Investing.com – Short-term uncertainty continues to reign in EUR/USD as the pair reacted little to yesterday's slightly disappointing US retail sales, as did expectations for the Fed meeting n 'were not affected either.

Indeed, the Investing.com Rate Barometer on Wednesday morning showed a 79% probability of a Fed pause next month, a similar figure to yesterday's.

As for Wednesday, the attention of forex traders interested in EUR/USD will turn to Europe, with a new estimate of April inflation. In the United States, it is mainly housing starts and building permits that are likely to influence the Euro Dollar.

Technical thresholds to watch on the EUR/USD

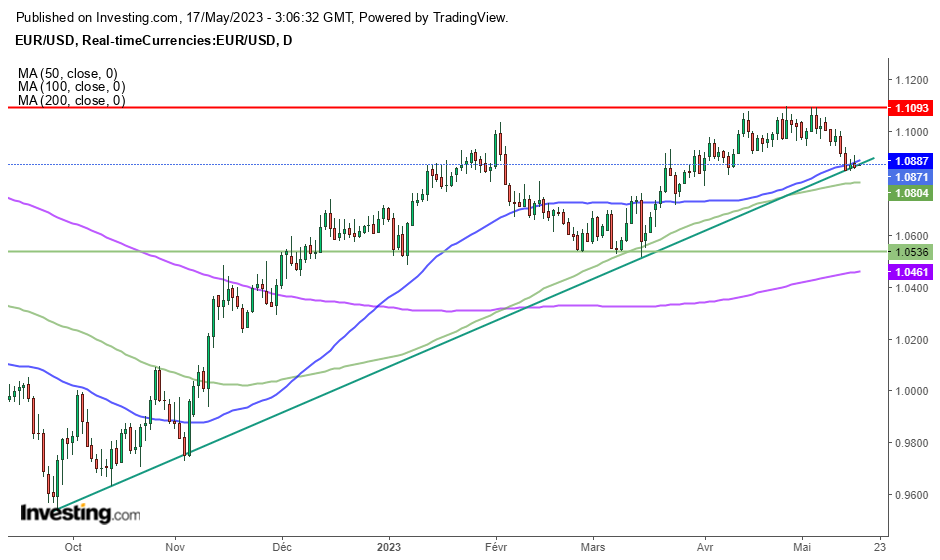

Finally, from a graphical point of view, the situation has changed little compared to yesterday morning, with EUR/USD still actively testing the bullish trend line visible since the end of 2022, as well as the 50-day moving average, which currently stands at 1.0887.

If the Euro Dollar weakens Further, the 100-day moving average, currently at the psychological level of 1.08, will be the first key support to consider.

On the upside, 1.09 and 1.10 are the first resistances to consider, ahead of this year's high at 1.1095 and the psychological threshold of 1.11.

EUR/USD: Hesitation still dominates, Euro puts pressure on key supports 1