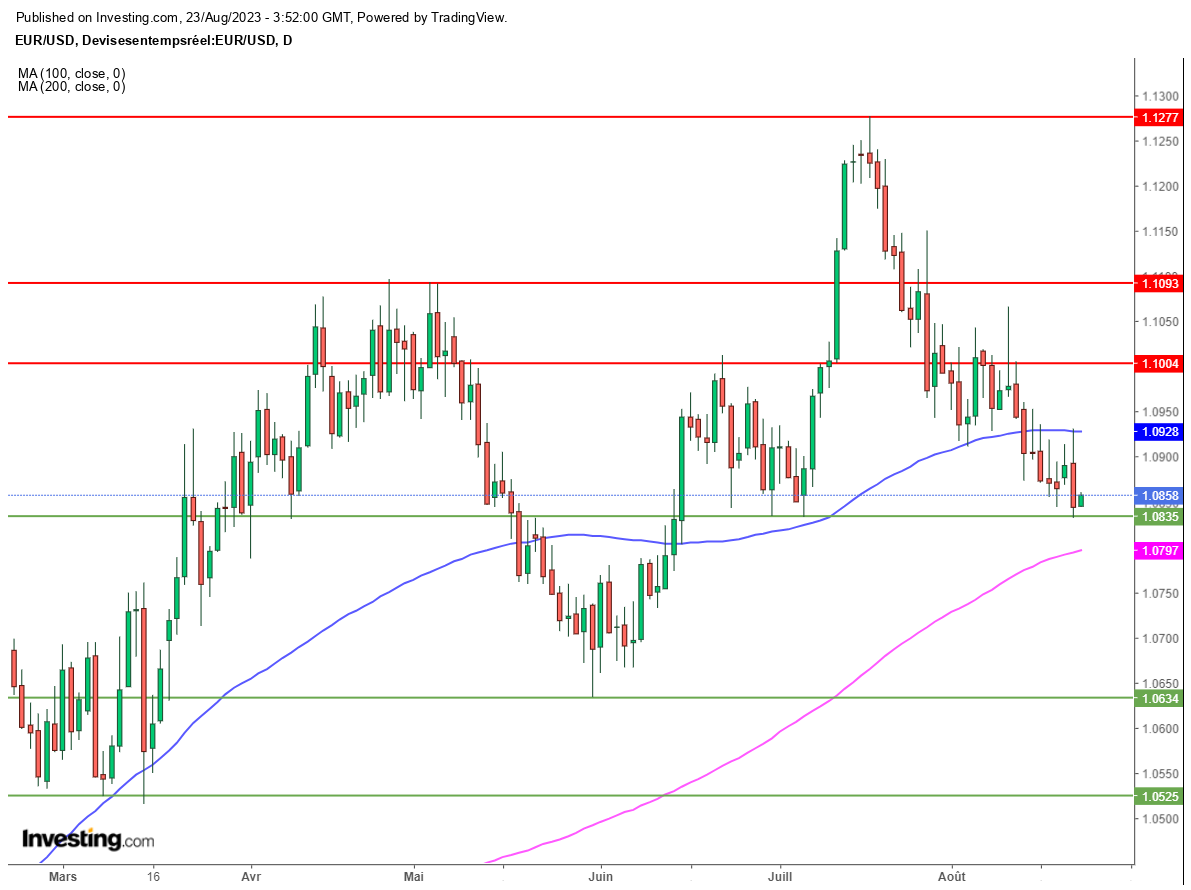

From a graphical point of view, it should be noted that the trend visible on the daily chart remains clearly bearish.

We should also point out that the 100-day moving average, currently at 1.0928, seems to have stopped the rise that preceded the current correction, as had been the case several times in recent days. This is therefore the first key hurdle to clear for the EUR/USD chart profile to improve. Then, it is the major psychological threshold of 1.10 which will be the first bullish objective.

On the downside, the 1.0830 zone is a graphic support that has been confirmed several times, the breakout of which would constitute an important bearish signal that would put the 200-day moving average in sight, which currently merges with the psychological threshold of 1.08.

The EUR/USD puts an abrupt halt to its rebound before Jackson Hole