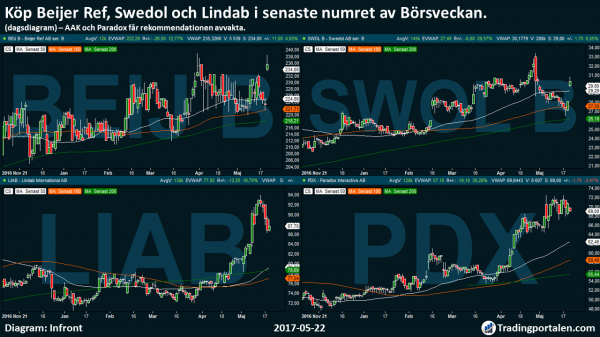

Buy Beijer Ref, Swedol and Lindab but wait with AAK and Paradox.

The councils provide Börsveckan in the new issue in which the magazine also looks Thuleaktien as a bit too expensive.

The new year has started well for the kylgrossisten Beijer Ref and Börsveckan see långsidig upside potential in the share. The growth strategy where a solid organic growth combined with complementary acquisitions, is seen as appealing, and the company’s ”prospects benefit from tighter green regulation. Buy.”.

Swedol shares attracts with a p/e ratio under 12 and share can ”certainly” to climb up towards $ 35 on a one-year term, whereupon the Börsveckan put a köpstämpel.

Byggkomponentbolaget Lindab has a price tag that looks more attractive than the competitor Systemair. For Lindab to be repeated, therefore, the purchase with a height price target to sek 100 for share.

AAK is a good company but its share price is expensive. Likely specialfettbolaget to make new acquisitions, but it is something that is a necessity in order to defend the present price level, consider Börsveckan, which reiterates the council to wait.

Also, the game developer Paradox singled out as too expensive.

”The price tag is in the highest the team and we continue to be hesitant to share”, the magazine writes.

On friluftsproduktbolaget Thule type Börsveckan that ”unfortunately, the conclusion that a bit boring and unfortunately all too common that we like the company but think the stock is a little too expensive. We fit on the Thule this time”.

Tradingportalen/Agency Directly.

Questions and comments always welcome in the newsroom[at]tradingportalen.com