DAX index after a short svaghetsperiod the last week bounced up and received short-term buy signals. Now, however, is not DAX as oversold longer and is also approaching a strong motståndsområde around about 12 340-12 400. Even if the long trend is still pointing up, there are long-term sign of weakness by, among other things, a negative handelsvolymsamband. Therefore, there is a great risk that the resistors are holding. And to the important support area at about 11 850-11 940 on the new can to be tested a bit later in the year.

The German stock exchange has in the past week, darrat in common with most other exchanges, but, the last few days recovered to a broadly unchanged position. The DAX index closed yesterday at 12 263,86 which means 0.2 per cent in a week and +6.8 per cent so far this year.

It was the turmoil of war between the united states and north Korea, where the soldan-brofelt champion Donald Trump warned of ”fire and fury” against the Dprk. North korea responded in turn with a threat to bomb U.S. bases on Guam. It has, however, as the familiar calmed down when north Korea for the moment, taken back by the threat against Guam.

The financial markets have probably not really taken krigshoten seriously but it has still caused significant concern on the stock exchanges. This has also been added to the underlying fear of what will happen in the long term when the central banks start to tighten their previously expansive monetary policy.

Which is liable to make the long-term, and the really high net-worth investors more and more handlingsförlamade. Which in turn is not good for the stock market situation. For it is these players who will step in and buy when the stock market goes down. They do not it will be the fall height significantly greater on the stock exchange.

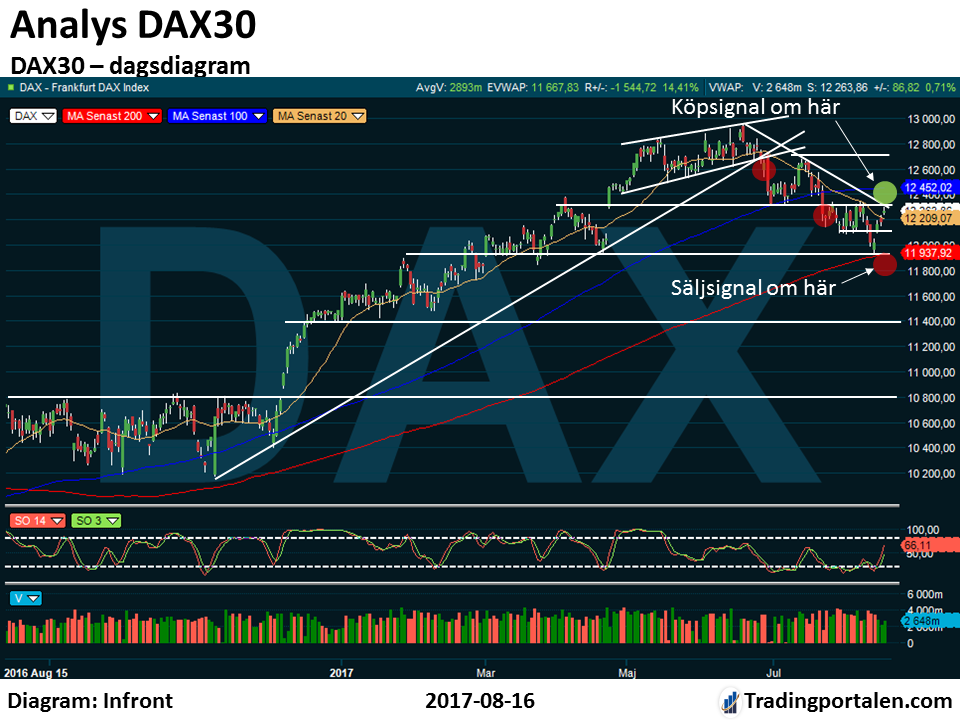

In the weekly chart for the DAX , we see the index shown in the past svaghetstendenser when it is not able to keep the old top 12 391 from the year 2015. The latest week, the index was also slightly below the upward trend line, which at the time of writing is at about 12 000, but then bounced just above it again. That was lowest in the DAX then down at the 11 934, which is in the at the important support area 11 850-11 940 which we wrote about in last week’s TIME-analysis. With the enhanced significance of this area further.

Would DAX at a later time to establish itself in the support area at about 11 850-11 940 becomes, therefore, this potential sell signal is very important to be aware of. Especially if this would take place in a relatively high trading activity. That is to say if the red volymstaplarna in would be clearly higher than the green.

As it had been the last time, unfortunately, has also börsomsättningarna been higher during the nedgångsdagarna than in uppgångsdagarna. This negative handelsvolymsamband is not good. It indicates both that the long-term and high net-worth investors are not net buyers and of a coming weakness on the German stock exchange. So the next few months, you have to be extra observant for any sell signals.

