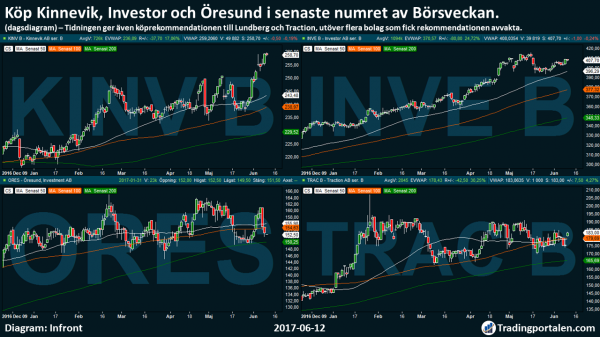

Kinnevik, Lundberg, Investor, Traction, and the sound is singled out as köpvärda investment company on the stockholm stock exchange of Börsveckan, according to the latest edition of the magazine.

- Kinnevik purchase. The largest holding has had a good development so far this year, but the private share has slipped. Discount to net asset value amounts to 20 per cent, which is attractive, according to Börsveckan.

- Lundberg – buy. One might well take the Lundberg share in a long-term sparportfölj, substanspremien to despite the fact, says the magazine.

- Investor purchases. A secure pillar in the portfolio, with a good spread of companies, good management and low debt that attracts, writes Börsveckan. The council will be to purchase the Investor and put in a drawer.

- Traction purchase. Börsveckan look favorably on active ownership, the rebate and the history.

- The sound – buy. The öresund portfolio is a premieprodukt to premiepris. Börsveckan like most of the core holdings, but has a hard time swallowing the high premium given that the bulk of the portfolio is listed.

- Industrivärden – wait and see. With the new management team is chugging along really well for the cyclical Growth, but it can turn quickly and the discount to net asset value is too small.

- Melker Schörling – wait and see. The only argument for buying the MSAB, in addition to the small discount, would be if you think that the company is becoming more active in the management under the new management (with good business as a result).

- Volati – wait and see. One of the more interesting investment companies on the stock exchange, with a broad portfolio and historically high growth. The valuation, however, is high.

- Latour – wait and see. For the high valuation of the portfolio companies, not least in the Assa Abloy group, which represents one third of the net worth.

- Spiltan – refrain. The perception of Paradox is crucial in Spiltan, mean Börsveckan who believe that Paradoxaktien is expensive.

Tradingportalen/Agency Directly.

Questions and comments always welcome in the newsroom[at]tradingportalen.com