CySEC : consultation paper on the compensation fund

CySEC : consultation document on the investor compensation fund

The Cyprus Securities and Exchange Commission (CySEC) has published on 12 April 2017, a consultation document (CP2017-02) on the replacement of the legal framework governing the operation of the investor compensation fund Investor Compensation Fund (ICF).

At the present time, all the investment firms in cyprus (Cypriot Investment Firms – CIF) and permitted to provide investment and ancillary services must participate in the ICF. This participation is an obligation for the CIF regardless of the services they are authorized to provide, and, in an interesting way, regardless of the fact that the funds of clients and financial instruments are held (in the case of a compensation potential).

The types of services that are allowed for a CIF to determine the level of initial contributions, while the level of care and custody of the funds and financial instruments of retail clients determines the level of annual contributions to a CIF. The assets of the ICF include the contributions of additional initial, ordinary annual and extraordinary made by its members, as well as any proceeds from the investment of these assets from time to time.

The assets of retail customers are covered as well and can be compensated by the ICF if a CIF is fraught with problems, the maximum amount of remuneration for each client is 20 000 .

What is it that changes considerably

The proposals made in the consultation document are intended to reflect developments in recent years on the financial markets while allowing for a more targeted approach reflecting the circumstances of each CIF, including the respective risks. In our opinion, they reflect a tougher approach by the CySEC and an attempt to find solutions in response to the loss of funds of clients seen in some occasions in recent years.

1. Up to now, the contributions to the ICF were part of the assets of its member contributor. In other words, any amount contributed to the ICF could be repaid at a CIF in case of cancellation of its authorization for any reason whatsoever, except in the event of a claim against it by its retail customers. If the new provisions come into force, the contributions and the fees paid to the ICF can no longer be returned to the CIF, even if their license is withdrawn. It seems that these new provisions, provided that they are applied, will also cover the contributions and returns of existing members of the ICF, that is to say that any amount currently represented in the balance sheet of the CIF (invested in the ICF) may be cancelled. This is probably the most radical of the consultation document.

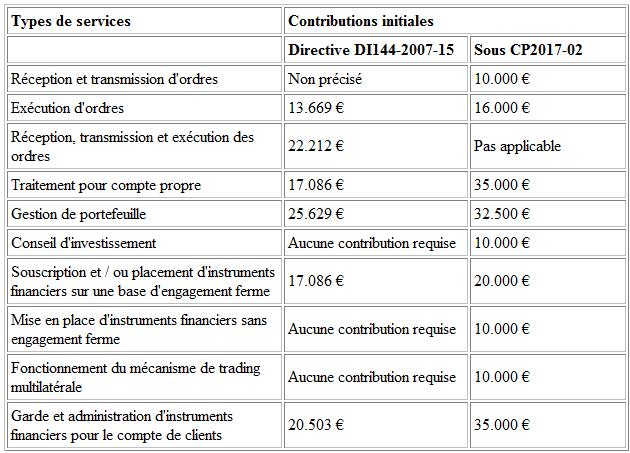

2. The initial contributions to the investment firms in the framework of the new proposals and of the existing directive are presented in the table below :

3. Members who do not hold client assets (for example, firms providing only investment advice) will pay no annual contribution. However, a new annual fee of 700 will be introduced for all members to cover administrative expenses and operational expenses of the ICF.

4. The annual contributions for regular members under the proposed directive appear to be calculated in the same manner as above, although with financial disincentives introduced for late payment. The actual contribution is still 0.1% on the condition that payment is made on time, but there is a heavy penalty for delays in payment after may 15 of each year, which increases this contribution to 0.5%. For example, a company that holds a maximum of retail clients ‘ assets of one million euros over the 12 months of a calendar year (with each asset of the retail customers is capped at 20 000 ) will be expected to contribute to 1 000 to the ICF no later than the 15th of may next, or 5,000 if the payment is made after may 15.

5. In addition, the ceiling of 0.5% of the total client assets eligible for the ITC in the course of a year, applied until now to the total amounts paid to the ICF by ICF is proposed to be deleted. Until today, a CIF would cease to contribute if their contributions aggregate (including the initial contributions had reached 0.5% of the maximum of the total assets of retail clients of the CIF the previous year. In other words, our CIF in the above example will have to contribute every year to the ICF from now on, even if the assets of its retail customers remain constant at 1 million euros over the years.

6. The CySEC has always had the right to ask members to pay an additional contribution extraordinary (which was always arbitrarily defined) if it considers that the means of payment of compensation are inadequate, particularly in the case of liquidation procedure of a member of the ICF. The consultation document includes a provision that allows the CySEC to calculate the extraordinary contribution by category or sub-category of members, so that it is carried out on a basis that reflects the risk of each category or sub-category of members, rather than on a single basis for all members. To our understanding, and without adequate explanations, it still remains arbitrary and ambiguous.

7. The refund of 90% of the valid debt to a customer up to eur 20 000, also changes and goes to 100%, with a maximum of 20,000. In other words, a trader who owns 30 000 in a CIF is encountering a problem and is unable to pay will receive 20 000 of the ICF, while someone with 10 000 will receive 9 000 .

8. Managers and management companies of UCITS are offered to become members of the ICF in connection with the services that are provided to customers other than the aif or UCITS. The consultation document includes provisions for specific contributions by the managers and the management companies of UCITS subject to their service offerings. The members of the ICF will not only investment firms, but also of the managers and of management companies of UCITS subject.