Obtained these sell signals is then in this long-term time horizon strong support levels at about 11 400-11 500 and about 10 800.

So far, however, these key support held. New buy signals are obtained also in the weekly chart of the resistors at about 12 400 and of about 12 951 broken. Extra interesting will be if they also are accompanied by increasing trading activity at the peaks.

In the shorter term day chart below, we see that the DAX got decreased in the last few months, when the intensities at about 12 670 and about 12 320 was broken. And the last week the support at about 12 090 passed.

Then went the DAX down to 11 934, in the key support area 11 850-11 940, and was also down almost exactly and bounced at its 200-day medeltalskurva. That is to say, all quite beautiful from a technical analysis perspective.

In addition, the stochastic indicator , then, that the DAX was very oversold. So all in all there was much that spoke for that TIME from there pretty easily would be able to make an upward movement as soon as the news turned to something more positive.

The recent rise also gave a short term buy signal when the resistance at about 12 090 forcerades. Note, however, that this rise so far has been in relatively modest trading activity. So the long-term how this would be received by this signal is, unfortunately, limited.

New buy signals on the DAX is obtained if the resistors at about 12 330-12 340 and about 12 400 broken. But the stochastic has now come up in the soon to overbought levels. Which indicates that this resistance can be a little more difficult to break than that which was passed at about 12 090.

Ago is also in this time horizon, the aid field, 11 850-11 940 important to be aware of. Strong sell signals are obtained even here on these support breaks.

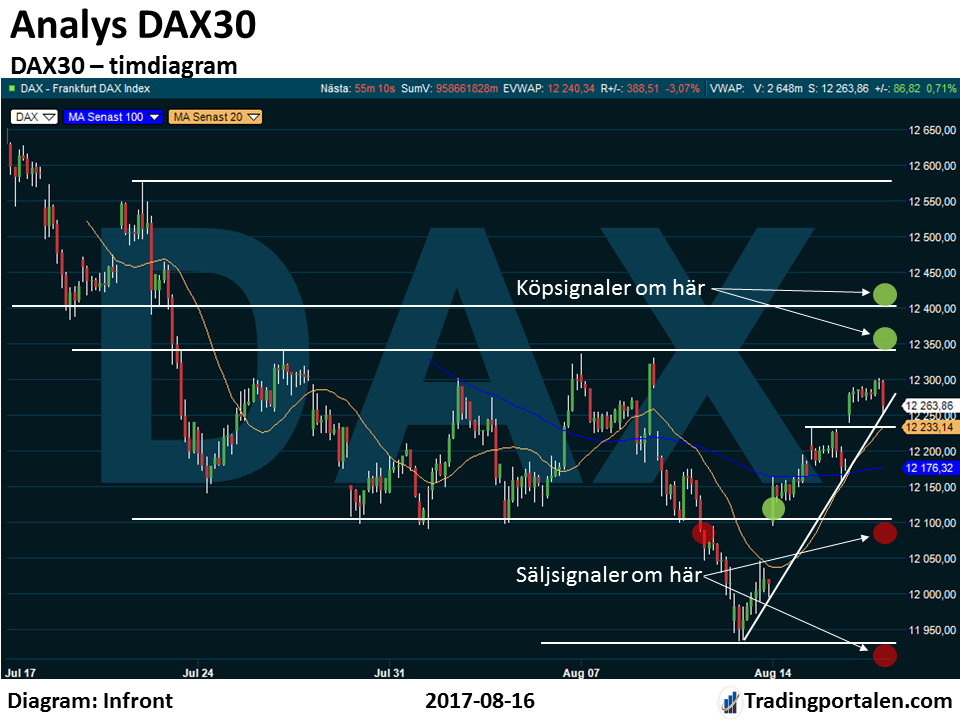

In the even more detailed timdiagrammet we see that the DAX is in a short-term upward trend, which at the time of writing to support about 12 to 250. Then there is also a support area at about 12 135-12 150. But the most obvious sell signals would be obtained if the DAX went in the assisted areas at about 12 090-12 100 and about 11 934.

Acting mainly with short-term strategies, one can see the interval between the intensities at about 12 to 100 and the resistors at about 12 330-12 340 as an interesting tradingintervall. Buy at support, sell and possibly go short on the resistors. Of course, very important when to place a stop loss just outside this tradingintervall.

However, there is a focus on more long-term calls the negative handelsvolymsambandet for some caution. As long as this pattern consists can, with advantage, use any gains to sell and pull down on the index and shareholdings. Monitor also like the support area at about 12 850-12 940. A close below this level is associated with an increase in trading activity would be a long-term major sell signal.