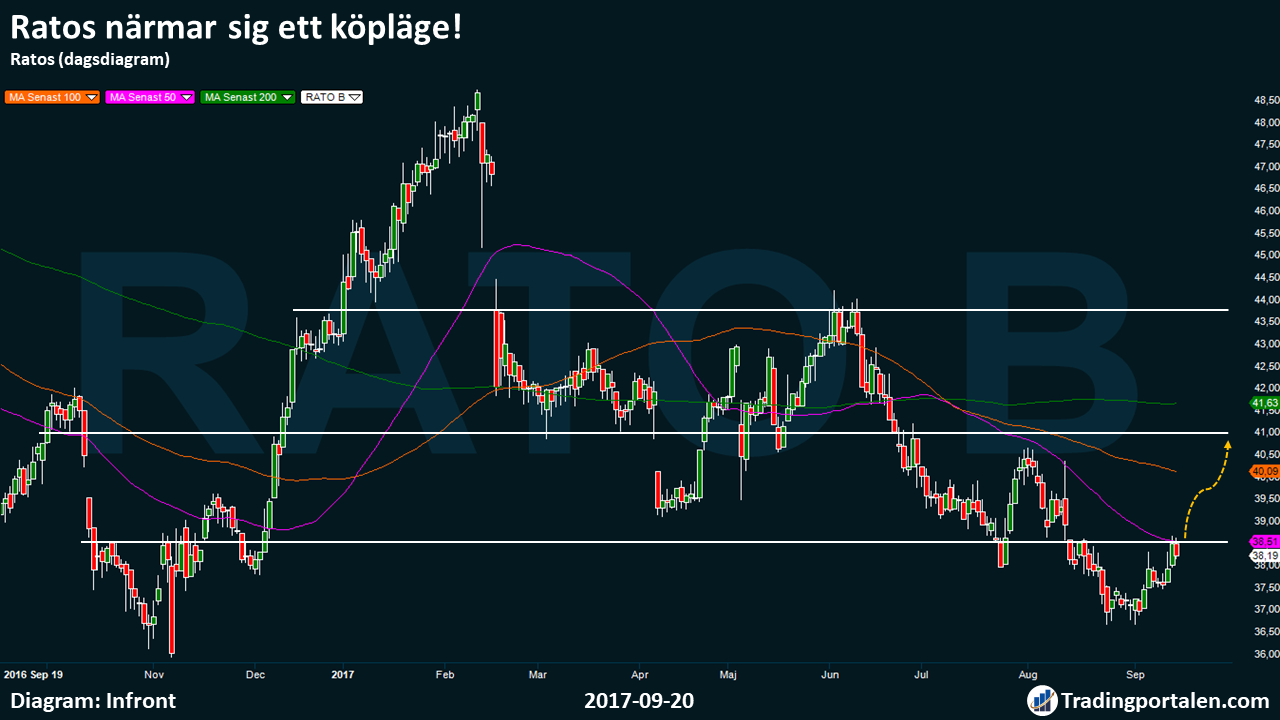

Ratos has like several other companies on the stock exchange had a negative development since the beginning of the summer. Bottoming occurred at the end of August, and the month of september started in the clearly positive attitude. Short-term crossroads, and technical resistance challenged now, but the underlying momentum in the thesis to indicate that, we get an outbreak and onward travel to the north…

Get Minianalys Swedish Shares automatically to your e-mail every day before the stock market opens!

Private Equity company Ratos, which is aimed mainly towards active and long-term holdings in unlisted companies, since the beginning of the summer experienced a clear negative movement on the stock exchange.

The company has, through the clear takeover of the sales force slowly, but surely, have moved everything to the south, until bottoming occurred at the end of August at 36.50 sek.

The month of September has started in clear positive attitude, and on Wednesday challenged the short-term branch in the form of the 50 day moving average at 38.50 sek.

In addition, we are at the right price 38.50), which earlier this year proved been hard to beat.

In case of an outbreak, establishment of this price level, and a closing above the MA 50, speaks highly for that we may get to experience a movement to initially sek 41. The input mode is thus seen at 38.75 usd, with a målkurs at 41.00 dollars.

In a scenario where the köpstyrkan and risk appetite continues on the stockholm stock exchange, yes then we can see the movements further north to 43.75 dollars. The risk increases significantly in such a scenario, in which folded down in tune with the rise of 41.00 sek is considered to be highly recommended.

In a scenario where we get an outbreak to the north, and renewed weakness in the unlikely event occurs within a short, limited such nedsida by tentatively placing a stop loss already at 37.75 sek, as the risk of a continued on traveling south then, is clearly elevated.

The stock is traded on the stockholm stock exchange, under the symbol RATO B.

Ratos

Entrance buy

38.75 kr

Ticker

RATO B

Målkurs

41.00 £

Market

The OMXS Large Cap

Emergency exit

37.75 kr

P/E

NEG

Latest

38.19 kr

Direct avk.

5.2%

Click on the link for more information about ”Focus, strategy and ansvarsbeskrivning”

Upcoming course

“Learn to support Yourself on Your Trading – a complete three-day course!” – see the next course!

More about technical analysis:

- Common concepts in technical analysis

- Moving averages – lagging indicator, which filters out the noise

- MACD – technical indicator, which fits well into the trends

- RSI – a classic momentumindikator that is a ”must” in swingtrading