Welcome to CFD-the school! Here we are going in 6 articles learn all the basic for you to understand what CFDS are. And how you can use CFD.you to increase the return on your capital in a controlled risk-taking. The CFD-the school’s various parts consists of:

1: Introduction to a exciting financial instrument.

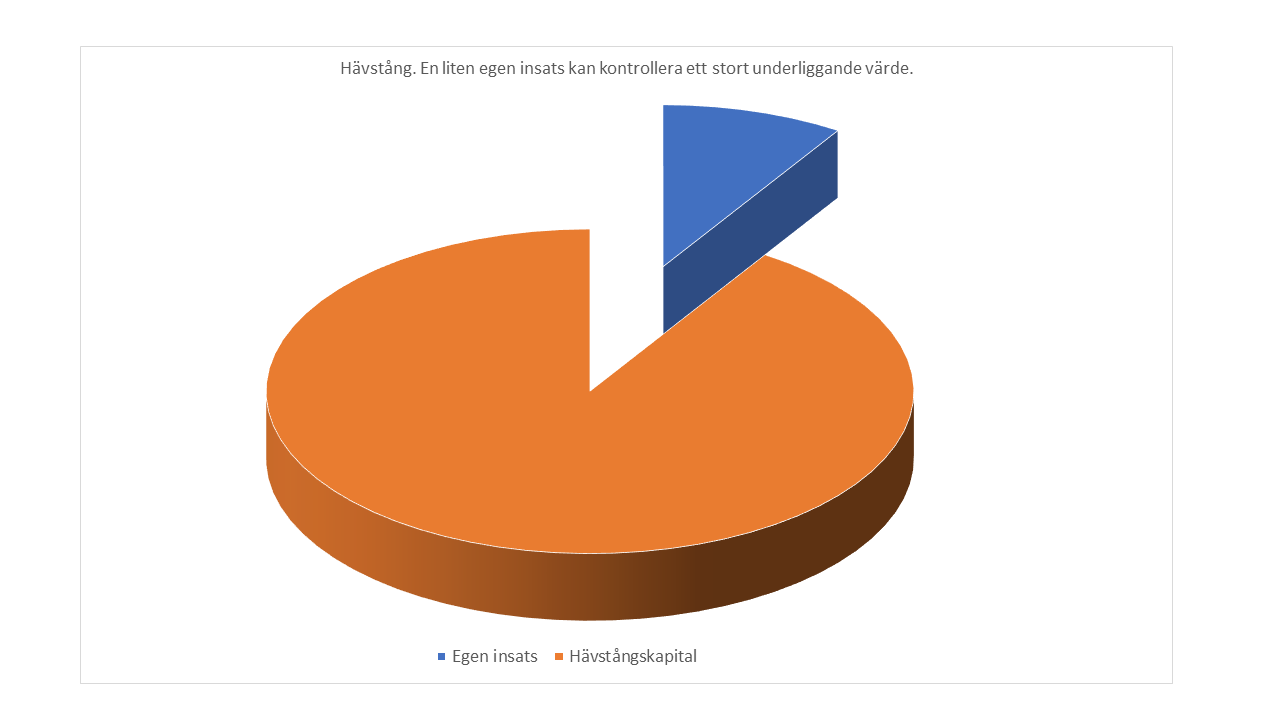

2: Leverage and risk.

3: Advantages and disadvantages.

4: Charge, spread, and taxation.

5: Range of products and pricing.

6: Practical example of trading.

We’ll start with what a CFD is. CFD is a derivative financial instrument where the price is based on the market price of an underlying asset. With derivatives, it means something that is derived from, deriverar from, any other instrument or securities. For the CFDS usually, the underlying asset is often a stock index, a share, currency or commodity.

The change in value of a derivative depends then on how the value of the underlying security evolve. Other derivative instruments are options and futures that you may have encountered in other contexts.

CFD is also an abbreviation of Contracts For Difference. Instead of shopping, for example, a share is therefore a derivative instrument that casts a share in the price. To CFD:n shades the price also makes it easy to understand the actual pricing. If the share price of 100 sek, the CFD on the share X the same or basically the same price. Rising share to sek 120 so rises CFD:n to 120 ce, You should thus get the same return, calculated in Swedish kronor via a CFD, which for the investment in the underlying security. But you buy and do not sell the actual stock, currency or commodity. You can not go and vote at the meeting for your CFD. Even if it is based on the company’s share.

Then, there can be many advantages with trading with a CFD instead. Such as the cost, great support and the opportunity to a very flexible financial leverage.

Or that it simply is not possible to transact the underlying asset in any way other than via a CFD. Just it can for many be a completely decisive advantage.

It becomes, in many cases, also much easier to manage the CFDS than other derivative instruments. Options, for example, requires extensive knowledge in order to act in the right way. You can also trade with complicated futures contracts, where you need to keep track of the expiration date on the terms and manage so-called rollovers to the new löpmånader.

The simplicity, flexibility and freedom of choice is great. You can just as easily shop in Volvoaktien as in oil, EUR/USD and S&P500. Or why not in gold?

And you can choose to manage your trade either manually or fully automatically in a trading systems. In addition, we offer you the possibility to choose your own risk with almost any leverage or none at all. More on all this will in the next section of the CFD-the school.

An important thing to keep in mind is that the CFD-actors acting as liquidity provider, a so-called market maker, for their customers.Which means it is the CFD-operator rate you trade at. When you buy or sell a financial instrument so there is a spread which is the difference between sales and köppriset. CFD-operator where you shop, a portion of the spread as their earnings. The lower the spread is, the lower is your cost to trading. You should compare the spread between the different players in the markets that interest you. It is an important advantage for you as a customer to market makern has an obligation to offer you a price so that you can get out of a position.

You are not a share, commodity or whatever it may be on an exchange. But your counterpart is the same actor all the time. Both when you buy as when you sell. And it’s the same CFD traders as you have the account with. So it comes to feel safe with the operator to open the account and trade with. It is, however, in the CFD the operator’s own interest to manage their market-maker role on a good and seriously seen. For otherwise it will be difficult to long-term to keep their customers. And without customers, so do not survive, CFD-operator any longer.

It is also important to choose a reputable CFD provider with the resources to offer good liquidity and a small difference, a small spread between the offered and the bid and ask price on behalf. Examine, therefore please carefully the various CFD providers to see which ones you feel comfortable with and can trust.

You may know someone with experience of how it works with different CFD actors? A tip is to hear with your circle of acquaintances if they have any experiences of the different CFD providers. Some CFD operators are also focusing a lot of resources on training and knowledge for you to become a better investor. While others may primarily bet on the sell side in order to constantly bring in new customers. Here to get maybe some insight on what the actors think of the long-term benefits for you as a customer.

Another practical thing that can be valuable is that the CFD-operator has offices in Sweden. It usually feel easier to communicate with someone who is working in Sweden and understand your circumstances/conditions. In addition, you can often get help with documentation to the tax authorities before the declaration.

If this is done, so is your business with the greatest likelihood of completed when you get your declaration. This saves many hours of work for those who are active in your trading because you do not need to fill in all the shops manually. Also prevents the errors in your declaration.

Often it then be the case that one chooses to put their business at one of the larger and established CFD-players that been on the market for a longer period of time. Especially if you can get a good understanding of their business by, for example, is listed. For then it is much easier for both of you, as for external analysts to examine how the business is managed than if it is a private company.