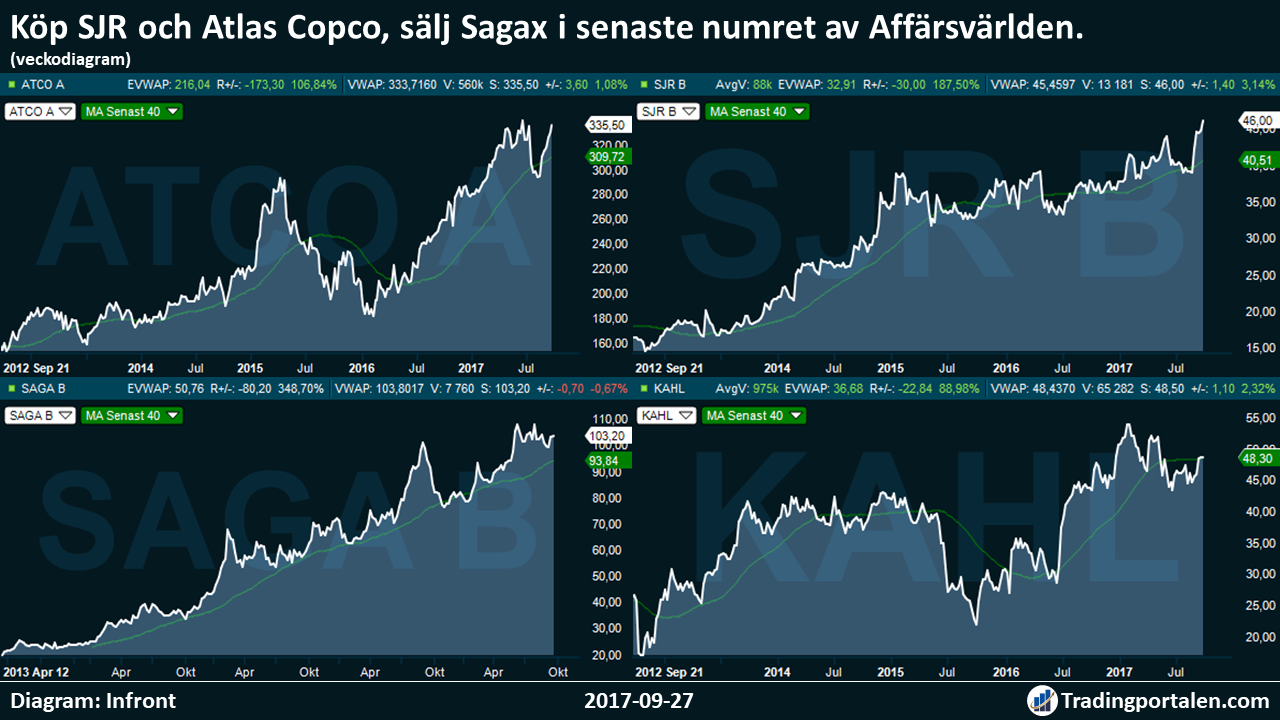

Buy bemanningsbolaget SJR and verkstadsjätten Atlas Copco, however, sell the property company Sagax.

It writes Business in its latest issue, which was published digitally on Wednesday morning.

SJR is considered to be ”back in the tillväxtspåret”, something that is not reflected in the valuation of the share.

”The fascination with SJR has been, and is, that it is a grundarlett companies which year in, year out performed, good growth and great profitability in the competitive staffing industry,” writes the newspaper and sees a potential increase in the price to ”at least 52:50 at our annual perspective” (SJR closed at the course 44:60 on Tuesday).

Atlas Copco is about to cut, and it is according to Business high time to buy in. Styckningar of workshops, usually mean value according to a Barclays study, but the stock market yawned to Atlasdelningen and misunderstood since the half-yearly report why now is köpläge.

Sagax is designated as both talented risk-takers in the administration, and the creative financiers, but framgångspremien as well as ”David Mindus-premium” (the president) in the share the view the world of Business to be too high. Premium take, together with the long time in the economy and record low Swedish interest rates to remove the ”any form of safety margin”, writes the Business and develop säljstämpeln with riktkursen 80 sek (closing price on Tuesday: 103:90 sek).

For Our part notes the world of Business to the company is the stock market’s cheapest, as measured in the finansprofessorn Robert Shillers so-called cape ratio, cyclically adjusted PE ratio (cyclically adjusted pe ratio). Clothing chain costs 7,5 normalvinster, ”and the analysts do not believe that klädhandlarens profit to melt together”.

Buy SJR and Atlas Copco, sales Sagax in the latest issue of the Business world.

Tradingportalen/Agency Directly.

Questions and comments always welcome in the newsroom[at]tradingportalen.com