EUR/USD has marked a new yearly high on Wednesday and remains well oriented; this Thursday morning, but the busy economic calendar of the weekend represents a major risk that could change everything.

Remember that the Euro Dollar has climbed; up to a peak at; 1.1095 yesterday, the highest for almost 13 months, while the Dollar was lower. affected by a reassessment of expectations for Fed policy between now and then; the end of the year.

EUR/USD Benefits from Fed Pivot Speculation

Indeed, the setbacks of the First Republic Bank, whose share price fell. of 29% Thursday after -49% the day before, has to some extent revived fears of a potential banking crisis, although the situation is less worrying than last month, when several US banks had to be saved by the government.

Thus, the market now takes into account a probability of 74.9% that the Fed increases to again its rates of 0.25% next week, a probability in net withdrawal compared to ` 85.2% a week ago. Moreover, there is now a 1 in 4 chance that the Fed will take a break for its next meeting.

But above all, the bets on a rate cut have been relaunched, with the Investing.com Rate Barometer showing a likelihood of by more than 60% that the Fed will lower its rates at least once by the end of the year.

However, these expectations could still be completely questioned by several given ;es expected Thursday and Friday.

Critical economic calendar for the Euro Dollar by the end of the week

The day of this Thursday will indeed be the occasion of the publication of the first estimate of the GDP of the USA for the first quarter of 2023. Growth is expected at 2%, after 2.6% in the previous quarter, and figures below consensus could strengthen the Fed's dovish pivot bets.

>>Find real-time results of key EUR/USD statistics on the Investing.com Economic Calendar

To a lesser extent, EUR/USD traders will be watching also the figures for weekly US jobless claims, as well as promises of home sales.

Friday will be no less lively, with the preliminary European growth data in the morning, and with the Core PCE price index in the afternoon. attached at the expense of US households, reputedly to be the most important index of inflation for the Federal Reserve.

Technical thresholds at; watch on EUR/USD

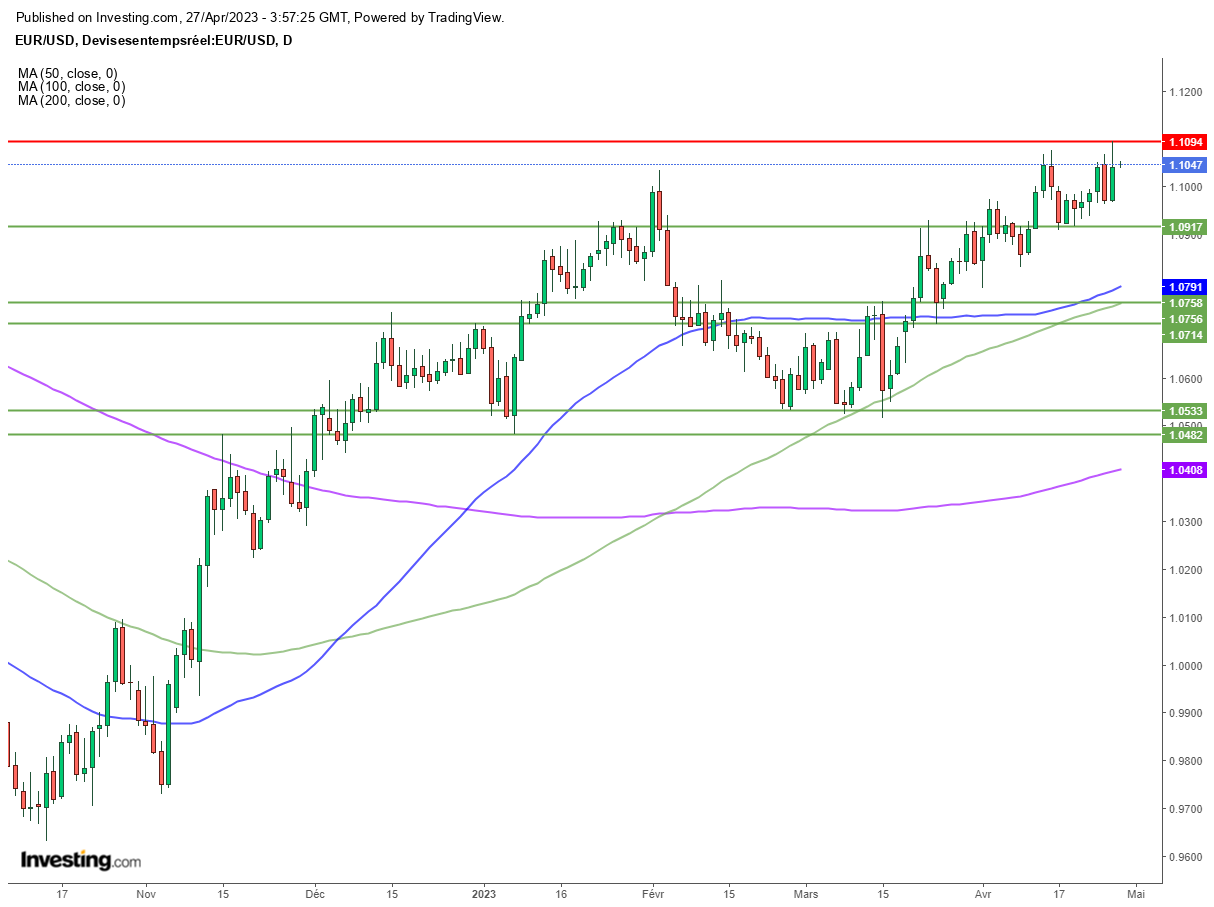

From a chart perspective, yesterday’s high at 1.1095 and the psychological level of 1.11 form an immediate resistance for EUR/USD, ahead of the psychological level of 1.12.

À on the downside, 1.10 is the first potential support, ahead of the 1.0920-1.09 area. Next, attention will turn to 1.08, then the 50-day MA at 1.0791 and the 100-day MA at; 1.0758.

EUR/USD faces a decisive economic calendar on Thursday, new record or plunge?