EUR/USD continues to lose ground on Thursday morning, with the currency pair now back below the psychological level of 1.09.

The Euro Dollar has in summer effect affected by a strengthening greenback, in part due to a hawkish intervention by Fed boss Jerome Powell. This one has indeed declared; more restrictive policies are coming, underscoring that economic data remains strong.

In this regard, it will be noted that the Investing.com Fed Rate Barometer is currently showing weaker ;a probability 79.4% as the Fed hiked rates 0.25% at its July meeting, from 71.4% last week.

Thursday, the attention of forex traders will be more on the statistics, as regional inflation data from Germany is expected in the morning, ahead of the national data to 2 p.m.

EUR/USD will also be likely to be influenced. by a new estimate of US Q1 GDP, as well as by US weekly jobless claims in January. 2:30 p.m., then by the promises of US housing sales at; 4 p.m.

We must not forget, however, that we will have to wait until tomorrow to see the most important indicators of the week, with the inflation figures for the whole of the Euro Zone, and with the US PCE price index, the Fed’s most closely watched measure of inflation.

Technical thresholds at monitor on EUR/USD

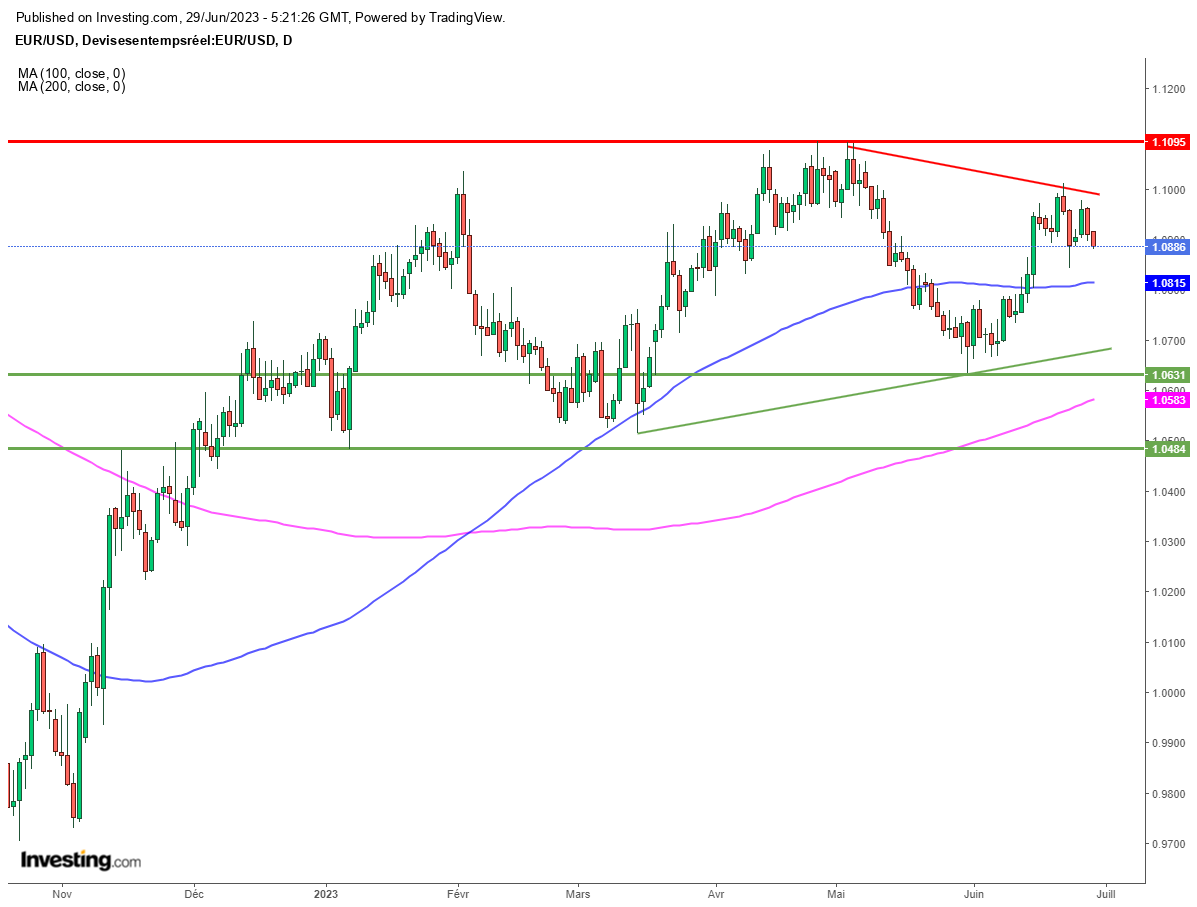

From a graphical point of view, the breakout of EUR/USD below the 1.09 threshold constitutes a negative signal, which puts the line of sight for the next support, at the end of the day. know the area of 1.08, where & ugrave; the 100-day moving average is currently located (1.0815).

Lower , the 1.07 threshold and the end-May low at 1.0635 will be the next potential supports ahead of the area formed by the 200-day moving average (1.0583) and the psychological threshold at 1.06.

À On the upside, only a sustained return above 1.10 would remove the downside risks, before in this case the possibility of that EUR/USD is aiming for this year’s top 1.1095.

EUR/USD deepens its correction ahead of a series of key data